- The recent drop in the ETH/BTC ratio has sparked discussions about the potential of investing in Ethereum.

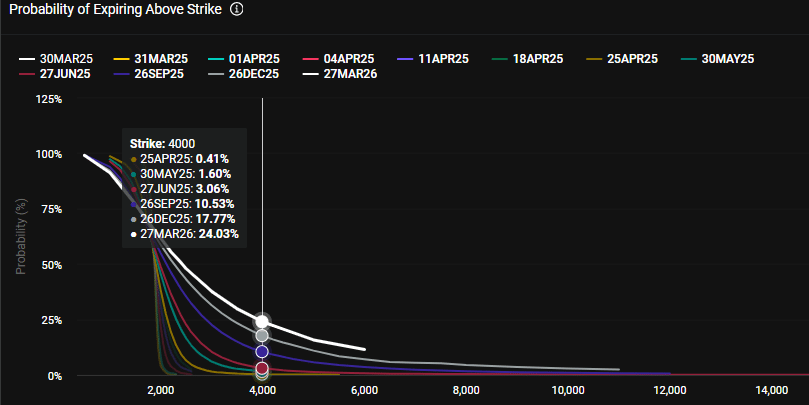

- Despite the decline, there are still speculators anticipating ETH to reach $4k by 2025.

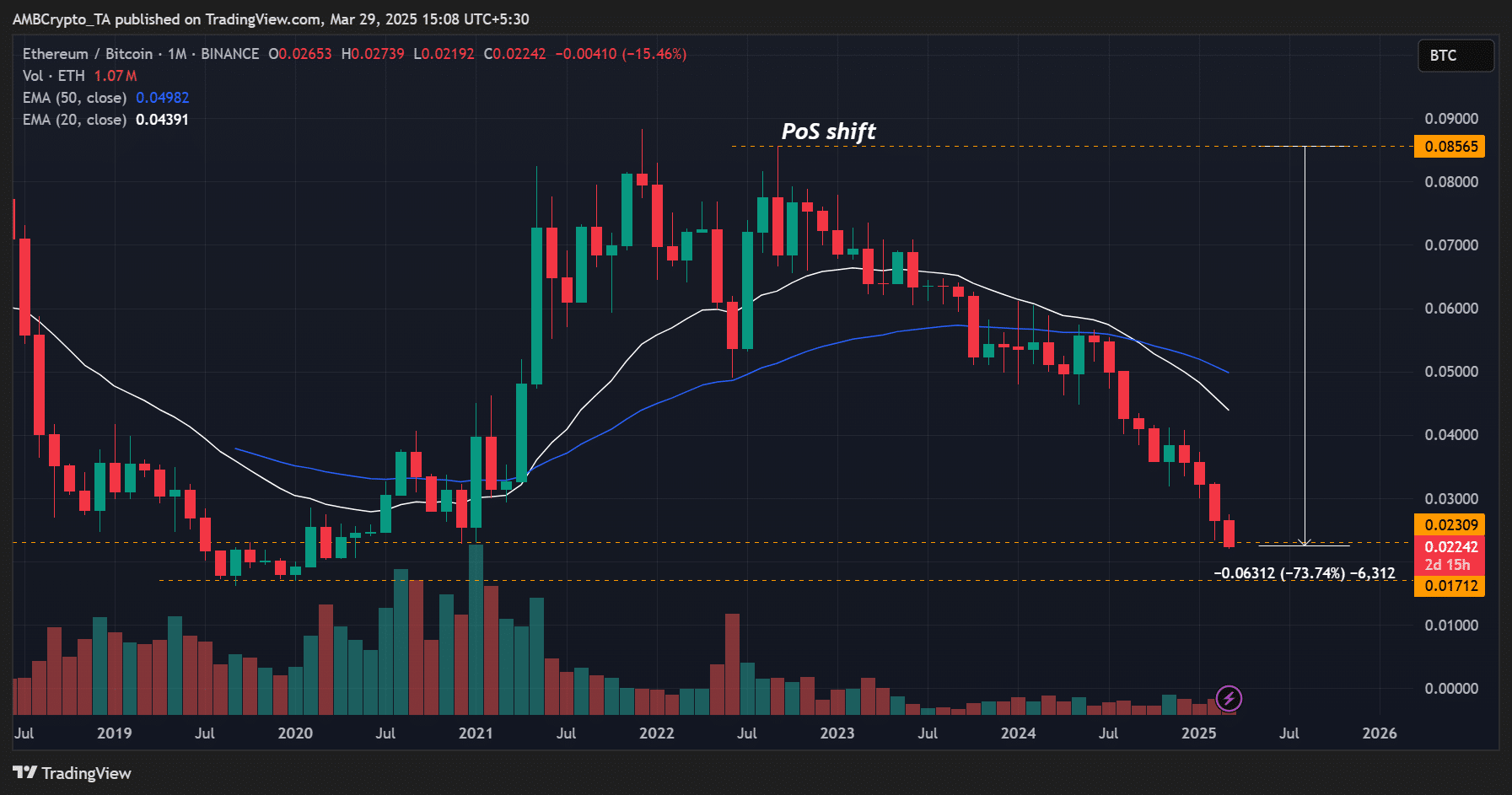

