This article is also available in Spanish.

Strategy (NASDAQ: MSTR) shares have seen a significant decline of over 55% from their high on November 24 at $543 to around $250. With the software intelligence company now holding approximately 499,096 Bitcoin—valued at around $44 billion at current prices—investors are questioning whether the company could potentially face a forced liquidation of its substantial Bitcoin holdings.

Analysts from The Kobeissi Letter (@KobeissiLetter) recently provided a detailed analysis on X discussing this potential scenario. They raised the question: “The MicroStrategy liquidation: As MicroStrategy, MSTR, falls over -55%, many are asking about ‘forced liquidation.’ The company now holds $44 BILLION worth of Bitcoin, could they be forced to sell it? Is liquidation even possible?”

Could A Forced Bitcoin Liquidation Happen?

According to The Kobeissi Letter, MicroStrategy currently holds approximately 499,096 BTC, which is valued at $43.7 billion. The company’s average cost basis per Bitcoin is around $66,350, leading to concerns about what would happen if Bitcoin’s price were to drop significantly below this average entry point.

“The Kobeissi Letter points out that MicroStrategy relies on raising capital, often through convertible notes, to purchase more Bitcoin. The company currently has a total debt of about $8.2 billion for its $43.4 billion Bitcoin holdings, representing a leverage ratio of approximately 19%. Most of this debt is in the form of convertible notes that are set to mature around 2028.

“Forced liquidation” could only occur if there is a “fundamental change” within the company, according to The Kobeissi Letter. This could potentially lead to the liquidation of Bitcoin holdings if an early redemption is called on the notes. However, scenarios like corporate bankruptcy or a shareholder vote to dissolve the company are considered remote under the current structure. Michael Saylor, MicroStrategy’s Executive Chairman and a well-known Bitcoin advocate, holds 46.8% of the company’s voting power, giving him the ability to block decisions that would lead to liquidation.

The analysts from The Kobeissi Letter suggest that despite the significant decline in share price, a forced liquidation is unlikely. The structure of the convertible notes and MicroStrategy’s capacity to raise capital provide the company with flexibility. However, if Bitcoin were to experience a prolonged and severe price drop, well below current levels, MicroStrategy could face challenges in servicing its debt and attracting fresh capital:

“However, what if these convertible bonds remain below the conversion price at maturity, beginning in 2027+? For this to happen, Bitcoin would need to fall well over 50% from current levels and remain there.”

Michael Saylor has dismissed the idea of liquidation multiple times. According to The Kobeissi Letter: “Michael Saylor was asked about liquidation recently. His answer was that even if Bitcoin fell to $1, they still would not get liquidated. They would ‘just buy all of the Bitcoin.’ While this sounds good in theory, the convertible note holders cannot be forgotten.”

MicroStrategy’s business model, which involves raising funds to purchase Bitcoin, potentially driving up the price, and then issuing new shares at a premium, relies heavily on investor confidence. If shares continue to decline or if Bitcoin drops significantly below MicroStrategy’s average entry price, the company’s ability to attract capital could be severely tested: “We are now witnessing the first ‘bear market’ in MicroStrategy since it gained popularity in 2024. The question becomes: will investors continue to buy the dip here? Michael Saylor says ‘Bitcoin is on sale.’”

Despite the voting power held by Saylor and the long-term convertible notes, a forced liquidation appears unlikely in the near future.

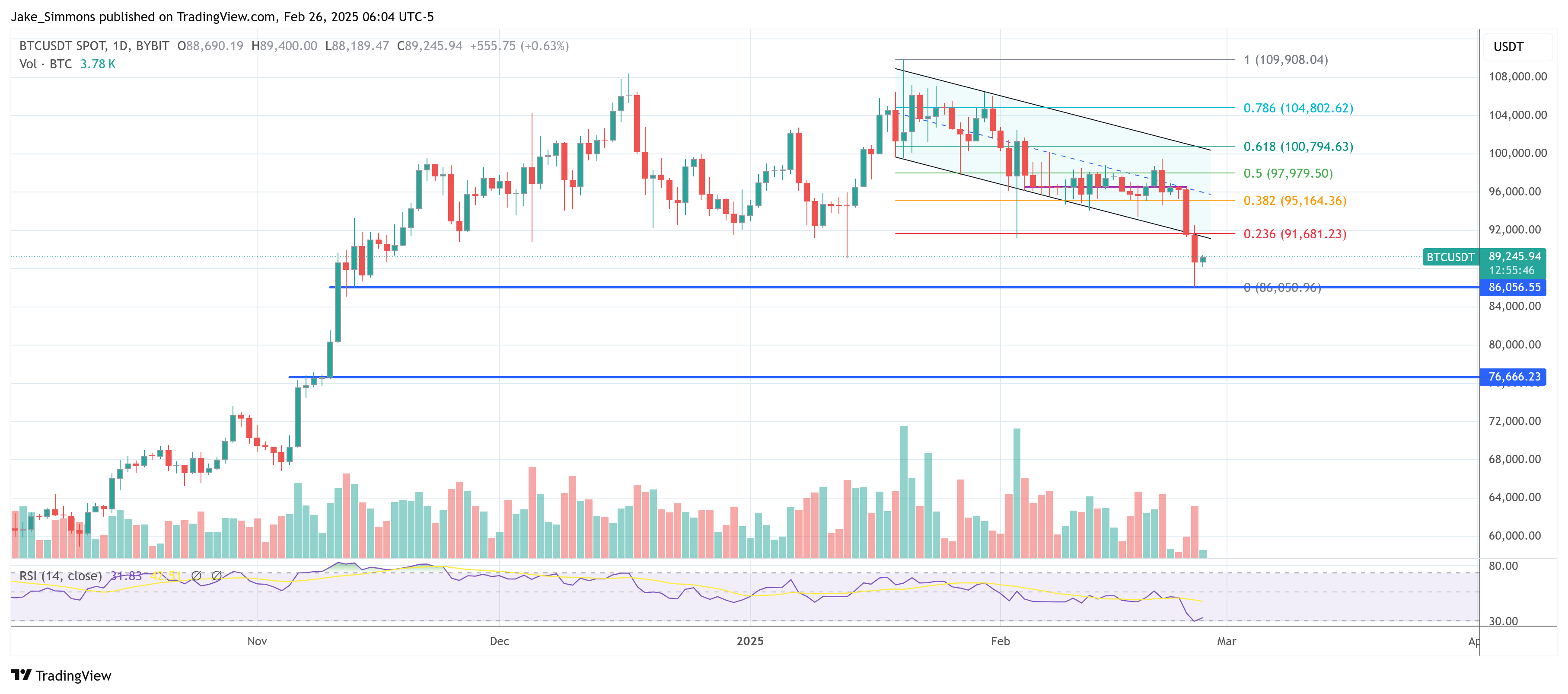

At the time of writing, BTC was trading at $89,245.

Featured image created with DALL.E, chart from TradingView.com