The recent volatility in Bitcoin prices, including a drop below $50,000 last month, has slowed down the anticipated bull run that many analysts were expecting. Despite the current price corrections, a crypto analyst believes that the Bitcoin bull run is still on track, predicting a significant rise to over $100,000 once the market stabilizes.

Bitcoin Bull Run Continues

Well-known crypto analyst, CryptoCon, views Bitcoin’s recent price decrease as a minor setback and maintains that the highly anticipated bull run for the cryptocurrency is still intact. On August 28, the analyst shared a bullish forecast for Bitcoin on X (formerly Twitter), based on current price behavior and historical trend patterns.

Related Reading

CryptoCon suggests that recent market events or news related to Bitcoin’s price fluctuations and market volatility may be distracting for many investors, causing them to lose sight of the bigger picture. The analyst presented a detailed Bitcoin price chart depicting all halving cycles from 2013, each showing a similar bullish pattern.

The analyst identified a recurring pattern in Bitcoin’s price movements before and after each halving cycle, with an initial decline followed by a strong bullish momentum. CryptoCon pointed out that in August 2012, Bitcoin experienced a significant bearish dip before reaching new highs in 2013.

This trend was evident in subsequent halving cycles, with prolonged periods of price stability or slight fluctuations before a sharp increase to new peaks in 2017 and 2021, respectively. CryptoCon refers to this distinctive bullish year as the “Red Year.”

The analyst characterizes 2024 as a “Blue Year,” marked by stable or uneventful price action. This phase is seen as a preparatory period before a potential “Red Year” where Bitcoin’s price could reach new all-time highs.

Based on the analysis of Bitcoin’s historical halving cycles, CryptoCon has raised his conservative estimate for the peak of the current cycle, adjusting the range from $90,000 – $130,000 to $110,000 – $160,000.

Similar Sentiments from Other Analysts

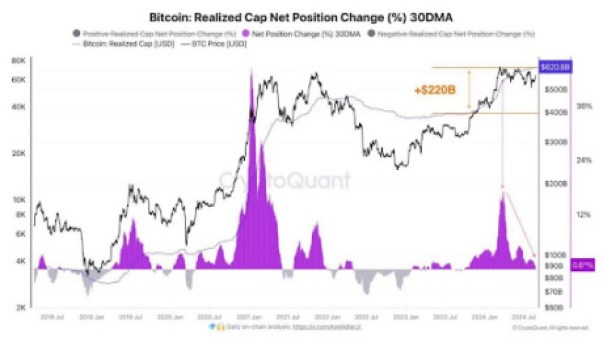

Another crypto analyst known as ‘Kyledoops’ on X shares a positive outlook on Bitcoin’s future price trajectory. According to Kyledoops, Bitcoin’s net capital inflow is slowing down significantly, indicating a delicate balance between gains and losses for investors.

Related Reading

He revealed that historically, periods of reduced capital inflow, similar to the current scenario with Bitcoin, have often been followed by significant price fluctuations and spikes in volatility. This temporary lull may indicate that major price swings are on the horizon for Bitcoin.

At present, Bitcoin is trading at $58,051, reflecting a 9.07% decline over the past week, according to CoinMarketCap. Despite ongoing bearish trends, the leading cryptocurrency is aiming to surpass and stabilize above the $60,000 price level.

Featured image created with Dall.E, chart from Tradingview.com