The information presented on this page is intended for educational purposes only. BW, Inc. does not provide advisory or brokerage services, nor does it endorse or recommend specific stocks, securities, or other investments.

Children are often adept consumers. As a parent running a small business, you have the chance to demonstrate to your kids firsthand what it means to be a producer. Small Business Saturday, happening on Nov. 30 this year, could be a perfect opportunity to do just that.

Established by American Express in 2010, Small Business Saturday encourages consumers to support local businesses to help keep money circulating within their community.

Here are three reasons why involving your kids in Small Business Saturday is beneficial, according to two mompreneurs.

It instills positive work ethics

Ronne Brown, the owner of HERLISTIC, a plant-based beauty and feminine care brand in Washington, D.C., has been participating in Small Business Saturday since founding her business in 2020.

Brown involves her kids (ages 24, 18, 12, and 10) in Small Business Saturday and beyond. Her children assist with customer service, shipping, and other tasks related to the business operations.

She emphasizes the importance of understanding the value of money and the effort required to earn it.

Additionally, Brown aims to teach her children the rewards of dedication and hard work.

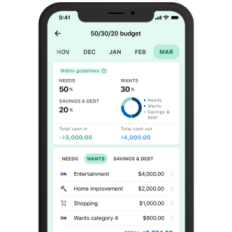

Start budget planning

Analyze your current expenses in different categories to identify potential savings

It provides an opportunity to earn income

Engaging your children in legitimate work on Small Business Saturday allows them to learn fundamental financial principles such as earning, saving, and investing. Prior to hiring children, it is essential to be familiar with child labor laws in your state and the IRS regulations regarding child employment.

Brown ensures that all her children, including her 24-year-old son, are compensated for their work. Moreover, she educates them about stock market investments.

She emphasizes the significance of not only earning money but also investing it wisely. By encouraging her children to think about doubling the money they earn, Brown instills valuable financial lessons.

If you hire your minor children, they can kickstart their investment journey by putting a portion of their earnings into a custodial Roth IRA or a custodial brokerage account, both of which require earned income to establish.

Another advantage of your children earning income through your business is that they may be exempt from federal income taxes if they earn below the standard deduction threshold, which is $14,600 in 2024.

It offers extra help to manage demand

Having your children assist with administrative tasks or customer service during Small Business Saturday can help you cope with a potential surge in sales.

Lisset Tresvant, the owner of Glow Esthetics Spa in Hollywood, Florida, has been participating in Small Business Saturday since starting her business in 2019.

Tresvant notes that sales tend to increase during this time, and having her children assist with tasks like packaging products and preparing items for shipment helps meet the demand.

By involving her kids in her business, Tresvant aims to give them a better understanding of her work and potentially groom them for a future role in the business.

Moreover, hiring your child can also aid in succession planning, ensuring a smooth transition of the business to the next generation. Tresvant envisions passing down her business to her children in the future.

“They understand that I’m building this legacy not just for myself, but for them as well,” says Tresvant.

Start budget planning

Analyze your current expenses in different categories to identify potential savings