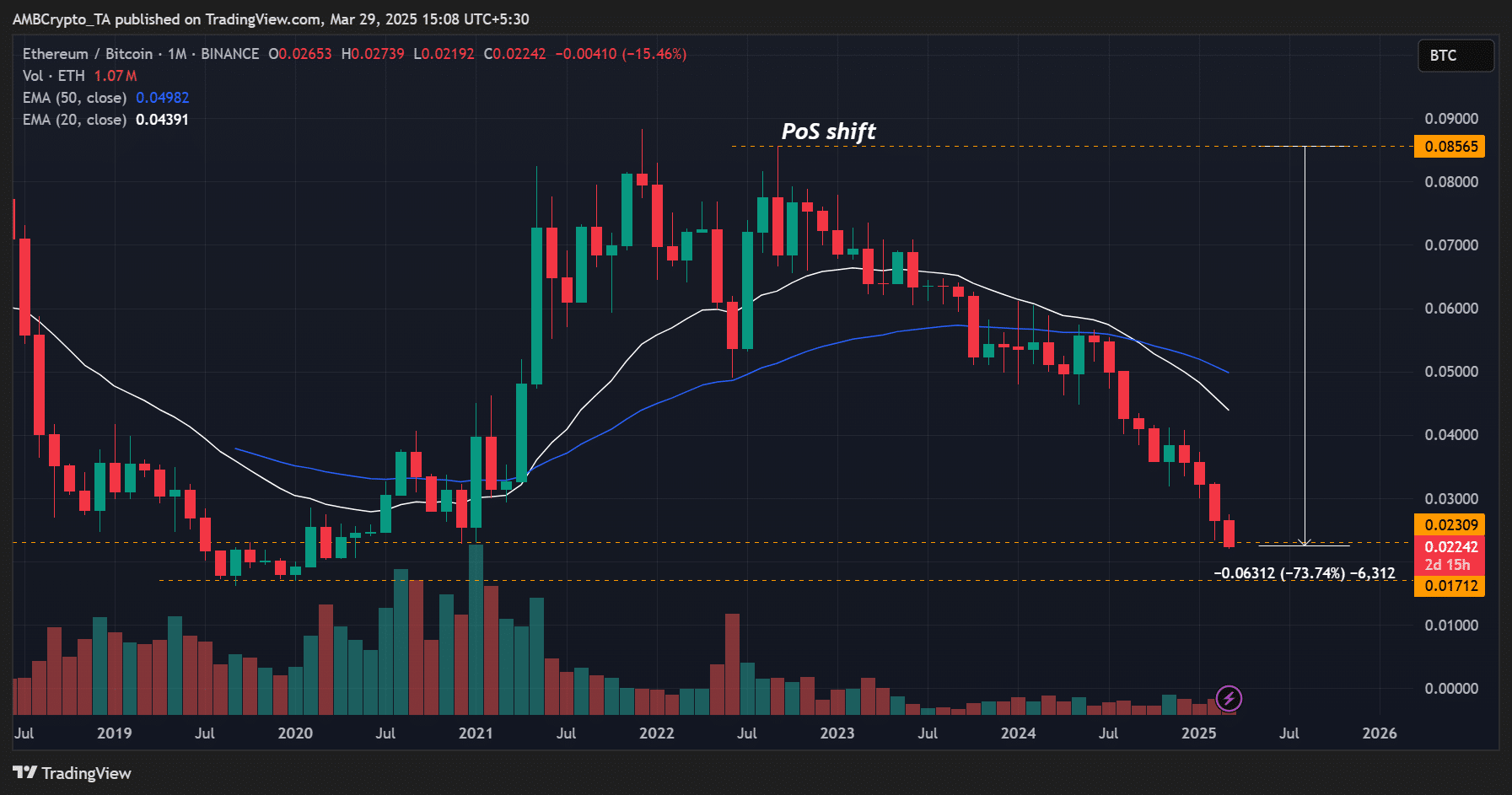

Ethereum [ETH] has been on a downward trend against Bitcoin for more than three years, as evidenced by the ETH/BTC ratio hitting a new low of 0.022 recently.

Reflecting on the prolonged decline, Alex Thorn, Head of Research at Galaxy Digital, noted,

“Ether has seen a 74% decrease against Bitcoin since transitioning from proof of work to proof of stake.”

Source: ETH/BTC, TradingView

Some in the community have suggested a return to PoW (proof-of-work) for Ethereum to enhance its value.

Is ETH a worthwhile investment?

