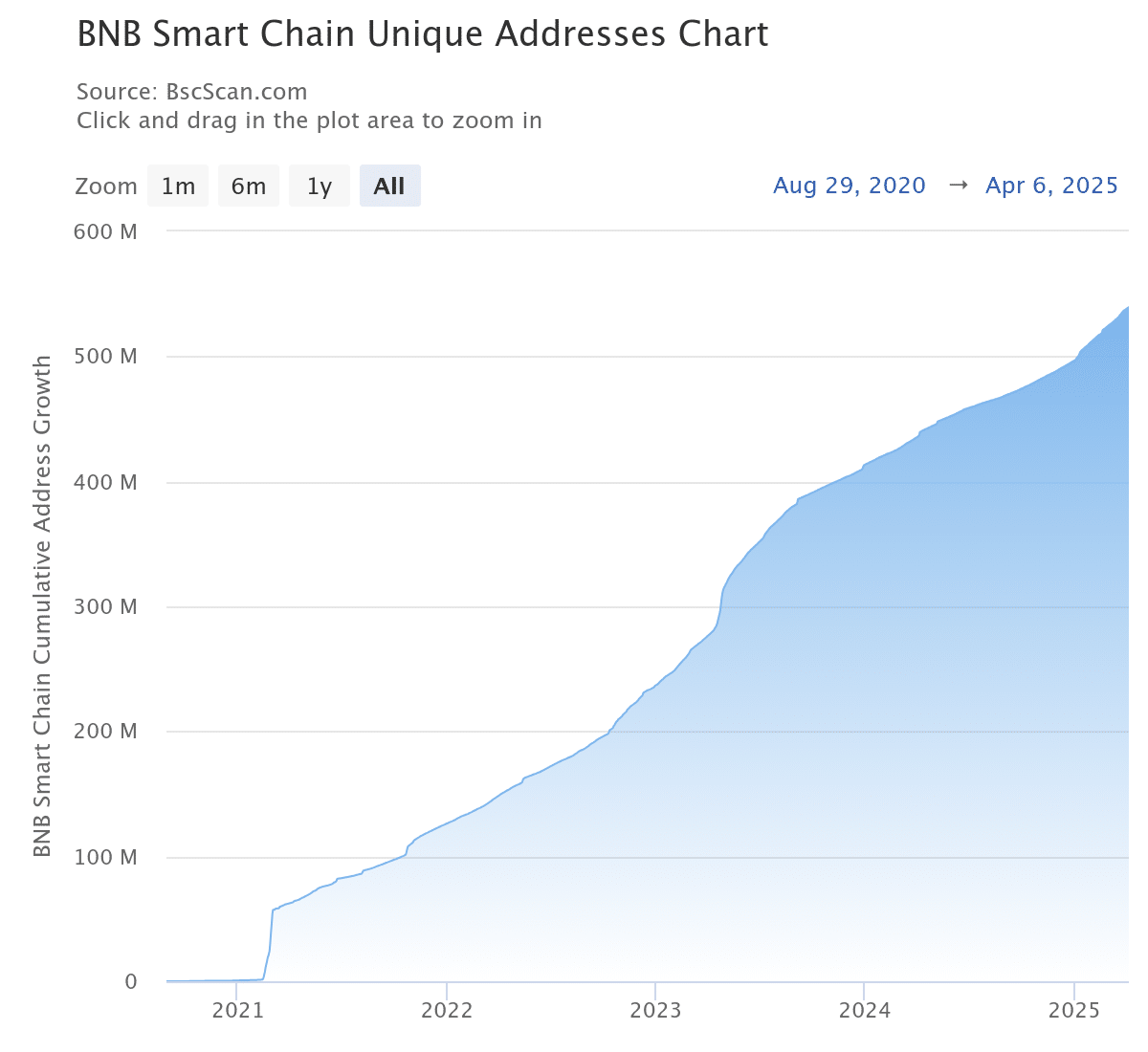

- BNB sees significant growth in unique address count, indicating a bullish trend.

