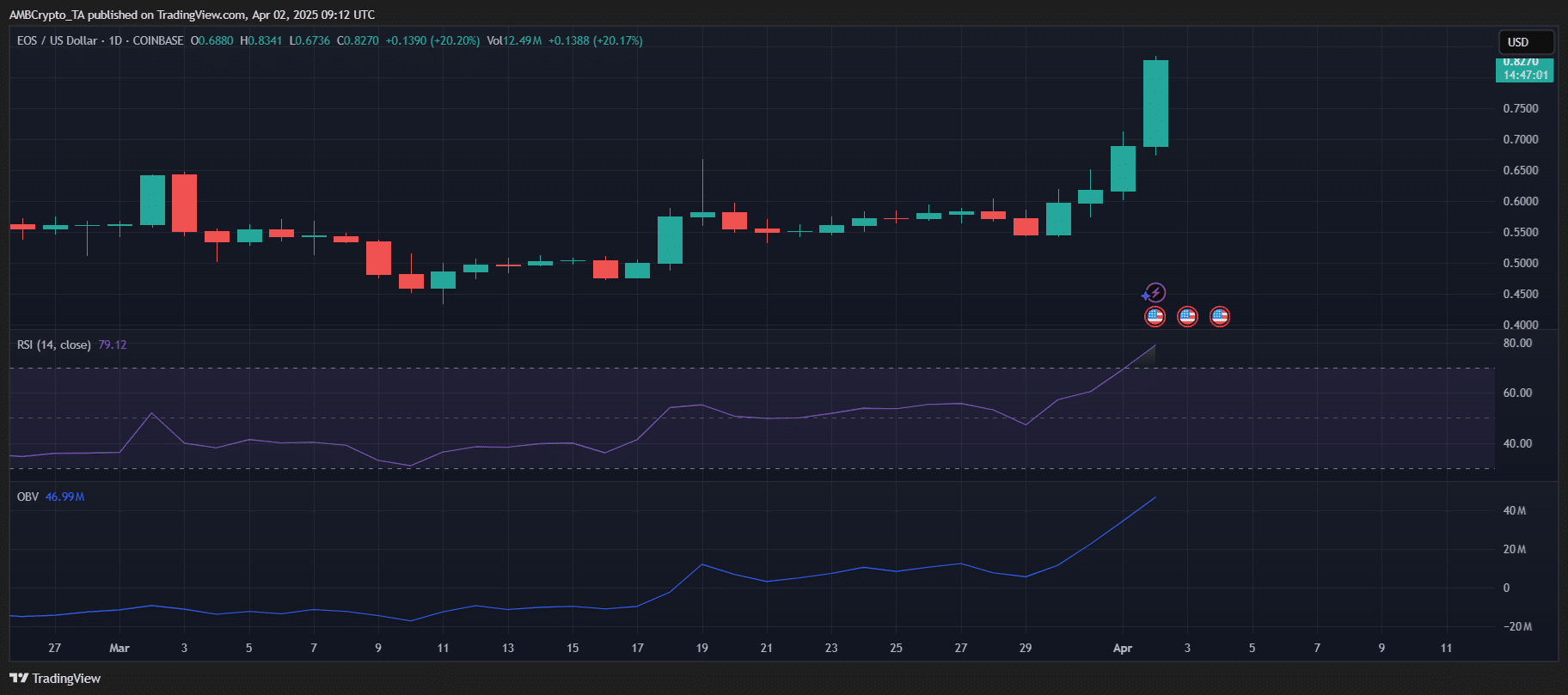

- EOS surged over 20%, driven by its rebranding to Vaulta, high staking yields, and bullish derivatives

- Social Dominance spiked but has since cooled off; EOS price remains stable with strong buying pressure

EOS [EOS] is causing a stir in the market, with a remarkable 20% rally that has traders buzzing about its transition to Vaulta.

With staking yields expected to outperform Ethereum[ETH] and Solana[SOL], and derivatives traders showing confidence in further gains, EOS is leaving behind its stagnant history and stepping into the limelight. But the question remains: can the excitement be sustained, or will profit-taking halt the gains?

Key drivers behind EOS’s surge

The recent surge in EOS crypto can be attributed to three main factors. Firstly, the anticipation surrounding EOS’s upcoming rebranding as Vaulta is capturing the attention of investors.

Scheduled to debut by the end of May 2025, Vaulta aims to transform EOS into a blockchain-powered banking hub, complete with a new ticker and continued integration with exSat, the Bitcoin banking solutions.

Secondly, the introduction of a staking yield of around 17% for the new Vaulta token surpasses Ethereum’s 2.03% and Solana’s 5.14%, supported by a reward pool of approximately 250 million tokens.

Source: Coinglass

Lastly, derivatives traders are increasingly confident in EOS. According to data from CoinGlass, Open Interest (OI) in EOS futures has surged, reaching a recent peak of around $170 million.

EOS price outlook

Source: TradingView

following sentence:

She decided to go for a run in the park to clear her mind.