- The momentum on the daily chart was on the verge of shifting towards a bullish direction.

- The sentiment of short-term speculators was bearish.

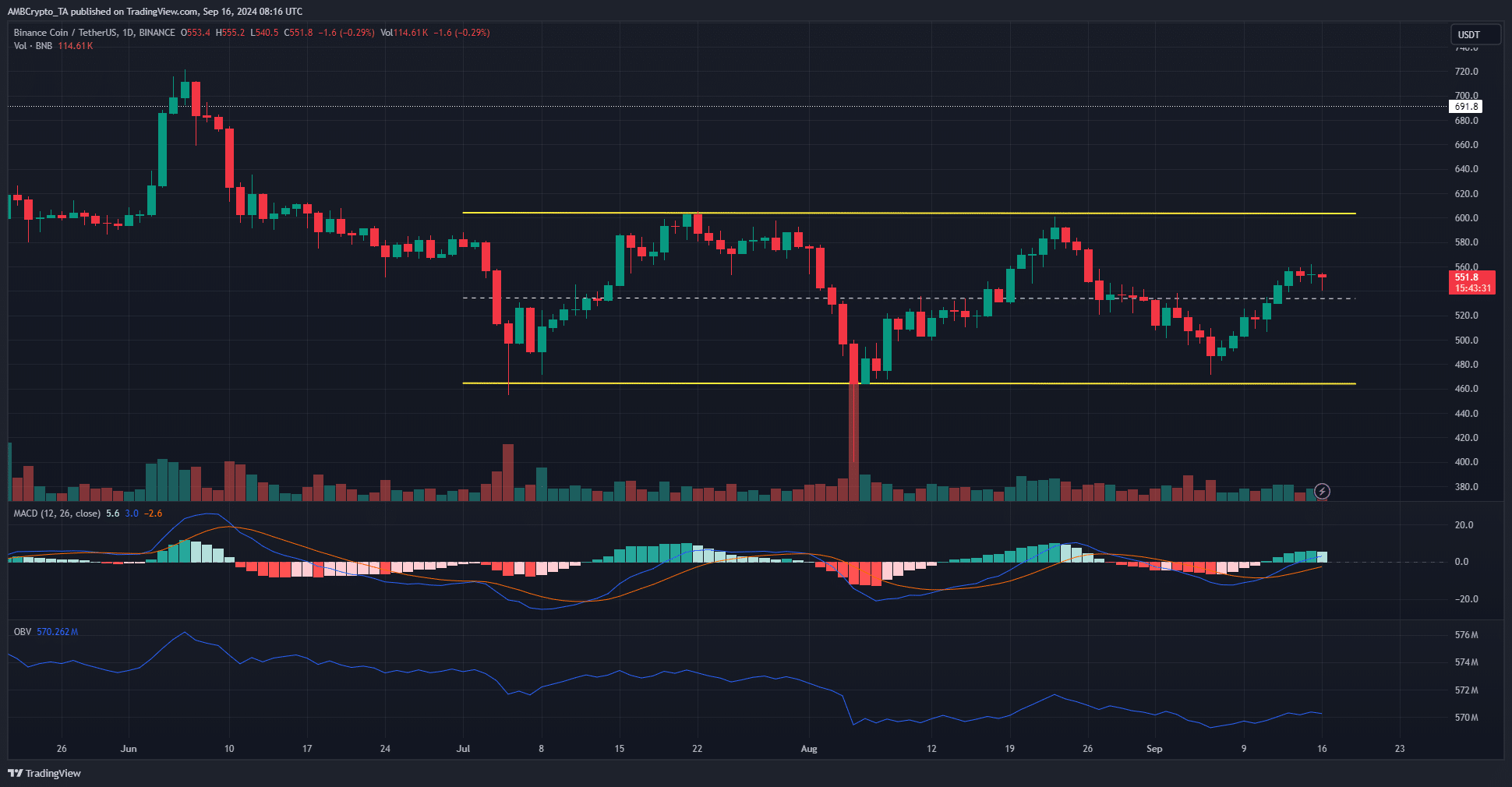

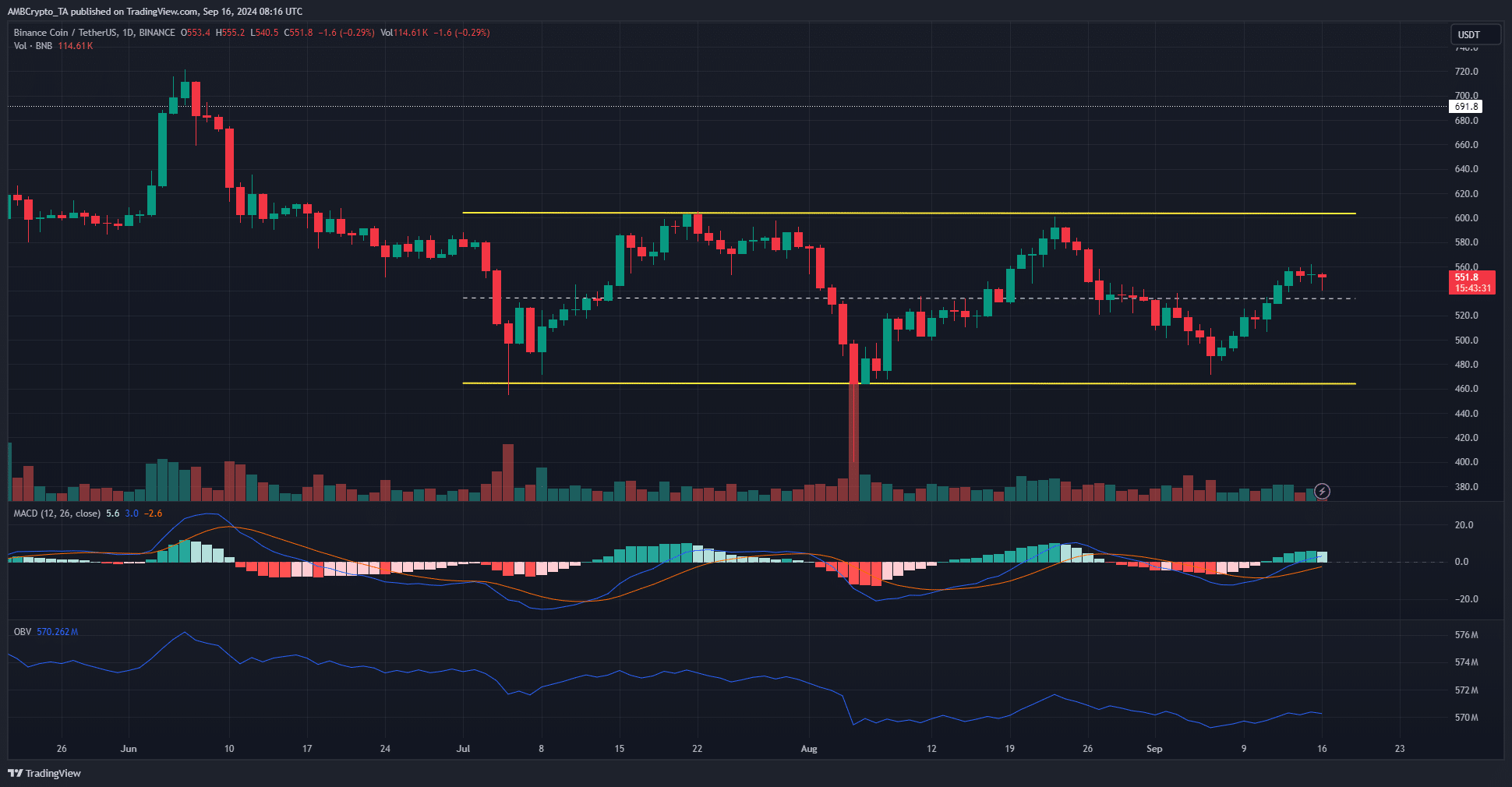

Binance Coin [BNB] bulls set their sights on reaching the high end of the range at $604 after a dip to $471 in the first week of September. Buyers have demonstrated determination in defending the demand zone at local lows.

While technical indicators provided mixed signals, some gains could be expected in the upcoming days. The buying pressure was not consistent enough to guarantee a breakout at this point.

The key psychological level of $550 was within reach for the bulls

Source: BNB/USDT on TradingView

The market structure on lower timeframes, such as the 4-hour chart, favored the buyers. The range formation saw its lows around $464 almost retested in early September. The subsequent price bounce has pushed BNB above the mid-range resistance at $535.

On the daily chart, the MACD indicator formed a bullish crossover, indicating that upward momentum was gaining traction. The indicator was also approaching the neutral zero line, suggesting a potential shift in trend.

Despite this, the On-Balance Volume (OBV) did not surpass previous highs, and trading volume remained subdued. As a result, the likelihood of a strong rally in BNB was low, but a gradual push towards $604, the range high, was possible.

