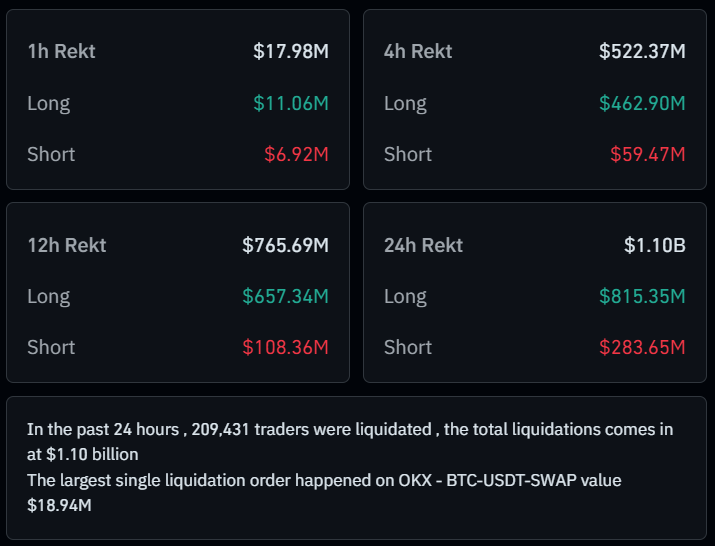

Bitcoin (BTC), the world’s largest asset, experienced a sudden drop leading to the liquidation of approximately $1.10 billion worth of long and short positions within the last 24 hours. This massive liquidation saw BTC alone contributing $565 million, with $417 million coming from long positions and $145 million from short positions, as reported by on-chain analytics firms Coinglass.

Top Crypto Liquidation

During this period, XRP, Solana, and Ethereum also experienced significant liquidations amounting to over $54.11 million, $30.15 million, and $108 million, respectively. The largest liquidation order took place on OKX in the BTCUSDT pair, valued at $18.94 million. The data indicates that bulls were the most impacted by this recent market crash.

Moreover, for the first time since surpassing the $100,000 milestone, BTC failed to maintain this level, resulting in the liquidation of 208,389 traders’ positions. In a matter of minutes, BTC’s price plummeted by 5.47%, dropping from $98,338 to $92,957. However, the price has since rebounded.

Bitcoin Current Price Momentum

Currently, Bitcoin is trading around $96,935, marking a price decrease of over 2.10% in the last 24 hours. The market crash has attracted significant trading volume, with BTC’s trading volume spiking by 98% during this period, according to CoinMarketCap.

However, traders are feeling anxious due to the unexpected price drop, as the cause of the decline remains unclear. This uncertainty has sparked concerns about the possibility of another drop or a potential market recovery.