Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

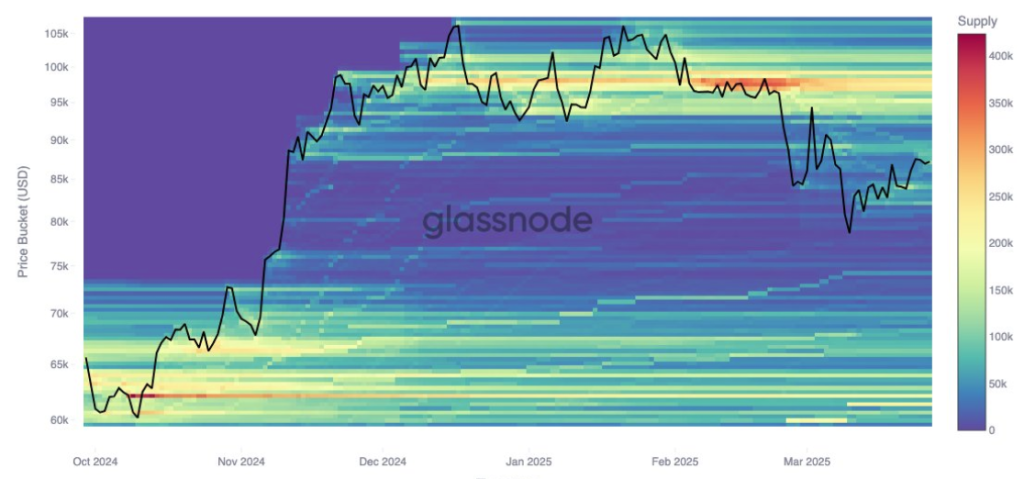

Bitcoin’s recent price movements have brought it close to the $80,000 level once again, with potential risks of a downward break. On-chain data suggests a significant support range between $80,920 and $78,000 that needs to hold.

Related Reading

Notably, data from Glassnode indicates a decrease in support at the $78,000 level, where minimal cost basis clusters are now present. This insight follows a notable transaction where savvy traders purchased approximately 15,000 Bitcoin at the March 10 low and later sold at the $87,000 peak.

Support Levels Strengthen Between $80,000 And $84,000

Bitcoin faced a significant drop in early March, reaching below $77,000 on March 10 and 11. Throughout the month, Bitcoin recovered from this low, reaching a peak of $88,500 last week.

Interestingly, on-chain data from Glassnode reveals that some traders took advantage of the dip and purchased around 15,000 BTC at the low point. However, many of these same traders sold at the $87,000 top, creating a depleted buffer zone that may not offer the same price stability.

The strongest cost basis clusters for Bitcoin have shifted upwards throughout the month, with key support levels now lying between $80,920 and $84,100. Significant accumulations occurred at $80,920, $82,090, and approximately $84,100, providing a new zone of confidence for recent buyers to weather market fluctuations.

Currently, Bitcoin is trading at $83,120, indicating a loss of support around $84,100. Attention is now on the $82,090 level and potentially the $80,920 range. Further correction might lead to a test of structural support at $78,000, followed by $74,000 and $71,000, where substantial buying occurred previously.

Image From X: Glassnode

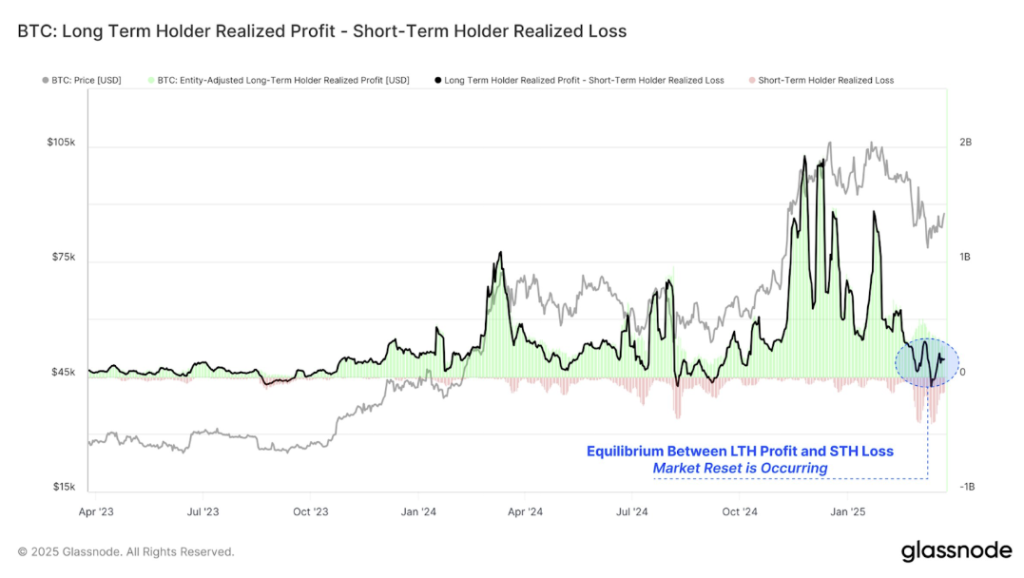

$95,000 Support Cluster Grows Amidst Cooling Demand

While support levels continue to rise, resistance is solidifying around the $95,000 mark. Investor data shows an increase in a cluster of 12,000 BTC at this level since March 24.

This suggests that some investors anticipate a price ceiling around $95,000, potentially leading to increased selling activity near that level. The interplay between support and resistance could result in Bitcoin trading within a narrower range in the near future.

Related Reading

Data from Glassnode indicates that long-term holders have been realizing profits, while short-term traders have been experiencing losses, creating a balanced market dynamic.

Image From X: Glassnode

Featured image from Tech Research Online, chart from TradingView