- A surge in revenue on the TRON chain suggests active participation across the network, hinting at a potential price increase

- Selling pressure in the derivatives market could hinder TRX’s rally

TRX has been on a downward trend recently, with an 8.62% drop over the past month and a 1.47% decline in the last 24 hours. Despite this, the decline has been minimal compared to the broader cryptocurrency market.

AMBCrypto’s analysis indicates strong fundamentals supporting TRX’s minimal drop, with the potential for a price surge in upcoming trading sessions. However, selling pressure from the derivatives market poses a threat to a potential rally.

Accumulation driven by spot traders keeps TRX stable

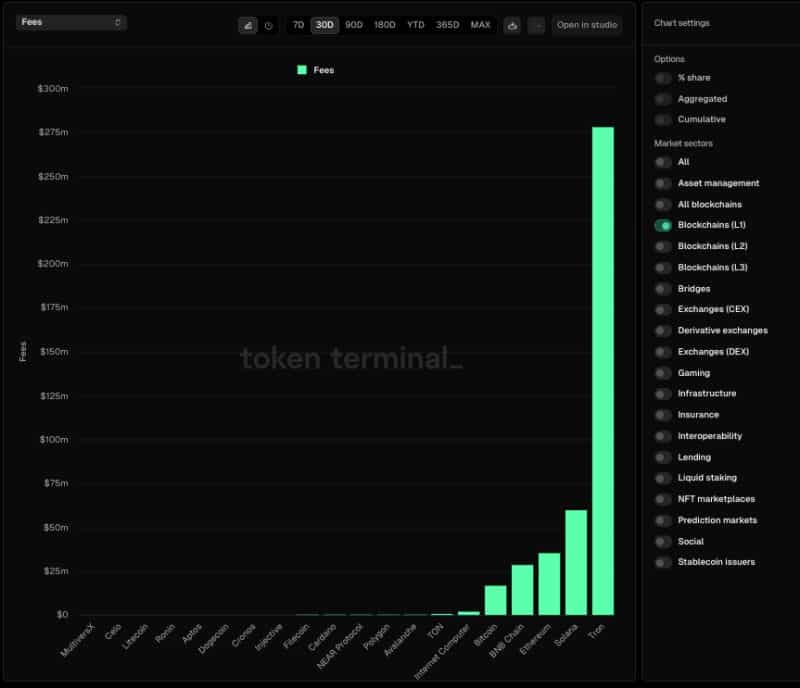

TRON has achieved a new revenue milestone, surpassing other prominent chains like Ethereum, Solana, Bitcoin, and BNB Chain in the last seven days.

Source: DeFiLlama

During this period, TRON generated $12.75 million in revenue, with the number of completed transactions increasing by 2.2% to 60.5 million.

Token Terminal’s data also shows that TRON generated the highest fees among blockchains by a significant margin, possibly due to the availability of stablecoins on its chain, with a stablecoin market cap of $62.27 billion at press time.

Source: Token Terminal

The increase in revenue, coupled with high user engagement, suggests that active traders are accumulating the asset, buying from sellers, and preventing significant price declines.

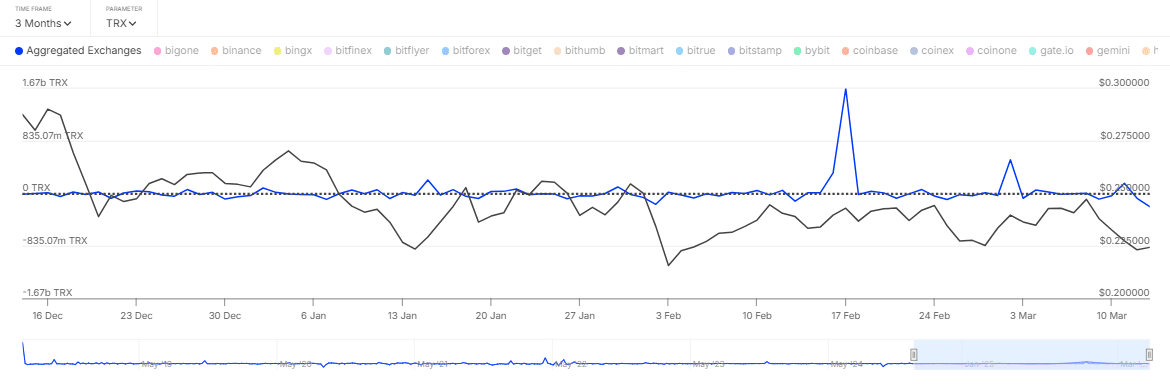

Analysis of exchange netflows on IntoTheBlock reveals that spot traders are responsible for the recent accumulation of TRX, maintaining its price stability. In the last 24 hours, these traders purchased 133.43 million TRX, worth around $29 million.

Source: IntoTheBlock

A significant purchase of this magnitude in a single day indicates strong buying interest. If this sentiment continues into the next week, TRX could experience further bullish gains.

While spot traders are buying, not all market segments are in alignment. Derivatives traders may have taken a selling stance.

Selling activity limits TRX’s potential for upside

The recent 24-hour price decline in TRX is likely driven by derivatives traders selling off their positions.

At present, the amount of unsettled derivative contracts has significantly decreased, accompanied by a decline in trading volume. For example, Open Interest dropped by 3.38% to $156 million, indicating that sellers are dominating the Futures market.

Source: Coinglass

The funding rate has turned negative, with a reading of -0.0086, indicating that short traders are periodically paying a premium. This suggests that the market is favoring them.

If selling continues in the derivatives market, it could create opportunities for spot traders to accumulate the asset at a discounted price before a potential price surge.