President Donald Trump recently completed the first year of his second term in office, but the majority of Americans are unhappy with the state of the economy. Consumer sentiment has dropped over 20% compared to a year ago, and recent polls show dissatisfaction with Trump’s economic leadership. In various polls, a majority of Americans expressed disapproval of Trump’s handling of the economy, with many believing that his policies have made life less affordable.

Trump has responded to these polls by threatening to expand his defamation lawsuit against The New York Times to include the results of the Siena poll. The Times defended its methodology, stating that the president’s preference for favorable polls does not impact their survey techniques.

One of the key features of Trump’s economy has been his use of tariffs and trade policies. He has implemented tariffs on imports from numerous countries and specific goods, which has raised the effective tariff rate to its highest level since 1935. These tariffs have led to increased costs for consumers, with projections showing that the average household could face an additional $1,700 in expenses annually.

Despite some price increases due to tariffs, inflation has remained relatively low. However, certain items like housing costs have continued to rise, while job growth and hiring have slowed, leading to a more challenging job market for Americans.

In addition, despite Trump’s promises of revitalizing manufacturing in the U.S., data shows that manufacturing employment has actually declined during his presidency. This decline reflects the ongoing challenges faced by the manufacturing industry in the U.S., including automation, higher costs, and uncertainty surrounding trade policies. The decline also contributes to broader labor market softening for blue-collar workers. This can lead to fewer stable jobs in the federal government sector, making it harder for hundreds of thousands of Americans and their families. Job cuts in one area also means an influx of more unemployed people competing for a smaller pool of jobs in other fields. Layoffs in the federal government also factor into the overall unemployment rate.

During times of turbulence, investors tend to sell off stocks, causing downswings in the market. However, the markets have consistently rebounded in response to increases in economic growth and resilient corporate earnings.

Over the past year, the S&P has shown a broad rise of 16.4%, although this gain was slower compared to the 23.3% increase in 2024.

Impact on Americans: Market volatility can be particularly stressful for households nearing retirement or those needing access to their savings. Nevertheless, these rebounds ultimately support wealth building and retirement accounts in the long run.

Impact of Increased ICE Activity on Industries

Trump’s immigration policies have been highly controversial, characterized by a rise in Immigrations and Customs Enforcement (ICE) raids. This heightened enforcement has led to disruptions in sectors of the labor market heavily reliant on immigrant and migrant labor, such as agriculture, construction, and hospitality.

Impact on Americans: Beyond raising humanitarian concerns, the reduction in the labor pool concentrated in vital sectors of the economy carries significant economic consequences. For instance, in construction, fewer workers mean less housing is constructed, while in agriculture, there is a decrease in food harvested.

Fluctuations in Growth: From Negative to Rebound

In the first quarter of the year, the U.S. experienced a period of negative GDP (-0.5%) due to a simultaneous decline in consumer spending and an increase in imports as businesses sought to preempt tariffs.

However, in the second quarter, GDP turned around (+3.8%) as consumer spending picked up and importers scaled back their spending. The positive growth trend continued in the third quarter (+4.3%).

Goldman Sachs foresees GDP rising by 2.8% in 2026, a faster increase than the previous two years but lower than the growth surges seen in 2020.

Impact on Americans: GDP growth indicates economic expansion, typically leading to more job opportunities, higher wages, and increased profits for businesses. Steady growth is ideal, while prolonged periods without growth constitute a recession. However, rapid growth can also drive up prices and raise borrowing costs.

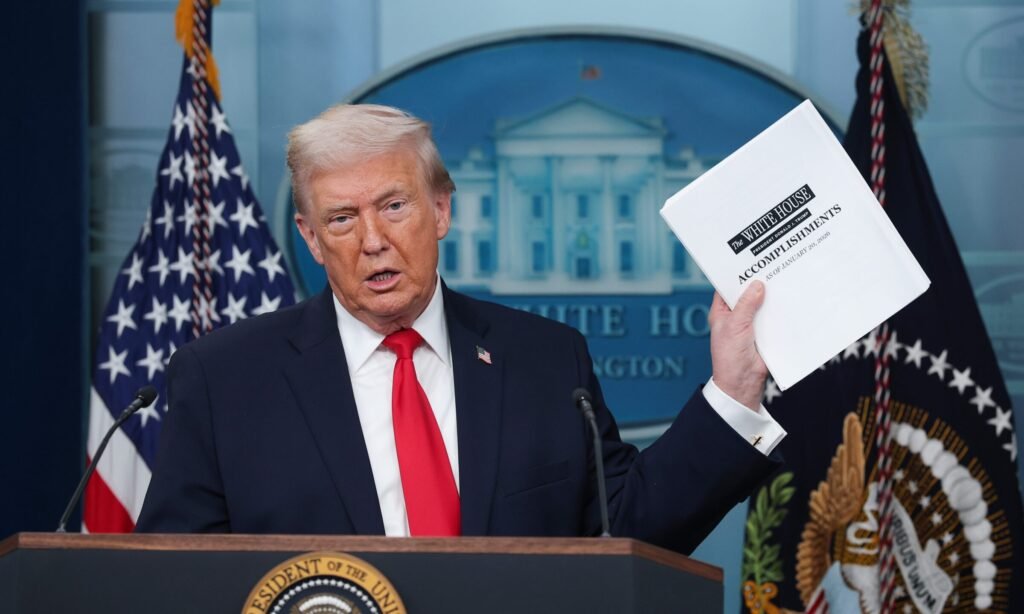

(Lead photo by Kevin Dietsch/Getty Images News via Getty Images)