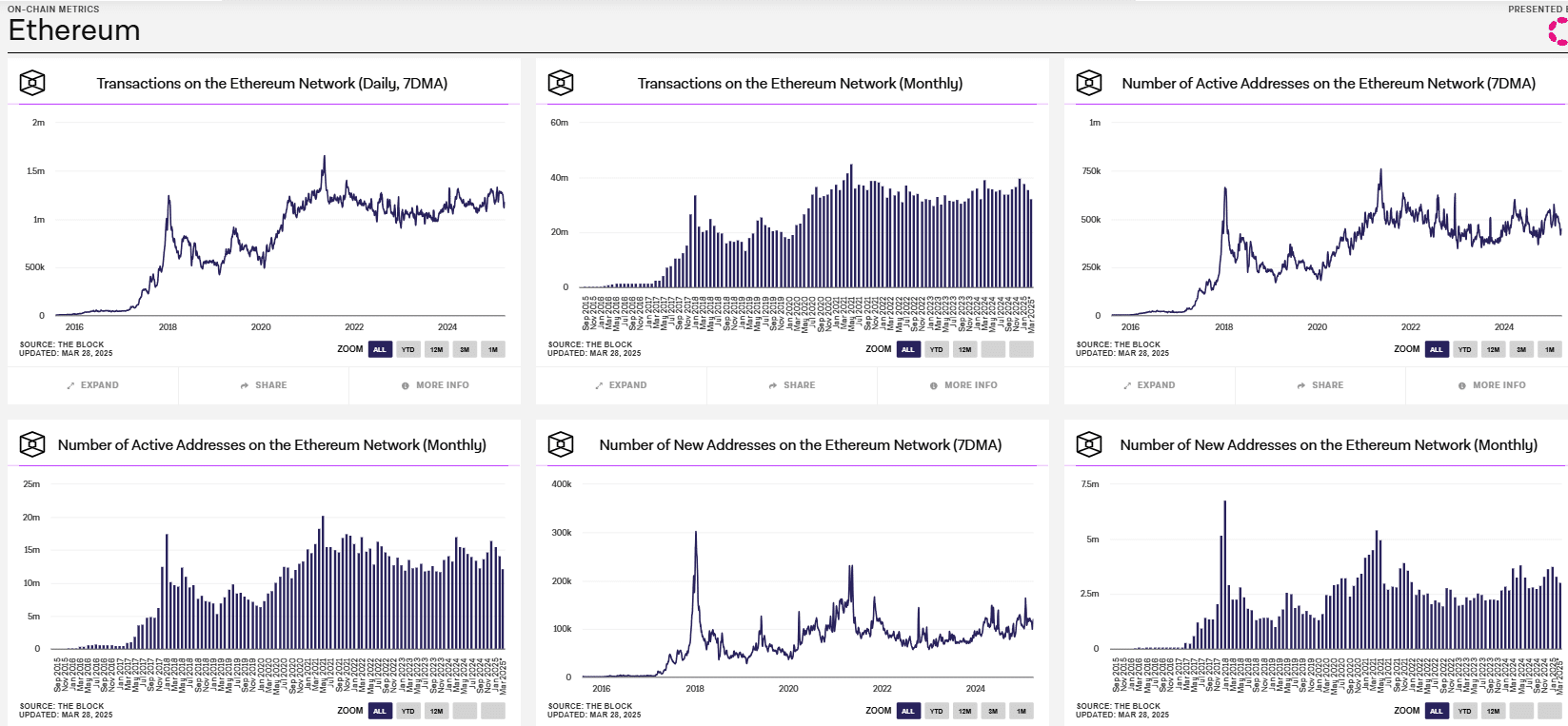

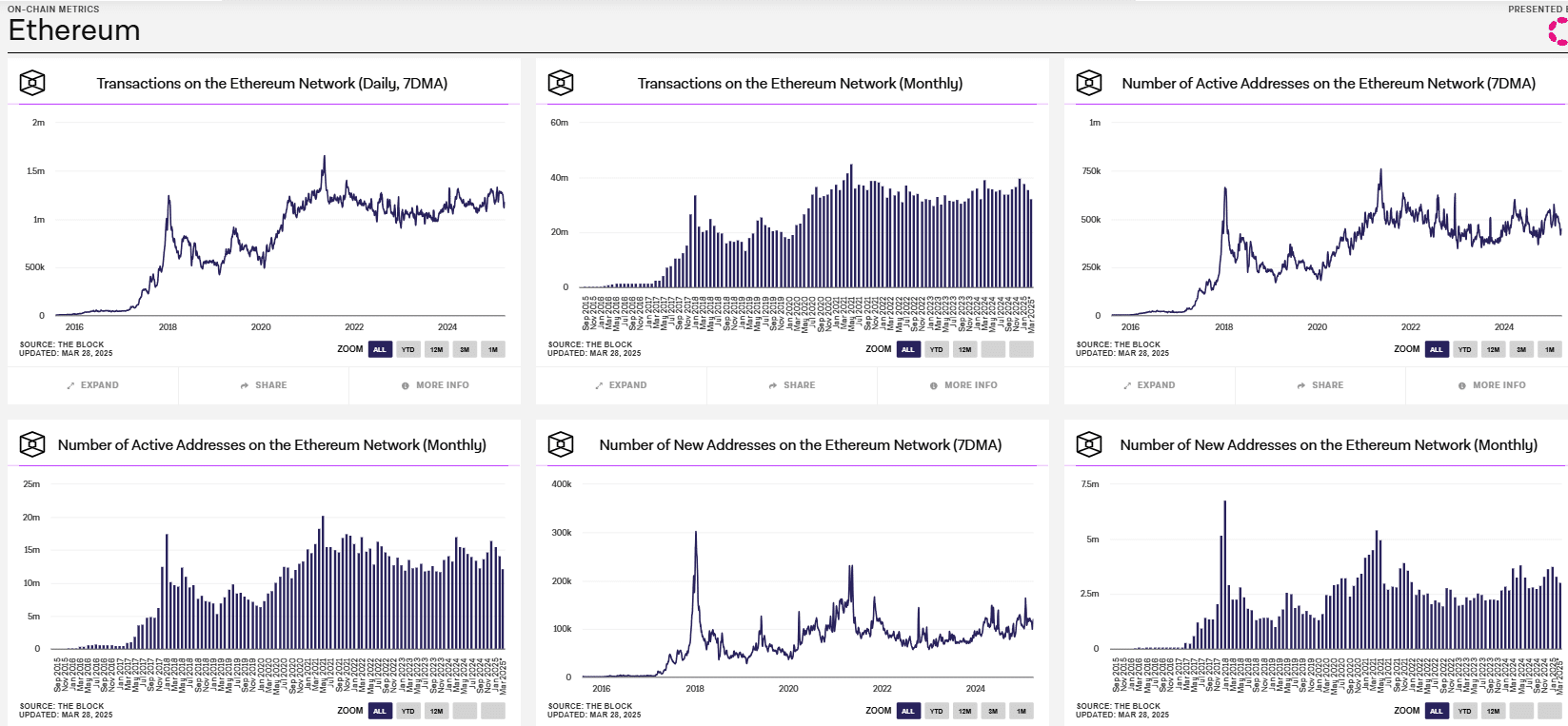

Quinn Thompson, the founder of macro-focused hedge fund VC Lekker Fund, argues that ETH may not be a sound investment due to decreasing network activity and other factors.

“Make no mistake, investing in $ETH is essentially futile. A network with a $225 billion market cap experiencing declines in transaction activity, user growth, and fees/revenues. There is no viable investment thesis here.”

Source: The Block

While acknowledging Ethereum’s utility, Nic Carter, a partner at Castle Island Ventures and co-founder of Coinmetrics, also views it more as a utility than an investment.

Carter attributes the decline in ETH’s value to L2 solutions and states,

“The primary reason for this is the excessive ETH L2s diverting value from the L1 and the consensus that creating excess tokens was acceptable. ETH was overwhelmed by its own tokens. It self-destructed.”

Thompson believes that the ETH/BTC ratio saw significant declines during the 2023-2024 bullish period and could face further challenges in a bearish cycle.

