Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

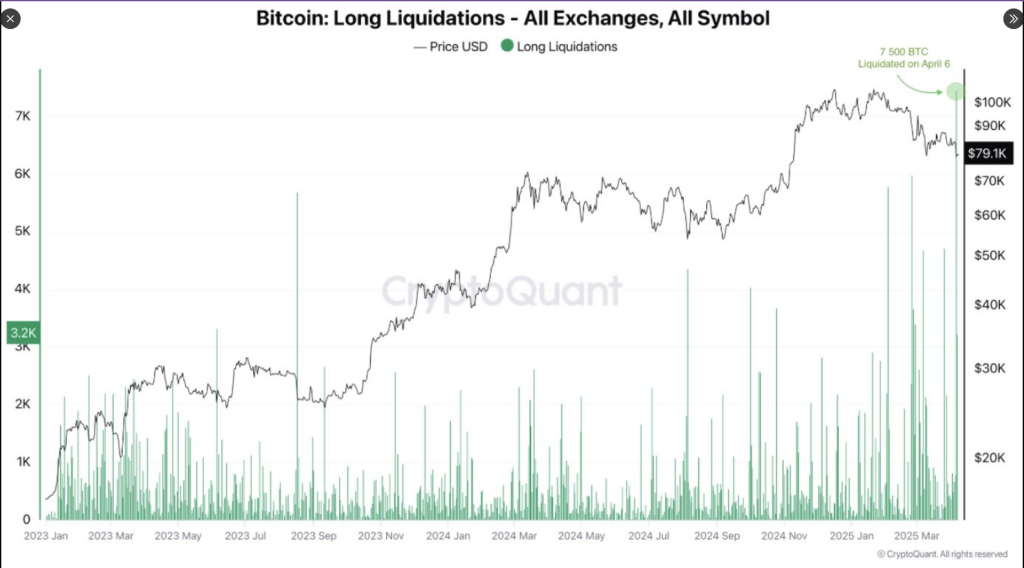

Bitcoin investors faced significant losses this week due to the largest long position liquidation in the current bull market. On April 6, over 7,500 BTC valued at more than $500 million were liquidated across major trading exchanges as prices dropped from $83,000 to $74,000.

Related Reading

Record-Breaking Liquidation Event Hits Crypto Market

According to CryptoQuant analyst Darkfost, this liquidation event was the largest since the 2023 bull rally began. The sudden drop in Bitcoin’s price on spot markets led to forced selling and a subsequent stabilization around $78,000. However, the recovery has been minimal, with prices hovering around that level.

The data shows that while similar liquidations have occurred in the past two years, none have been as significant as Monday’s event. Many traders were caught off guard by the swift market shift, especially those who had leveraged their positions for potential gains.

The biggest Bitcoin long liquidation event of this bull cycle

“On April 6, approximately 7,500 Bitcoin in long positions were liquidated, marking the biggest single-day long wipeout of the entire bull run so far.” – By @Darkfost_Coc

Read more ⤵️https://t.co/eqW2JE8TWD pic.twitter.com/IEthwRDRVz

— CryptoQuant.com (@cryptoquant_com) April 9, 2025

Trump Economic Policies Linked To Market Volatility

Darkfost pointed to growing concerns about US President Donald Trump’s economic policies as a major factor in market volatility. The uncertainty stemming from his tariff plans has created broader financial instability that extends beyond cryptocurrency markets.

Reports indicate that the American stock market has experienced trillions of dollars in losses over multiple trading days this month. A report revealed that US stocks lost $10 trillion in value within three months of Trump taking office in January 2025.

Experts Warn Traders About Risk Management

Analysts have issued warnings about the risks of trading in volatile markets. Darkfost emphasized the importance of protecting capital during times of volatility and advised traders to avoid high-risk or leveraged positions.

For crypto investors, the advice is to proceed with caution and avoid aggressive trading strategies. The rapid price movements demonstrate how quickly market conditions can change, leading to significant losses for unsuspecting traders.

Long-Term Bitcoin Prognosis Is Still Mixed

Some market observers believe that bearish trends could persist for up to 12 months due to ongoing global economic uncertainty. CryptoQuant founder Ki Young Ju noted that in uncertain times, traditional safe-haven assets like gold may outperform cryptocurrencies.

Ju pointed out that since Trump’s return to office, gold has gained 11% in value while Bitcoin has dropped by 25%. He suggests that Bitcoin has yet to establish itself as a true “digital gold” store of value.

Despite short-term concerns, Ju remains optimistic about Bitcoin’s long-term potential. He believes that Bitcoin will eventually capture a portion of gold’s $20 trillion market cap, indicating potential for growth despite recent challenges.

At the time of writing, Bitcoin had reclaimed the $81k level. BTC had risen by 7% in the last 24 hours but experienced a 2% decline over the past week.

Featured image from Gemini Imagen, chart from TradingView