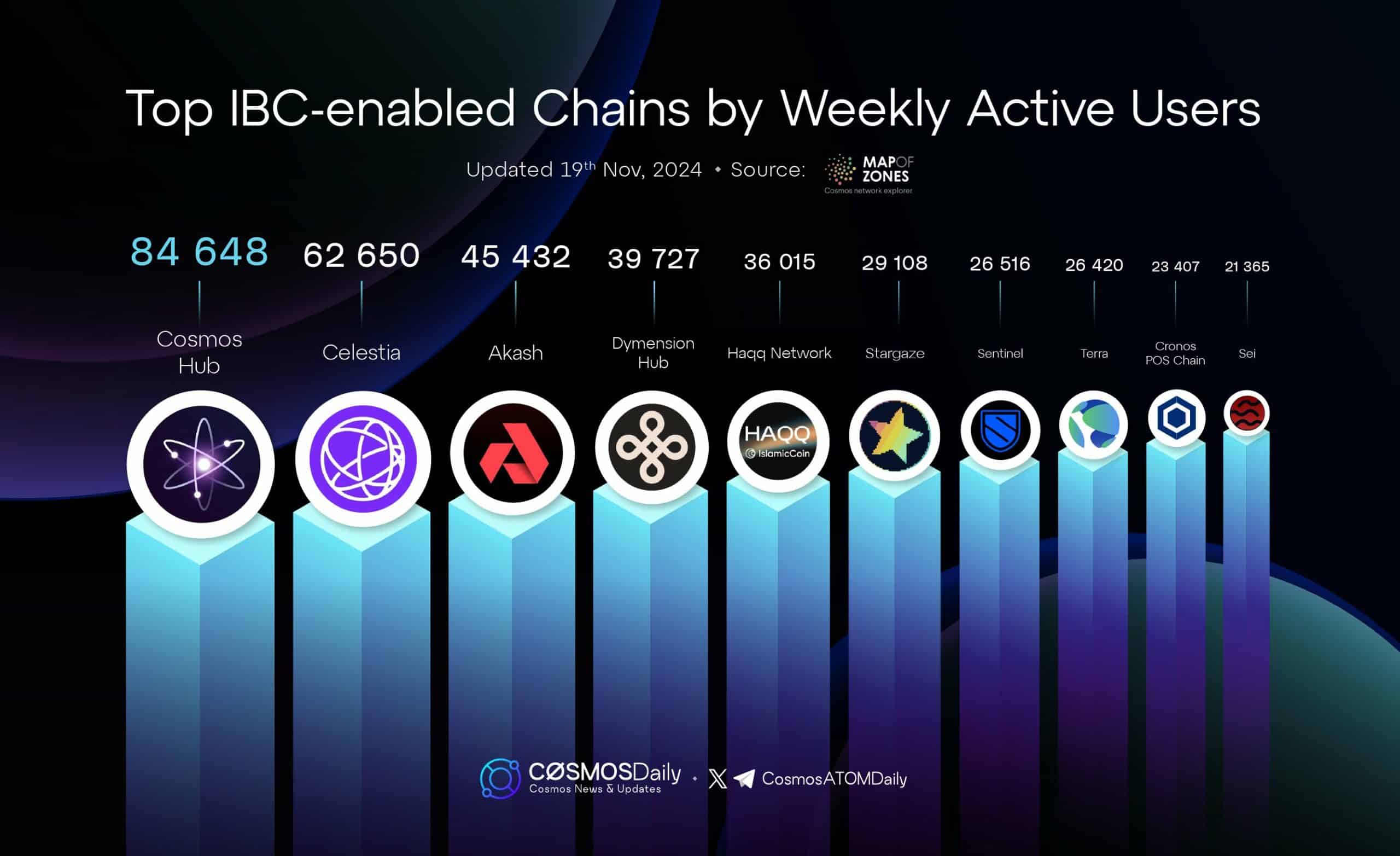

- Despite being among the top IBC blockchains in terms of active users, Celestia [TIA] has struggled to overcome bearish sentiment.

- Traders are predominantly pessimistic, with the majority opting for short positions on the asset.

Over the last month, Celestia [TIA] has seen a significant drop, losing over 12% of its value. The daily chart indicates a continuous sell-off, with an additional 6.60% decline as bearish momentum strengthens.

AMBCrypto’s analysis suggests that this may not be the bottom, cautioning that TIA’s market value could face further declines in the near future.

TIA’s active users surge, but market sentiment remains bearish

Recent data shows a significant rise in active users on the Celestial blockchain, the native network for TIA, over the past week.

Celestial, an IBC-enabled chain, allows seamless data transfer and interoperability between blockchains. The latest data reveals that Celestial has attracted 62,650 active users, securing the second position among IBC chains in terms of user activity.

Source: X

Despite the surge in active users, TIA’s market performance has not improved. The price of TIA continues to decline despite the growth in user activity. According to CoinMarketCap, its market capitalization has decreased by 6.29% to $2.14 billion, while trading volume has dropped by 48.69%.

These metrics indicate diminishing market confidence, with further analysis suggesting a potential continuation of bearish momentum for TIA.

