One month ago, multiple discount retailers were concerned about the sudden drop in US consumer purchasing power due to the slowing growth in consumer credit and the decline in credit card debt growth. However, in a surprising turn of events, October saw a significant increase in consumer credit growth, reaching a new record high of $5.084 trillion.

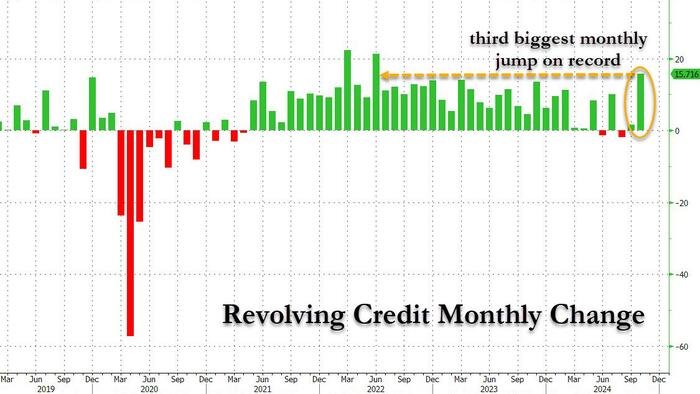

While non-revolving credit showed modest growth, it was revolving credit (credit card debt) that saw a substantial surge, marking the third largest monthly increase on record. Despite the Federal Reserve’s rate cut, credit card APRs continued to rise, reaching a new all-time high of 23.37%.

The recent revision of savings data by the Biden Department of Commerce further highlights the precarious financial situation of many US consumers, who are heavily reliant on credit cards and other forms of debt. This trend raises concerns about the sustainability of the US economy and the potential consequences of excessive debt burdens.

Overall, the latest consumer credit data underscores the challenges facing US consumers and the urgent need for sustainable financial practices.