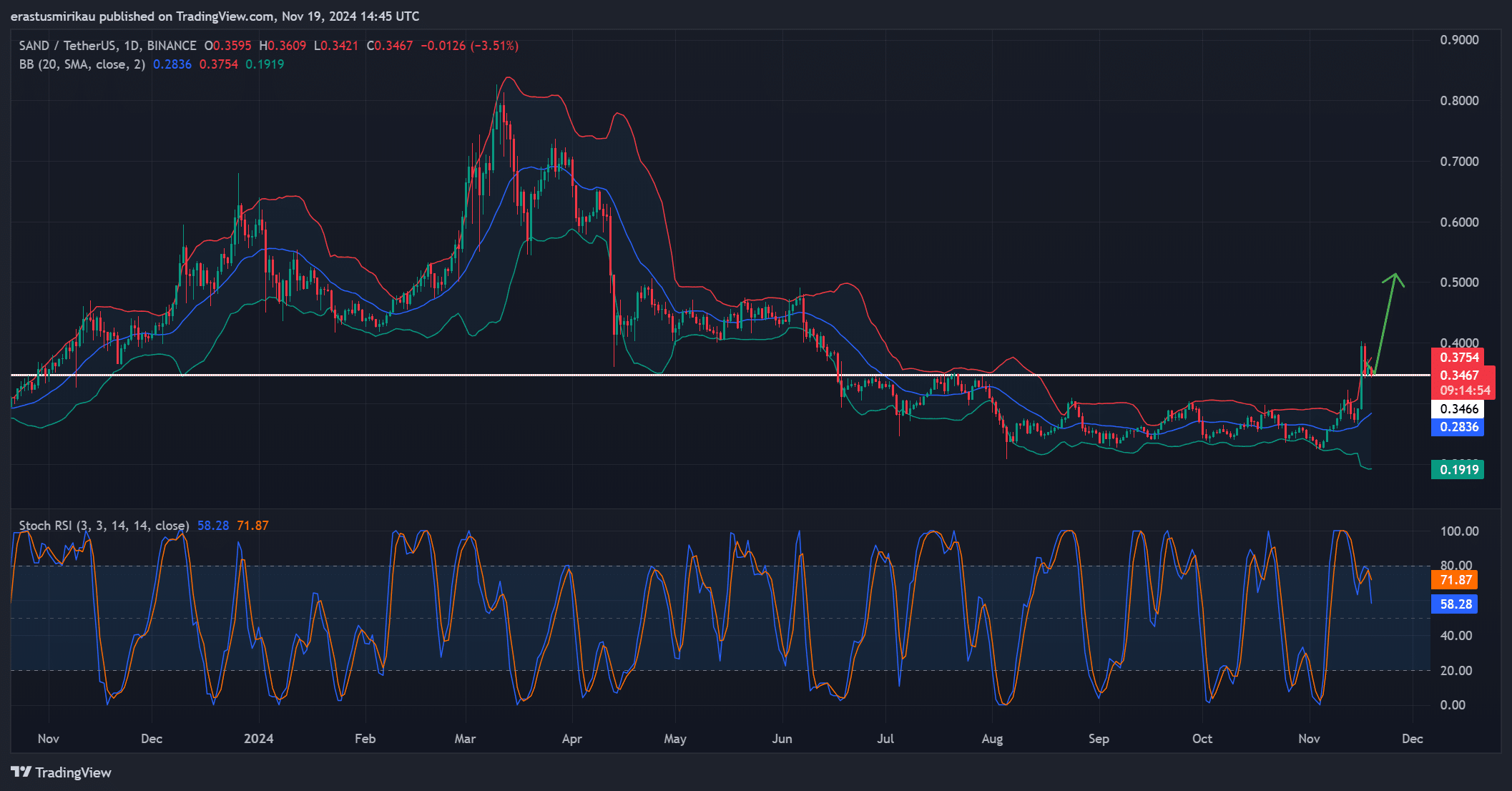

- SAND appears to be consolidating below the $0.375 resistance level, with the RSI at 71.87

- Positive on-chain metrics show a 13.10% increase in large transaction growth

The Sandbox [SAND] has recently experienced a surge in activity, with 9.04M SAND ($3.28M) deposited into Binance in the last 13 hours, bringing the total for the past 26 days to 19.05M SAND ($5.9M). Currently, SAND is trading at $0.3465, reflecting a 2.20% decrease in the last 24 hours.

Despite this, bullish signals from on-chain data and key technical levels suggest a potential significant movement in the near future.

SAND Approaching Critical Resistance Levels

SAND’s price is hovering near a crucial resistance level at $0.375, historically a key zone. The narrowing Bollinger Bands indicate reduced volatility, hinting at a possible breakout. A successful close above $0.375 could lead to a surge towards $0.50, while a failure to hold could result in a drop back to support at $0.34.