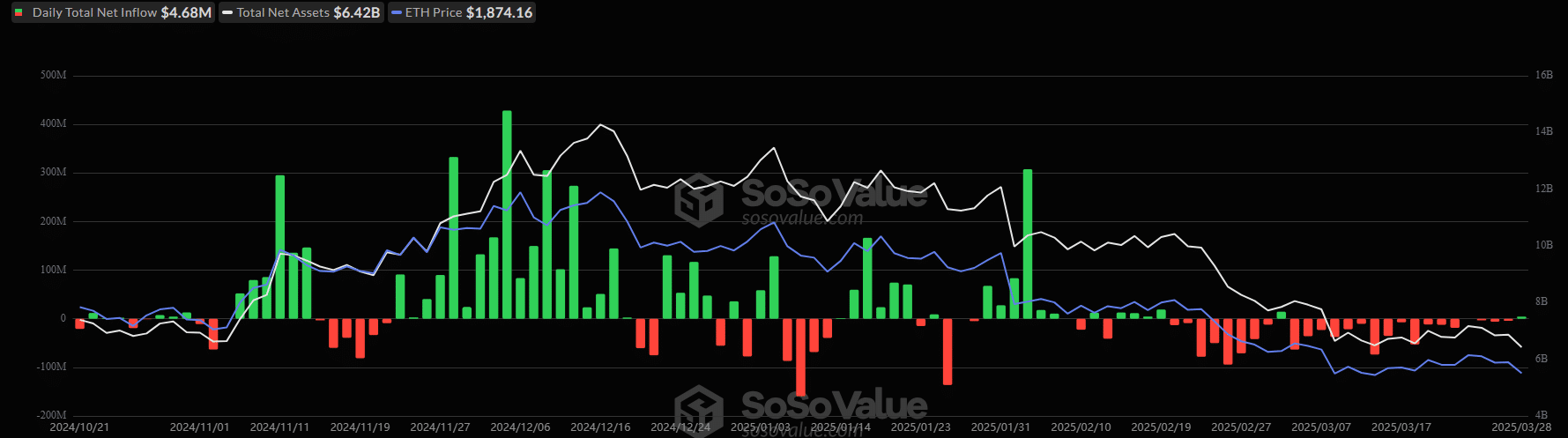

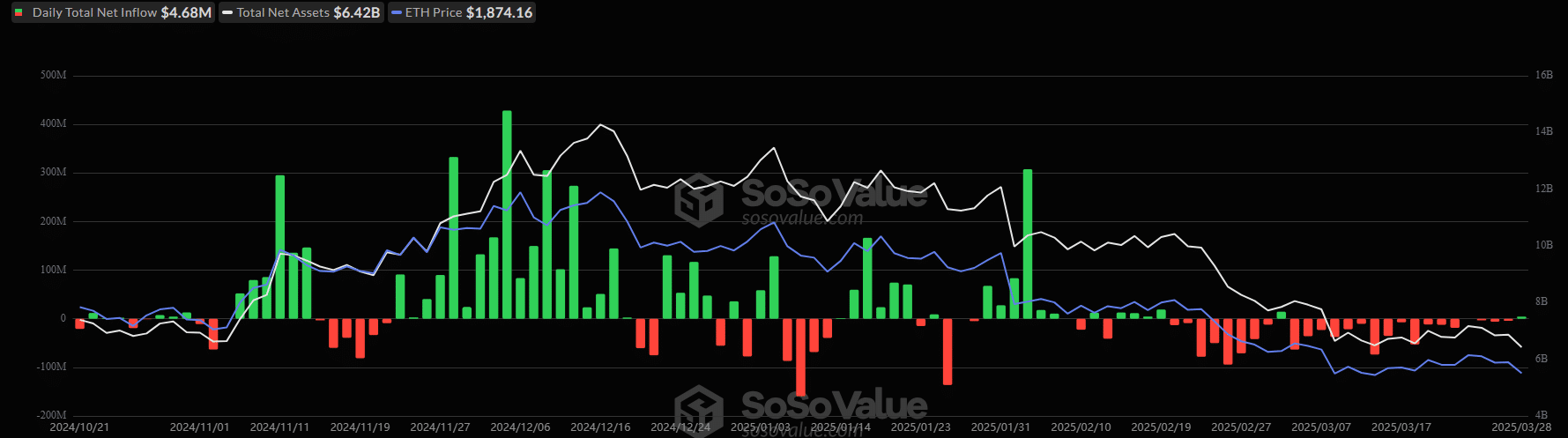

Recent ETF flows have showcased a disparity between the top two cryptocurrencies. U.S. spot BTC ETFs witnessed over $1 billion in inflows for 10 consecutive days, with only one day of outflows last Friday.

On the other hand, U.S. spot ETH ETFs have experienced consistent outflows since February 20, except for two days of inflows. In March, outflows exceeded $400 million.

Source: Soso Value

Overall, negative sentiments on social media align with weak institutional interest in Ethereum.

Despite the outflows, the outlook for ETH’s recovery remains positive. On Polymarket, the consensus among bettors is a $4k price target for ETH in 2025, with the highest volume of bets placed on this figure. The second-highest volume is for $5k.

Deribit’s option traders anticipate reaching the $4k target by September, with a 10% probability. Currently, ETH is priced at $1.87k, down 54% from its peak of $4k in December.

following sentence:

The cat sat lazily in the sun, enjoying the warmth on its fur.

Rewritten sentence: Basking in the sunlight, the cat lounged lazily, relishing the warmth on its fur.