- Solana (SOL) has surged over 15%, surpassing Binance Coin (BNB) to claim the fourth position in the cryptocurrency market.

- If SOL maintains above $180, a new all-time high could be on the horizon.

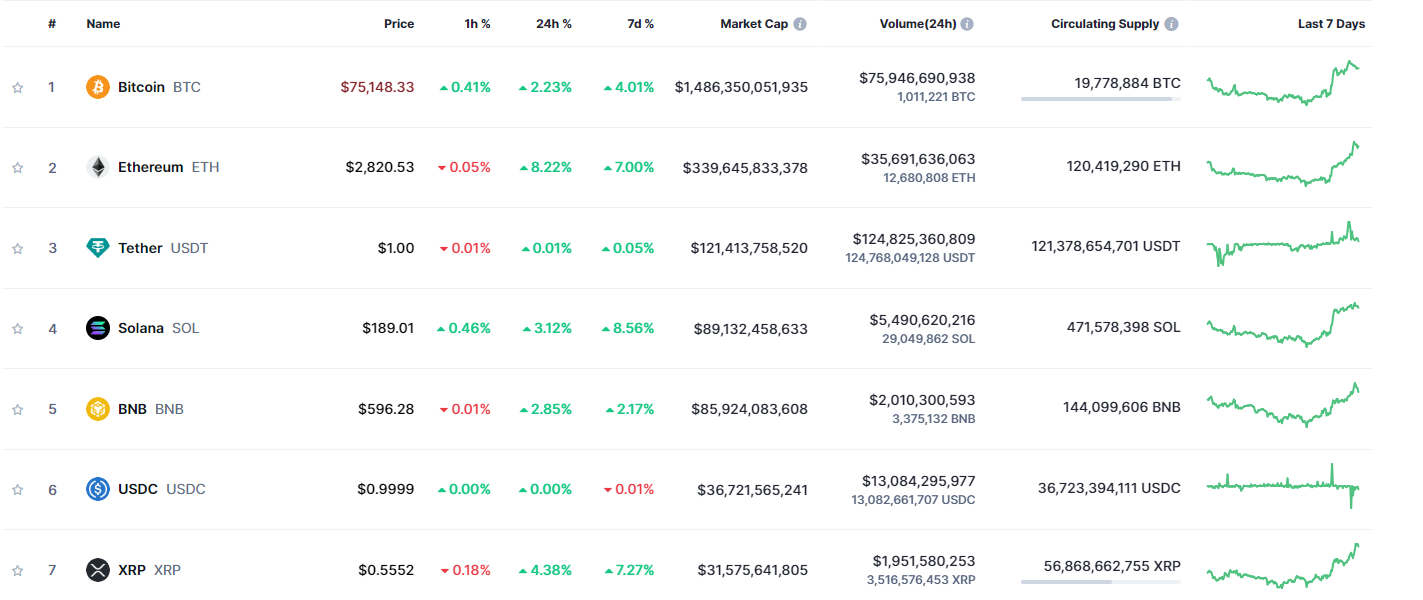

The cryptocurrency market is lively, with Solana stealing the spotlight by jumping 15.8% and overtaking Binance Coin after the US elections.

With SOL breaking the $180 barrier, analysts are eyeing a possible surge towards $250. Is Solana the one to watch, having recorded a 30.5% monthly gain?

More than just flipping BNB

Solana has not only surpassed BNB but has also emerged as the top performer among the top 5 altcoins, attracting significant liquidity from Bitcoin.

This marks the second time Solana has shown strength among cryptocurrencies, holding above breakout levels during market retraces in Q3.

Additionally, SOL posted a daily gain of over 11%, slightly outperforming BTC on the day of the election results, while Ethereum saw a 4% increase.

The market dynamics are shifting, with Solana now overshadowing Ethereum as the top choice for capital inflows.

Source: CoinMarketCap

Flipping BNB confirms this shift. If this trend continues, SOL could reach a $100 billion market cap and potentially challenge ETH’s position.

What are the chances?

