- The cryptocurrency market sentiment remains weak at the start of the new week.

- Analysts from Bernstein suggest that Bitcoin (BTC) could soon enter the next phase of its bull run.

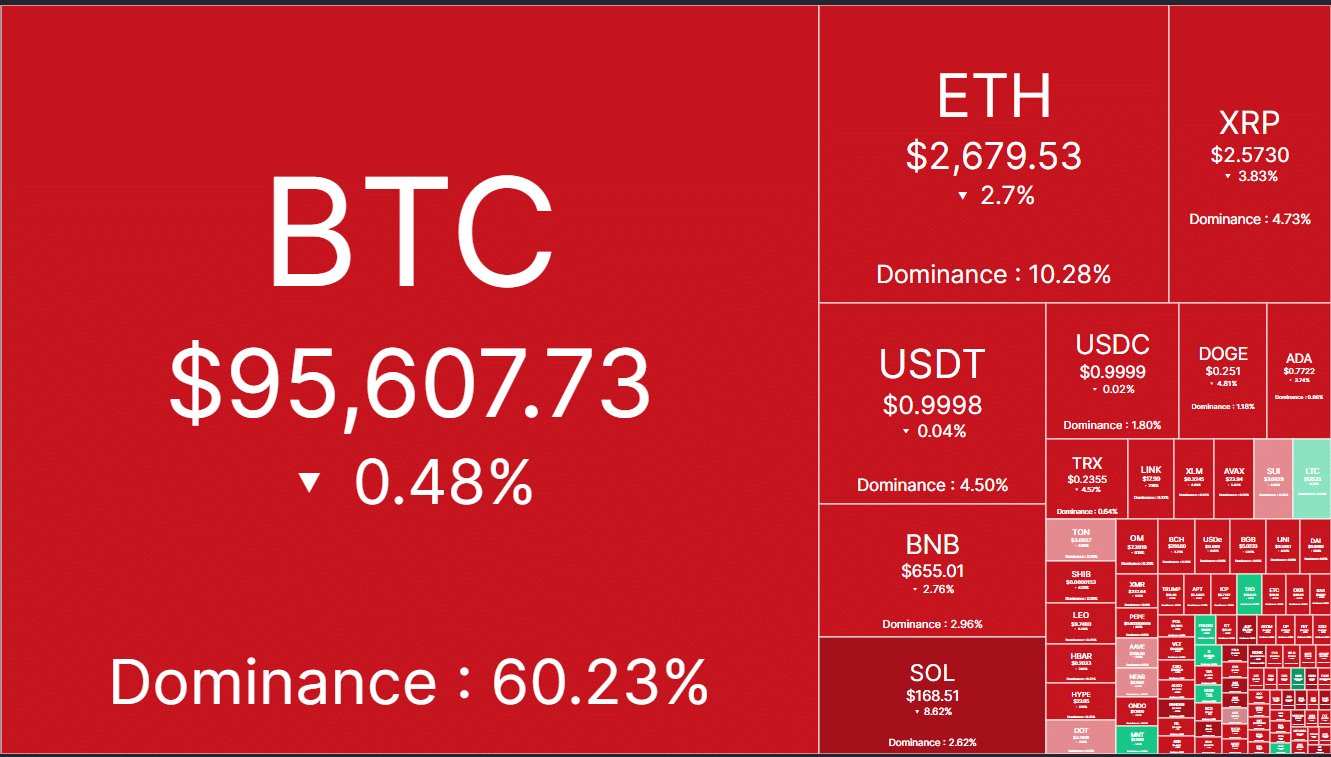

Over the weekend, the crypto market experienced a decline in market capitalization from $3.3 trillion to $3.15 trillion, representing a $150 billion loss in just three days.

During this period, Solana (SOL) saw the most significant drop, losing 15% and falling below $170, while XRP declined by 8% but remained above $2.5.

Source: CoinMarketCap

Despite the overall market decline, Bitcoin (BTC) only decreased by less than 3%, and Ethereum (ETH) retracted by 2%, indicating relative strength during this period of weakness.

Market Sentiment Impact by LIBRA

The cryptocurrency market has been impacted by macro uncertainty and further worsened by the recent controversy surrounding the meme-coin ‘LIBRA scam’.

QCP Capital, a crypto options trading desk, highlighted the negative sentiment in the market:

“BTC dominance has risen to around 60%, reaching four-year highs, while Ethereum (ETH) and other altcoins continue to underperform. The recent scandal involving LIBRA and Argentinian President Javier Milei has added to the negative sentiment surrounding altcoins and meme-coins.”

Additionally, the bullish momentum of Bitcoin (BTC) has been limited since the Federal Reserve’s decision to pause interest rate hikes in January.

Fed governor Patrick Harker recently reiterated the need to keep interest rates unchanged until inflation stabilizes.

The bearish pressure has kept Bitcoin below $100,000 for almost two weeks, with BTC dominance surpassing 60%, hindering the recovery of alternative coins.

Some analysts, like Realvision’s Jamie Coutts, anticipate another market downturn before a potential Bitcoin rebound:

“Several solid protocols have experienced significant declines of 50-80%. Sentiment is low, and we may witness another market downturn.”

Despite the current market conditions, analysts at Bernstein, led by Gautam Chhugani, remain optimistic about Bitcoin’s medium-term prospects. They stated:

“The next phase of the Bitcoin bull market is approaching, supported by various positive catalysts. We believe that the Crypto Task Force, led by David Sacks, is working towards establishing a National Bitcoin reserve as directed by the President.”

They also suggested that the US Sovereign Wealth Fund (SWF) could include Bitcoin and other cryptocurrencies as reserve assets.