- Bitcoin’s significant +$800M per day realized losses could indicate a potential bottom

- Overall demand for Bitcoin has been negative, with BTC ETFs experiencing over $5 billion in losses

Bitcoin has remained below $85k after briefly dropping to $76k, a movement that analysts at Bitfinex believe could signal stabilization.

In their weekly market report, the analysts highlighted a daily realized loss of $818 million, a market trend that often precedes a potential bottom.

“Such widespread capitulation often precedes market stabilization, though geopolitical and macroeconomic concerns remain a significant overhang.”

Is a Bitcoin rebound imminent?

Short-term holders have been selling BTC at a loss for the first time since October 2024, a concerning trend that could hinder reversal efforts, according to analysts at Bitfinex.

Source: Bitfinex

The Bitcoin Spent Output Profit Ratio (SOPR) has dipped below 1, indicating that holders have been selling at a loss.

“Short-term holder SOPR recorded its second-largest negative print of this cycle at 0.95, signaling that new market entrants are capitulating.”

In order for a recovery to occur, Bitfinex analysts suggest that the SOPR must rise above 1 again, signaling ‘re-accumulation’ and ‘bullish continuation’.

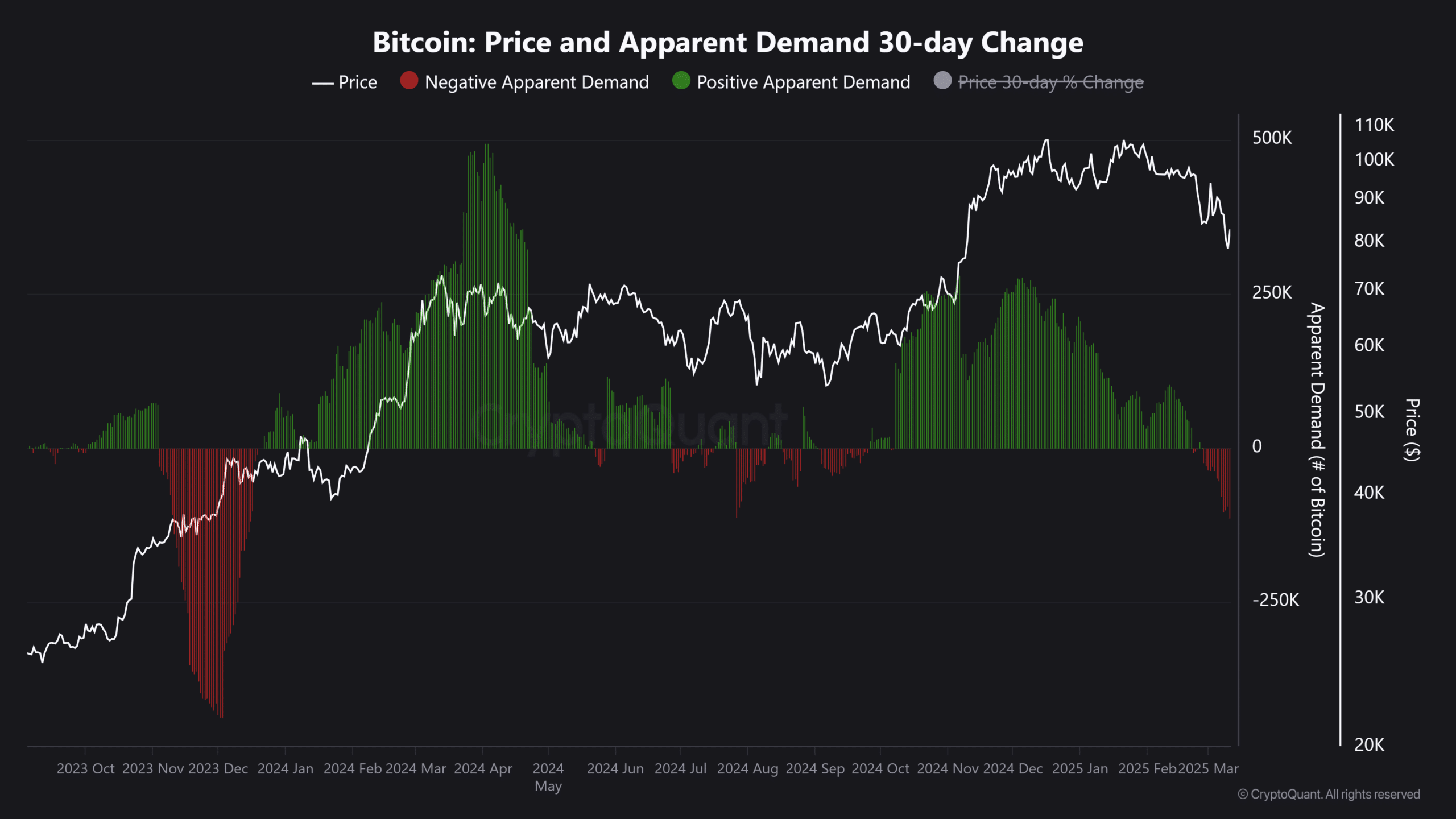

Weak demand for BTC aligns with Bitfinex’s caution. According to CryptoQuant data, demand for the cryptocurrency has been negative since late February.

Source: CryptoQuant

U.S. spot BTC ETFs have seen significant outflows, with over $5 billion exiting the market in the last 6 weeks.

Bitfinex analysts also warned about the impact of mixed readings on U.S. macroeconomic factors on crypto markets, particularly in light of cooler-than-expected U.S. CPI inflation data for February.

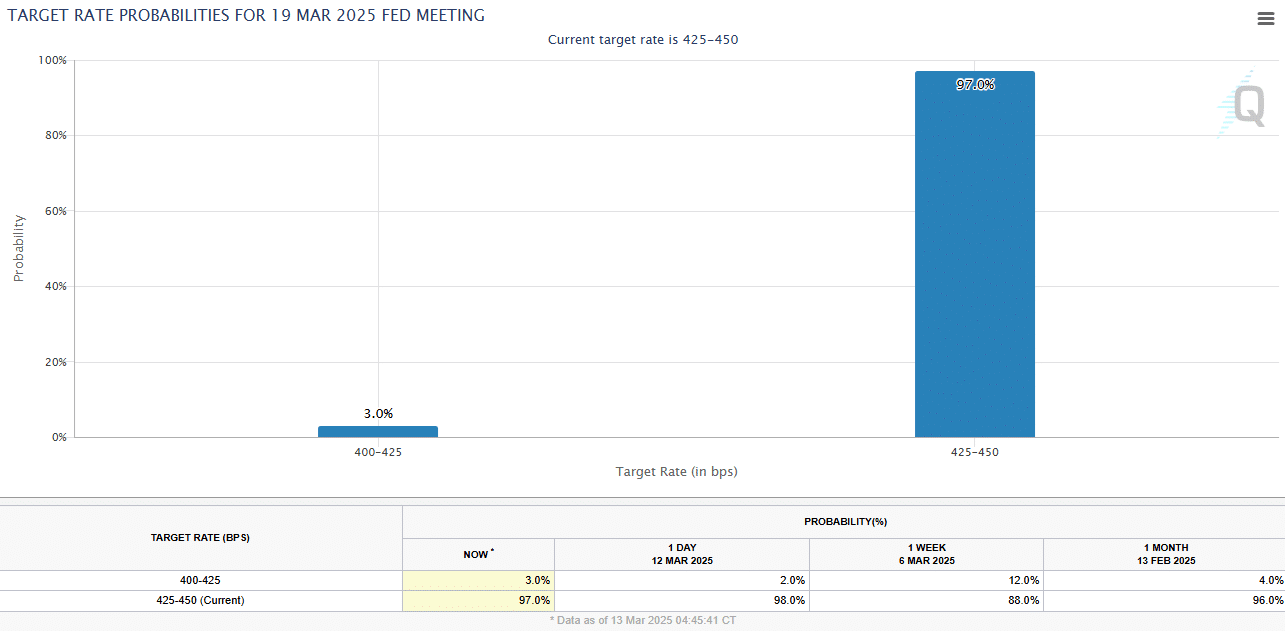

With only a 3% chance of a rate cut during the upcoming FOMC meeting, Bitcoin may face choppy waters in the short term.

following sentence:

The cat chased the mouse around the house.

The mouse was chased by the cat throughout the house.