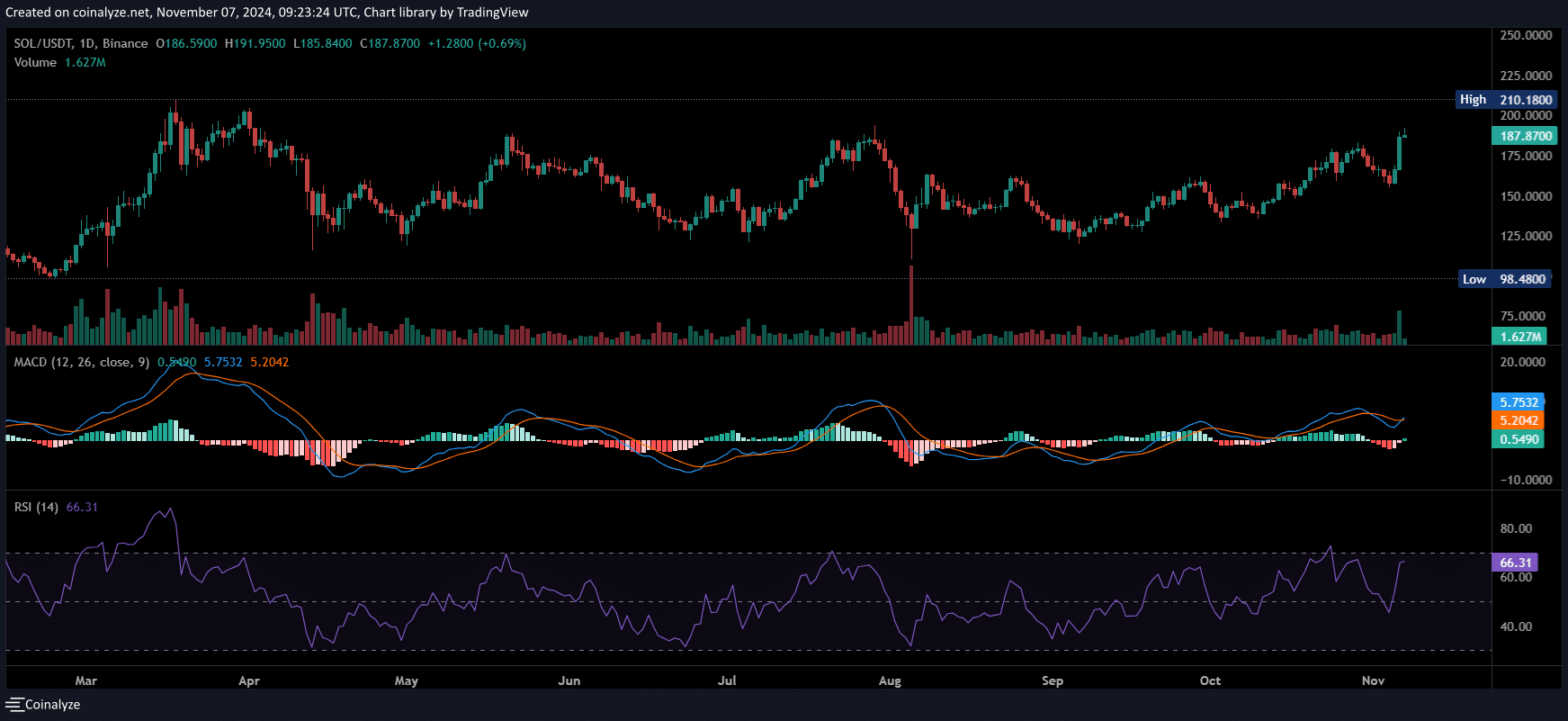

SOL’s breakout above $180 marks an escape from an 8-month consolidation range that started after hitting a yearly high of $202, coinciding with BTC reaching $73K.

In the last 24 hours, SOL’s daily trading volume surged by 210% to $10.7 billion, with a market cap increase of 14.66% to $88.1 billion.

As a result, SOL has surpassed BNB with an $85 billion market cap, becoming the fourth-largest cryptocurrency by market capitalization.

With a bullish MACD crossover on the daily chart, the probability of SOL testing above its yearly high is high.

Source: Coinalyze

Reclaiming the $200 level, unseen since March, could propel SOL past its previous ATH of $260 in the coming weeks.

If the momentum continues, SOL’s market cap could reach $100 billion. However, for this scenario to unfold, BNB would likely need to underperform.

A tight competition for dominance

As BNB nears a crucial resistance at $600, monitoring its performance in the days ahead will be crucial.

A recent report from AMBCrypto suggests a short-term bullish outlook for BNB, anticipating consolidation unless significant accumulation occurs.

This scenario could present an opportunity for Solana bulls to maintain SOL’s fourth position, vital for attracting capital during market volatility.

While the current momentum is driven by Bitcoin’s ATH and a pro-crypto stance in Congress, SOL could experience a pullback if it fails to hold its support level, potentially slipping below BNB.

Read Solana’s [SOL] Price Prediction 2024–2025

In summary, Solana has achieved significant milestones this quarter, positioning itself as a stable high-cap token as Bitcoin enters a high-risk phase.

While the current outlook favors SOL over BNB, surpassing the $260 ATH would further solidify this trend.

text in a more concise manner while retaining the original meaning:

Please rewrite the text to make it more concise.