Bitcoin (BTC) may be on the brink of a significant price drop as the overall crypto market experiences heightened volatility on March 26, 2025, leading to drastic price fluctuations from gains to losses.

Bitcoin (BTC) Price Action and Technical Analysis

The cryptocurrency market has been witnessing substantial price swings in recent days. The market was quite bullish in late February and early March 2025, with significant upside momentum followed by the formation of a bearish price action pattern.

Bitcoin Price Prediction

Bitcoin (BTC) has exhibited a bearish rising wedge pattern on the four-hour timeframe, according to expert technical analysis. There is a looming possibility of a breakdown if BTC closes a four-hour candle below the $86,200 level, potentially leading to an 8.5% drop to $78,700 based on historical patterns.

Currently, BTC is trading below the 200 Exponential Moving Average (EMA) on the daily timeframe, signaling a downtrend.

$232 Million Worth of BTC Outflow

Despite market uncertainty and bearish price action, whales and long-term holders have been accumulating BTC, as reported by on-chain analytics firm Coinglass.

Data suggests significant outflows of $233 million worth of BTC from exchanges in the past 24 hours, hinting at potential accumulation that could create buying pressure and drive further upside momentum.

This marks the fourth consecutive day of continuous BTC outflows from exchanges.

Traders’ Bearish Outlook

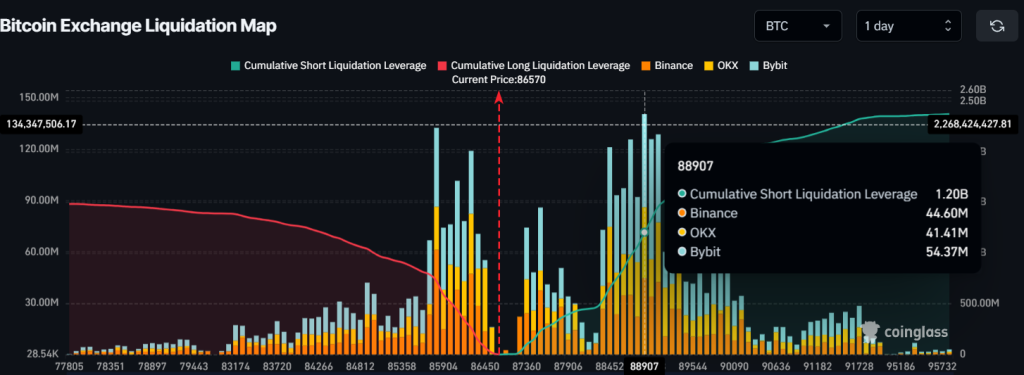

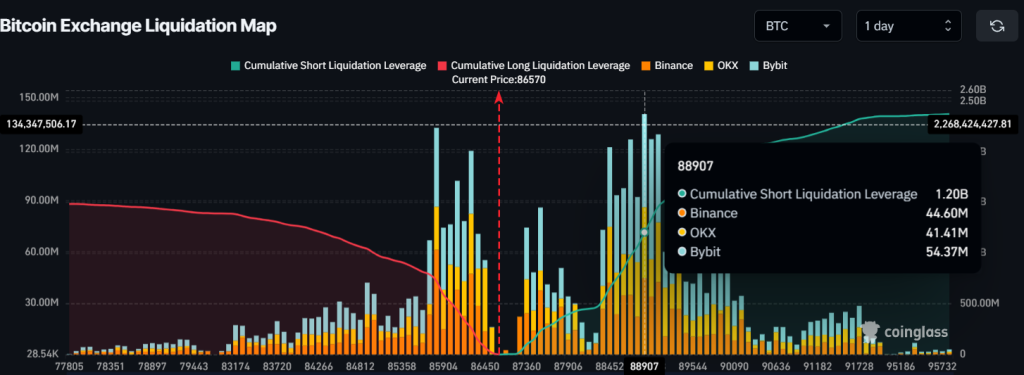

Traders seem to align with the current market sentiment, heavily favoring the short side. Coinglass data reveals over-leveraged positions at $88,907 on the upper side and $85,813 on the lower side, with $1.20 billion in short positions and $722 million in combined short and long positions.

This underscores the current dominance of bears in the market, suggesting that the price is unlikely to surpass the $88,907 level.

Current Price Momentum

At the moment, BTC is hovering around $86,690, registering a 1.50% decline in the last 24 hours. Concurrently, trading volume has decreased by 10%, indicating reduced participation compared to the previous day.