- Virtuals Protocol, Aave, and Chainlink were the biggest winners in the past week.

- Dogwifhat, Brett, and Bonk led from the other end of the table as the biggest losers.

This week saw Virtual Protocol [VIRTUAL] emerge as the top-performing asset, gaining 39.80%, while Aave [AAVE] and Chainlink [LINK] also delivered impressive returns.

However, the week wasn’t without its losers, with memecoins topping the chart and facing notable declines.

Biggest winners

Virtual Protocol [VIRTUAL]

Virtual Protocol emerged as the top-performing asset last week, recording a 39.80% increase, according to data from CoinMarketCap. It started the week positively, rising by 2.65% to trade around $1.70.

The uptrend gained momentum between the 11th and the 13th of December, where sharp buying pressure pushed the price to a peak of $2.45.

This rapid surge reflected strong market sentiment and bullish activity, further supported by the growing trading volume.

By week’s end, the price stabilized around $2.45 despite experiencing a minor 0.19% decline, which signals a brief profit-taking phase.

The consistent increase in volume highlights sustained investor interest. Its volume has declined by over 32% as of this writing and is now around $205 million.

Aave [AAVE]

AAVE emerged as the second-highest gainer of the past week, posting an impressive 29.49% increase. The asset started the week with a modest upward move, trading around $282.85, reflecting early signs of bullish momentum.

AAVE’s price action reached a turning point on the 12th of December, with a sharp 21.20% surge that propelled its value to a weekly high of $367.10, driven by strong market demand and rising trading volumes.

Despite the strong performance, AAVE experienced minor selling pressure towards the end of the week, settling at $365.49 after a 3.24% decline.

The price correction suggests some profit-taking but remains within an overall bullish structure. If AAVE holds above $360, it could attempt to retest its recent high, with $340 as the critical support level to watch.

Chainlink [LINK]

Chainlink [LINK] emerged as the third-highest gainer of the past week, recording a 12.66% increase despite significant price fluctuations.

It kicked off the week with a 5.23% gain, trading around $26.10, signaling early bullish sentiment. However, the price faced a sharp downturn the following day, dropping by 14.57% to a weekly low of approximately $22.

This correction reflected profit-taking pressure but failed to dampen the overall bullish outlook.

Source: TradingView

The major turning point occurred on the 12th of December, when LINK saw an impressive 21.12% spike, catapulting its price to $29.00.

This sharp recovery was accompanied by a surge in trading volume, indicating renewed investor confidence and momentum.

By the end of the week, LINK stabilized at $29.11, registering a slight gain and solidifying its position as one of the top-performing assets.

From a technical perspective, LINK remains above its 50-day moving average, acting as a key support level.

The Relative Strength Index (RSI) hovered around 69, nearing overbought territory, suggesting cautious optimism for continued gains.

The upward trajectory of the 20-day Bollinger Bands reflects sustained volatility with room for further upside.

If bulls maintain momentum, Chainlink could target the $30 psychological resistance, with the $28 level as immediate support.

A decisive move above $30 could open doors to further gains, while failure to hold support may trigger a minor pullback.

Top 1,000 gainers

Outside the top 100, this week’s top gainer, Black Agnus [FTW], surged by over 4,318%. The second and third-largest gainers were Solvex Network [SOLVEX] and Peezy [PEEZY], with over 3,965% and over 2,158% increases, respectively.

Biggest losers

Dogwifhat [WIF]