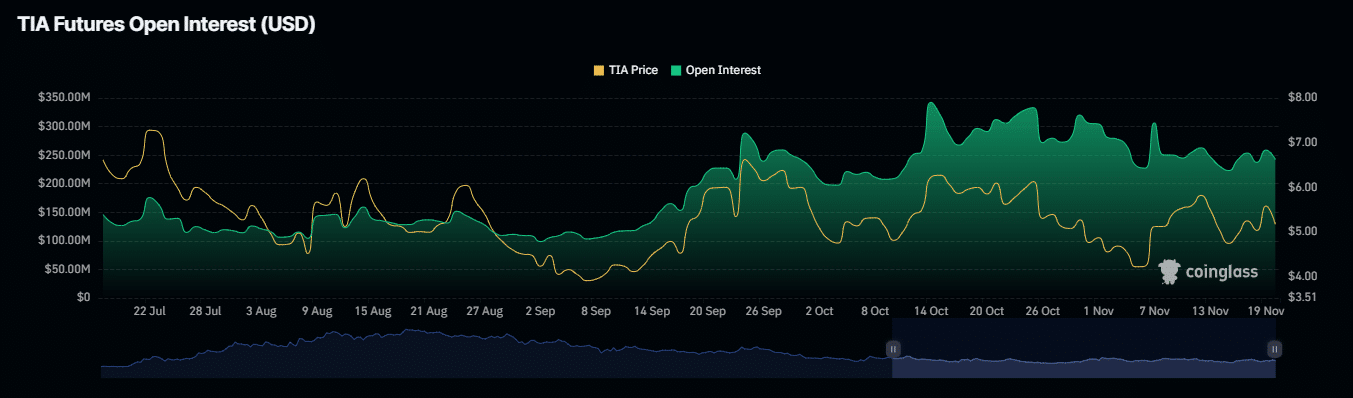

Bears tighten their grip on the market

Currently, bearish sentiment prevails in the market, reinforcing existing downward signals.

Open Interest, which tracks the total number of unsettled derivative contracts, particularly futures, has dropped by 7.33% to $238.65 million in the last 24 hours.

Source: Coinglass

Furthermore, the number of short positions outweighs long positions, as indicated by the Long-to-Short ratio of 0.8328. This suggests an increasing bearish influence.

The low ratio corresponds with the recent liquidation of significant long positions worth $941.10 thousand, adding to the downward pressure on the asset. In contrast, only $71.34 thousand in short positions have been closed during the same period, further emphasizing the dominance of bears.

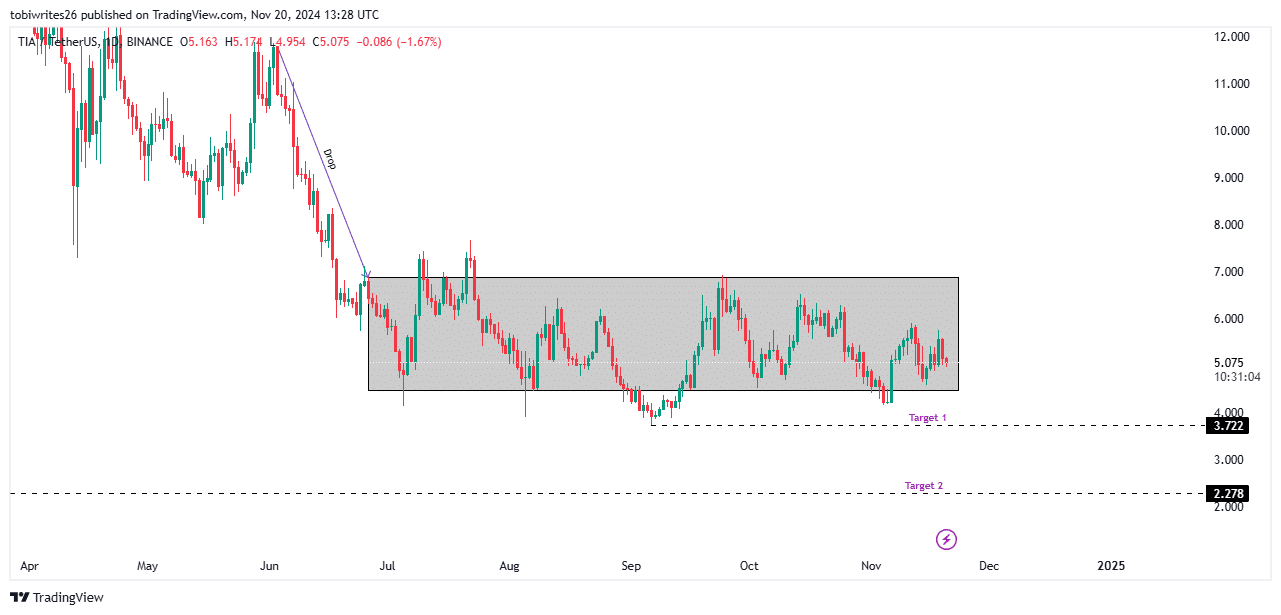

If the downward momentum persists, which is the prevailing bias for TIA, AMBCrypto’s analysis has identified potential lower targets for the asset.

TIA could drop to $3.6 as bearish pressure escalates

Since June, TIA has been trading within a consolidation channel, fluctuating between key support and resistance levels. Such patterns typically precede a significant breakout, either upwards or downwards.

Source: TradingView

Is your portfolio in the green? Check out the TIA Profit Calculator

In the current bearish market phase, TIA faces two critical downside targets. The first is $3.7, a level that could be tested if selling pressure intensifies.

If the bearish momentum persists, the asset may experience a more significant decline, potentially dropping to $2.2.

text in a simpler form:

Rewrite the text in a way that is easier to understand.