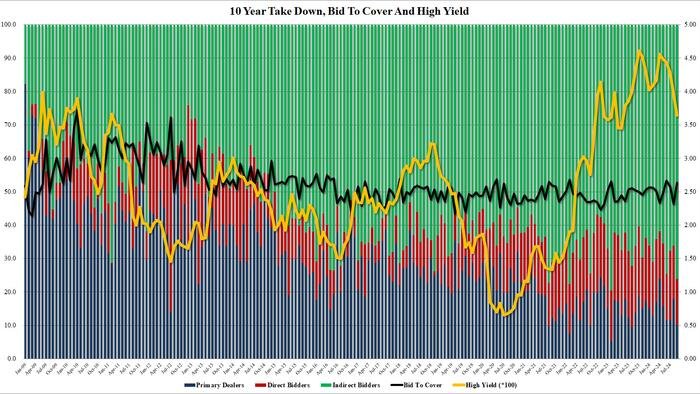

Following yesterday’s outstanding 3Y auction, the Treasury just completed a $39BN sale of a 10Y reopening of the 9Y-11M cusipg LF6, which once again attracted strong demand for the second consecutive day.

The auction concluded with a high yield of 3.648%, significantly lower than last month’s 3.96% and marking the lowest rate since May 2023. It also surpassed the When Issued rate of 3.662 by 1.4bps, the 3rd consecutive auction to do so in the last 4 sales, highlighting a clear improvement from last month’s disappointing 3.1bps tail.

The bid-to-cover ratio stood at 2.637, a significant increase from August’s 2.317 and the highest level since June’s 2.67%.

The breakdown of buyers was particularly impressive, with Indirects receiving 76.1% of the allocation, the largest share for foreign investors since February 2023. Directs took 13.7%, leaving Dealers with just 10.2%, the lowest since August 2023.

Despite the strong performance of the 10Y auction, yields initially dipped to 2023 lows earlier in the day, only to rise following the release of the higher-than-expected CPI data. However, a subsequent reversal, coupled with the NVDA stick save, reignited interest in risk assets, causing yields to climb towards session highs of 3.68%.

Loading…