The Stochastic RSI is currently at 71.87, suggesting SAND is nearing overbought levels. A potential downward crossover could trigger a short-term price retracement, providing traders with an opportunity to re-enter before another attempt at the resistance level. Therefore, the next few trading sessions will be crucial in determining SAND’s direction.

Source: TradingView

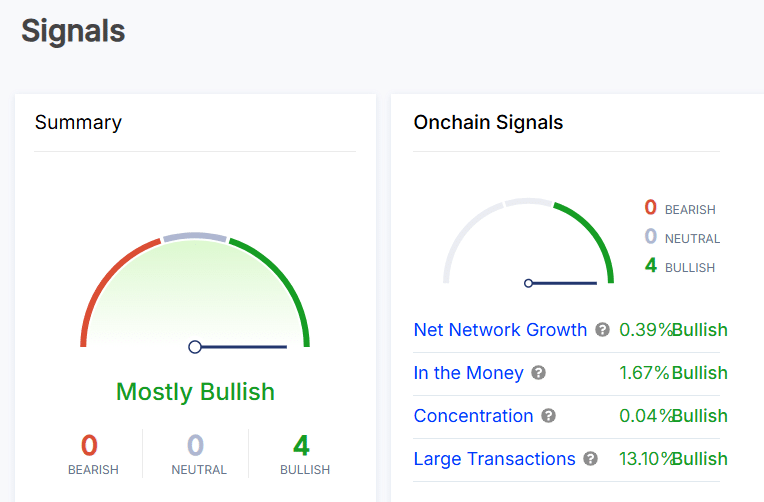

Bullish On-Chain Signals for SAND

On-chain metrics continue to provide optimism for SAND. Net network growth has risen by 0.39%, indicating increasing user adoption. Additionally, 1.67% of SAND holders were in a profitable position at press time, despite the recent price dip.

The concentration metric showed a 0.04% increase, showcasing a balanced distribution of tokens among large holders and smaller investors.

Moreover, large transactions have surged by 13.10%, pointing to a growing interest from institutional investors and high-net-worth individuals. These metrics could boost confidence in the altcoin’s long-term potential and precede stronger upward momentum.

Source: IntoTheBlock

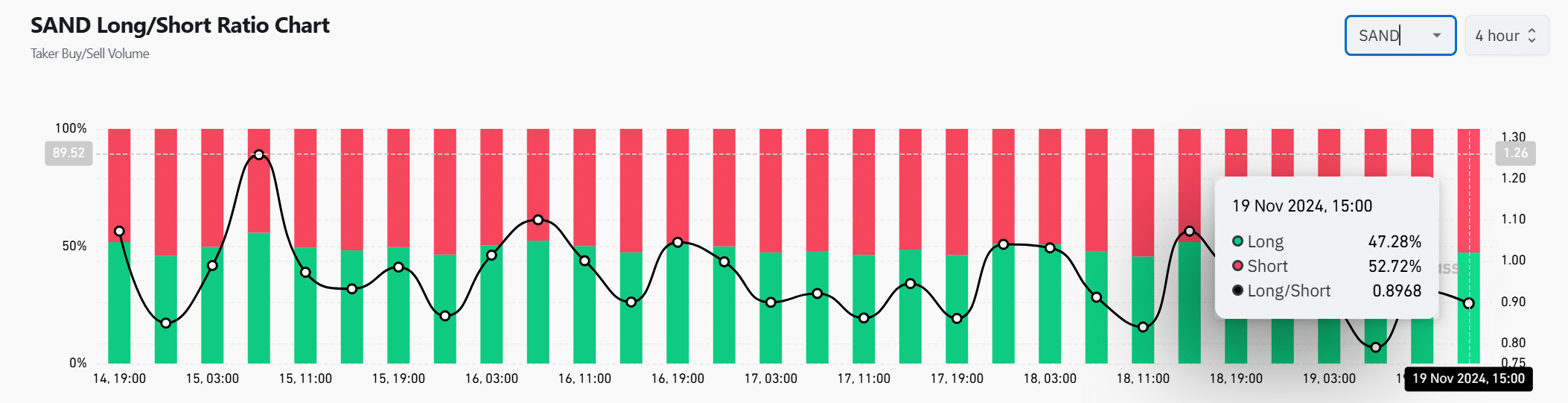

Contrarian Opportunity with Short Bias

The current long/short ratio indicates that 52.72% of traders hold short positions compared to 47.28% longs, with an overall ratio of 0.8968.

While this signals a slightly bearish sentiment, such conditions often create opportunities for a short squeeze. If SAND breaks through resistance, liquidations of short positions could drive upward price movement.

Source: Coinglass

Realistic or not, here’s SAND market cap in BTC terms

Is SAND Poised for a Breakout?

The positive on-chain signals and technical setup for The Sandbox suggest a potential breakout above $0.375.

While short-term retracement is possible according to the Stochastic RSI, strong on-chain metrics and institutional interest support a bullish outlook in the long term. A breach of the key resistance level could propel SAND towards $0.50 in the near future.

sentence: The cat jumped on the table and knocked over the vase.