- BONK has experienced a significant drop of approximately 21% in the past week as the memecoin market faces a bearish trend.

- The lack of speculative activity and increased selling pressure could lead to further declines.

Memecoins have been struggling in the current market conditions, with the total market capitalization decreasing by 15% to $97 billion over the last seven days. Bonk [BONK], ranked as the fourth-largest memecoin, has not been immune to these bearish trends, experiencing a 21% decline within the same period.

The downward momentum of BONK may persist due to a lack of interest from buyers in the spot market and reduced activity from derivative traders.

BONK’s price analysis

BONK’s daily chart reveals a descending parallel channel, indicating a sustained downtrend driven by higher selling pressure than buying interest.

Currently, the memecoin is testing support at the midline of the channel. A break below this level could intensify the bearish trend. To reverse this trend, BONK would need to surpass the upper trendline with significant buying volume.

Source: TradingView

The Chaikin Money Flow (CMF) indicator indicates selling pressure, suggesting that BONK is currently in a distribution phase. The Money Flow Index (MFI) also supports this bearish sentiment with a reading of 47, indicating a dominance of bears in the market.

Reduced speculative bets could prolong the downtrend

Typically, a surge in derivative trading activity reflects strong convictions among traders regarding future price movements. However, traders seem to be unwinding their positions in the case of BONK.

Open Interest for the memecoin has declined by 28% in a week to $14.12M, as reported by Coinglass. Concurrently, 24-hour trading volumes in derivatives hit $36M, the lowest since the beginning of the year.

This decrease in activity could stabilize prices due to reduced volatility, but it might also lead to negative sentiment and subdued price action.

Key levels to monitor

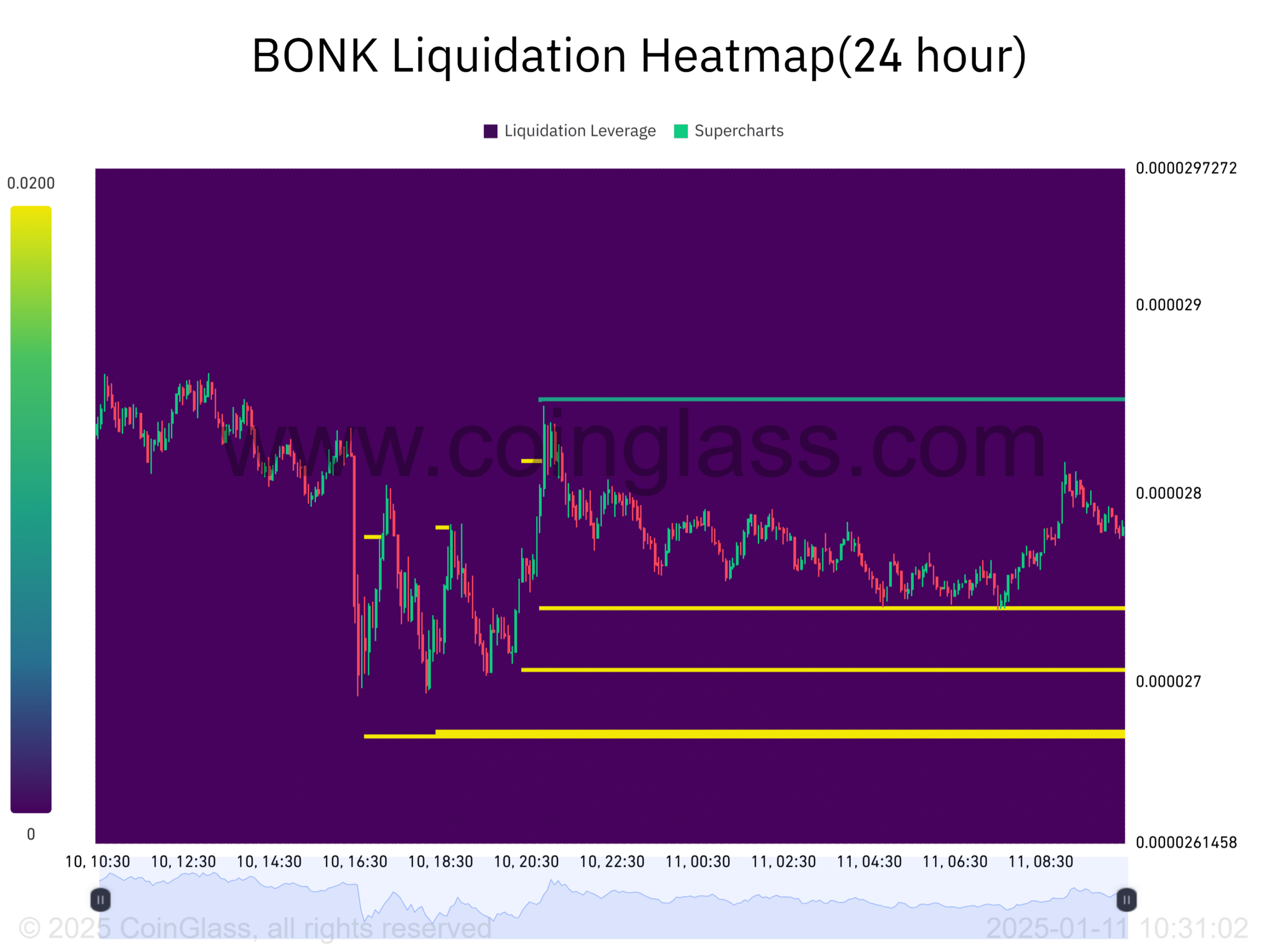

Over $1M worth of BONK long positions have been liquidated in the past four days, adding to the selling pressure. Despite these liquidations, several support clusters below the current price level could drive prices lower.

Read Bonk’s [BONK] Price Prediction 2024-25

The nearest liquidation cluster is at $0.0000273, followed by clusters at $0.0000270 and $0.0000267. A drop to these levels could trigger further liquidations and contribute to the ongoing downtrend.

Source: Coinglass

Conversely, the absence of liquidation clusters above the current price level could impede an upward trend and lead to consolidation at the current levels.

given sentence in active voice:

“The book was read by the student.”

The student read the book.