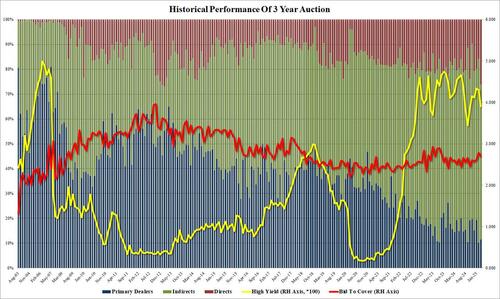

During a week where there is a rush towards the perceived “safety” of bonds due to the rapid decline in stocks – the fastest since the onset of the covid crisis – one would naturally assume that demand for the first coupon auction of the week would be exceptionally high. However, that assumption would be incorrect. The Treasury just completed the sale of $58 billion in 3-year bonds in an auction that fell short of expectations.

The auction concluded with a high yield of 3.908%, a significant decrease from the 4.300% recorded in February and the lowest level seen since October. It also fell short of the When Issued rate of 3.902% by 0.6bps, marking the 5th consecutive auction with a tail in the past 6 sessions.

The bid to cover ratio stood at 2.70, a decline from 2.79 but still above the recent average of 2.62.

The auction internals painted a less optimistic picture, with the share of Indirect bidders dropping from 74.0% to 62.5%, the lowest level since January and below the recent average of 67.5%. Direct bidders were allotted a significant 26%, the second highest on record with only February 2013 surpassing this level. Dealers were left with just 11.5%, higher than last month’s near record low of 10.2% but below the recent average of 15.7%.

Overall, this auction fell short of expectations. Given the current trend of investors flocking towards Bills and the short-end of the curve as a hedge against the ongoing market turmoil, one would have anticipated a more robust response. This raises the question: how are investors utilizing the excess cash gained from selling off their struggling high-risk stocks…

Loading…