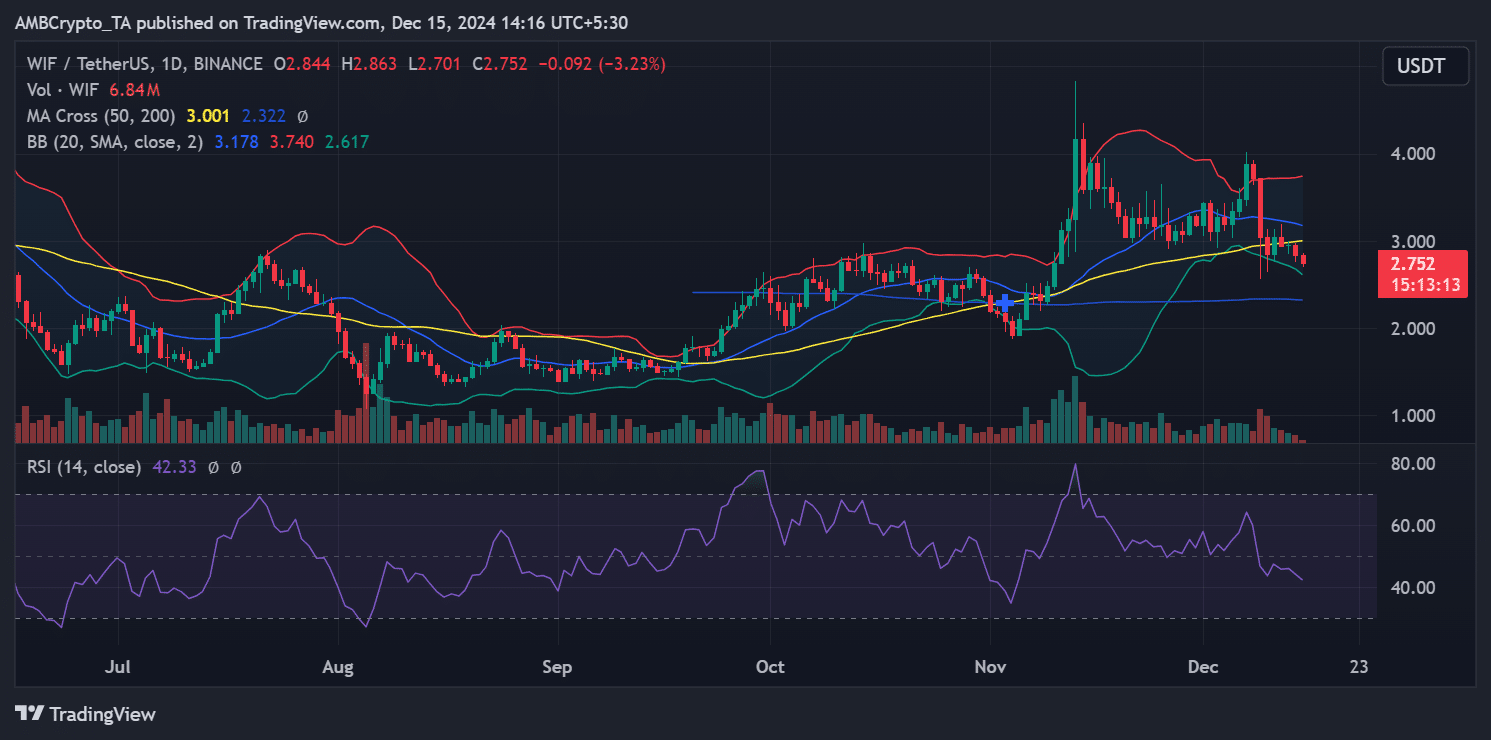

WIF emerged as the biggest loser of the past week, recording a 27.07% decline. The bearish momentum kicked off early, with a 4.18% drop on the first day of the week, dragging its price down to around $3.717.

This initial weakness was amplified on the 9th of December, when WIF saw a substantial 18% decline, plunging to the critical support level near $3.

Source: TradingView

Despite intermittent attempts to stabilize, selling pressure persisted throughout the week. By the end of the week, WIF closed at approximately $2.844, registering an additional 3% drop to cap off its underwhelming performance.

Furthermore, the price has dropped below the 50-day moving average (currently near $3.00), signaling a bearish trend reversal. The 200-day moving average at $2.32 is now the next critical support level.

Meanwhile, the Relative Strength Index (RSI) is hovering around 42.33, indicating that WIF is approaching oversold territory but is not yet primed for a significant reversal.

The Bollinger Bands suggest increased volatility, with WIF trading closer to the lower band, signaling persistent downward momentum.

If bearish forces continue, WIF could retest support at $2.50. A bounce back above $3.00 would be critical for any short-term recovery.

Brett [BRETT]

BRETT ranked as the second-biggest loser of the past week, posting a notable 23.79% decline.

The downtrend began on a muted note, with a minor 0.79% drop on the first day of the week, leaving the price hovering near $0.20.

However, selling pressure escalated sharply on the 9th of December, resulting in a steep 17.81% drop, dragging the price to a key support level around $0.17.

Despite brief stabilization attempts, bearish forces dominated the remainder of the week. By the week’s close, BRETT had slipped further to approximately $0.16, marking an additional 2.94% decline.

As of this writing, BRETT’s market capitalization was around $1.6 billion, with an over 8% decline.

Bonk [BONK]

BONK closed the week as the third-biggest loser, recording a substantial 23.32% decline.

The downward trend for BONK began with a small 1.40% decrease, bringing its price close to $0.00004590. However, similar to many other meme coins, the token saw a significant correction of nearly 15% the following day, dropping to around $0.00003902. As selling pressure intensified, BONK continued to decline throughout the week, ending at $0.00003645 after a 6.15% decrease.

Technical indicators are clearly bearish, with BONK’s price now below the 50-day moving average, indicating short-term weakness. However, it still remains above the 200-day moving average, suggesting potential long-term support. Volume data shows substantial selling activity, aligning with the overall downtrend.

Among the top 1,000 losers this week, the biggest loser was HarryPotterObamaSonic10Inu 2.0 [BITCOIN], with a decline of over 99.91%. Following closely behind were trumpwifhat [TRUMP] and MICHI, both experiencing over a 99% decline.

In conclusion, it’s important to stay informed about the market’s volatile nature, where prices can change rapidly. Conducting thorough research (DYOR) before making any investment decisions is always recommended.