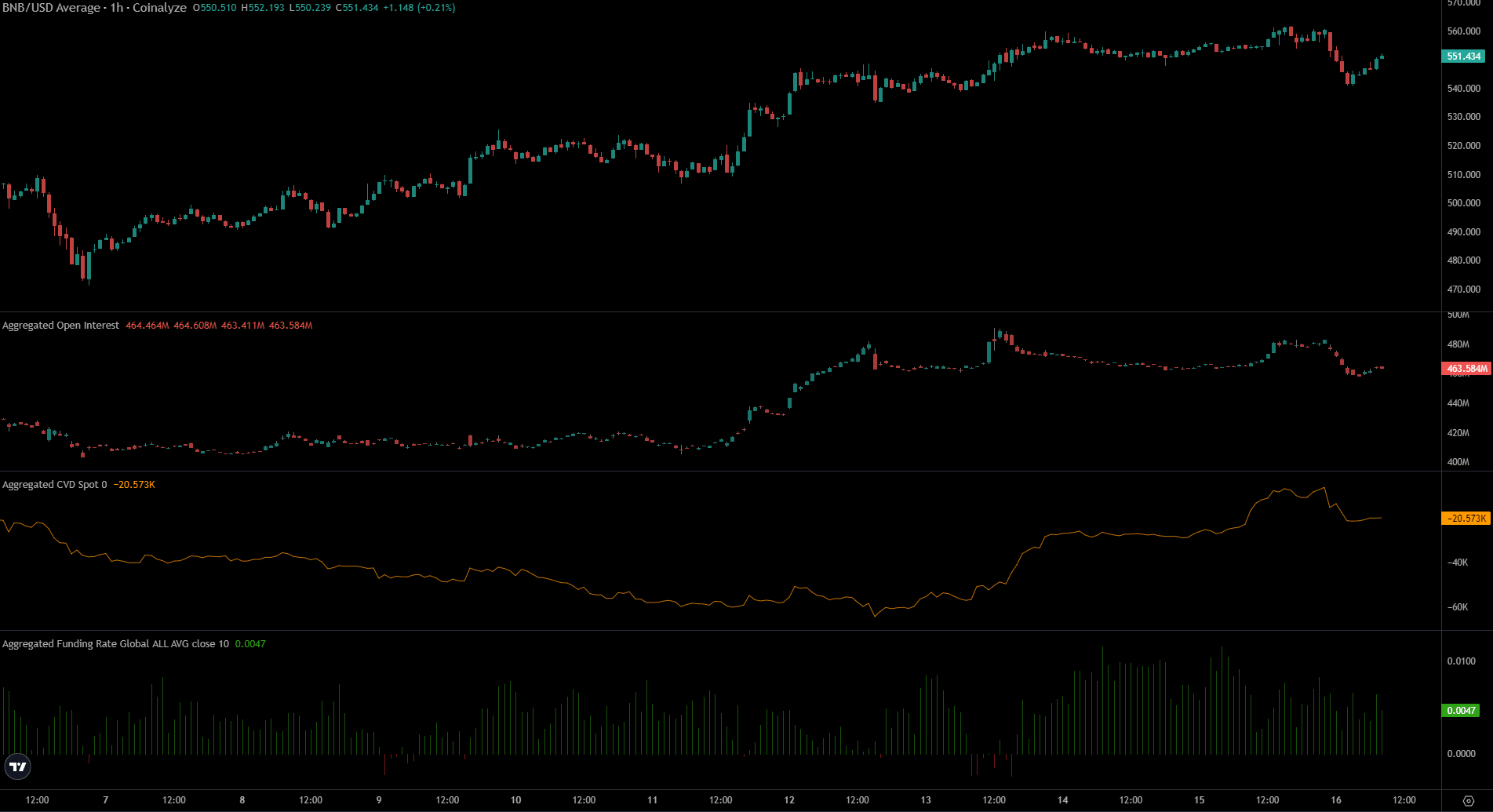

Futures market indicated a temporary bullish sentiment

Since September 12th, the funding rate has mostly been positive. Open Interest also saw a slight increase on the 11th and 12th but has remained stagnant since then. During this period, the price has fluctuated between $540 and $560.

Read Binance Coin’s [BNB] Price Prediction 2024-25

This shift indicated that the bullish sentiment from the previous week had waned, giving way to uncertainty. The recent drop in Open Interest suggested a bearish sentiment in the short term. The spot Combined Volume Delta (CVD) has seen a significant uptrend in the past few days, indicating strong demand.

Although the signals were contradictory, the high CVD and the reclaiming of the mid-range resistance were positive signs pointing towards a move to the range highs.

Disclaimer: The information provided does not constitute financial, investment, trading, or any other form of advice and is solely the opinion of the writer.