The affordability of housing in the United States has significantly deteriorated in recent years, with house prices reaching record highs during and post the pandemic, and mortgage rates escalating over the last three years due to the Federal Reserve’s attempts to control inflation.

It all started with a surge in the demand for housing during the Covid-19 pandemic, as many Americans, with extra cash from government stimulus checks, reconsidered their living arrangements and looked for more space amidst lockdowns and the sudden shift to remote work. The already low mortgage rates further fueled this demand after the Fed reduced interest rates to near zero at the start of the pandemic.

However, the supply of new and existing homes was severely limited, with construction disrupted by Covid restrictions and potential sellers holding back from listing their homes during the uncertain times. This imbalance led to a rapid surge in home prices nationwide, pricing out many prospective buyers. This trend worsened when the Fed began tightening its policies in March 2022 to combat inflation.

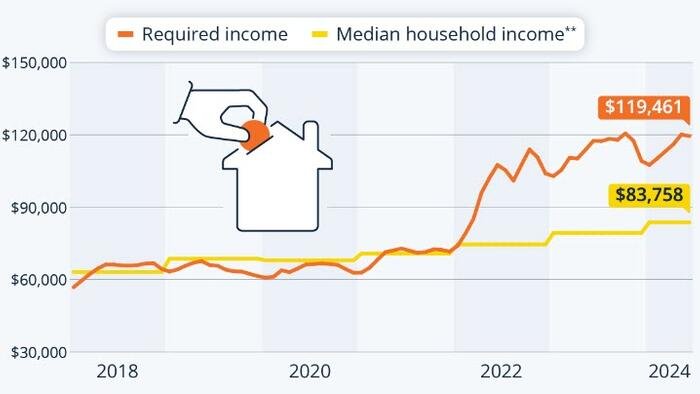

According to Statista’s Felix Richter, data from the National Association of Realtors reveals that the majority of Americans can no longer afford an average home, as the annual household income required to comfortably afford a median-priced home has surged by 60% since January 2022.

Discover more infographics on Statista

Previously, the minimum income needed to purchase a mid-range house – valued at around $380,000 at the time – was $74,000, aligning closely with the national median income.

Now, a significant affordability gap exists, with a necessary income of $120,000 contrasting a median income of approximately $84,000 – more than 40% below what is required.

Loading…