- Traders with close stop-orders may face forced exits, potentially leading to a market rally.

In the last 24 hours, the market has seen a 3.57% decline, possibly influenced by large investors triggering a buyback scenario for Binance Coin [BNB].

BNB adoption on the rise

Over the past day, BNB adoption has surged, with a record 539 million unique addresses, reflecting a 268,000 increase from the previous day.

Unique addresses represent first-time interactions with the BNB Smart Chain, indicating user activity on the chain.

Source: Bscscan

The increase in unique addresses is attributed to BNB trading activity, with users either buying or receiving the asset in the past day.

Moreover, the chain has witnessed a significant rise in transactions, hitting 4 million, indicating heightened participation and contributing to the asset’s growth.

Source: Bscscan

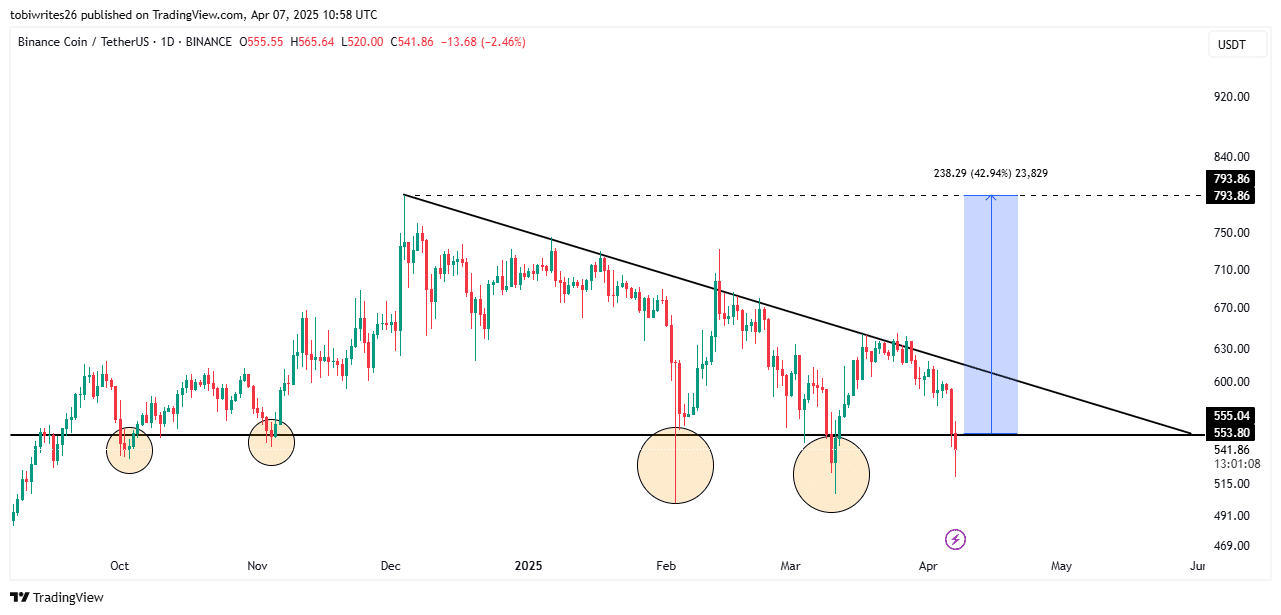

Analysis shows BNB is poised for a significant uptrend, trading in a historical buy zone.

Historic zone—Will ‘paper hands’ exit?

On the daily chart, BNB has reached a crucial support level, forming a bullish triangle pattern, indicating a potential upward movement.

This level is crucial as previous instances have led to major price surges after touching this zone.

However, recent occurrences have triggered liquidity sweeps, causing price drops followed by quick reversals.

Source: TradingView

This situation tends to flush out ‘paper hand’ traders from the market, while large investors capitalize on discounted BNB prices during downward trends.

With strong buying momentum, BNB could break the descending resistance line and surge by 42% to $793, a level last seen in December 2024.

Market analysis indicates a positive response to lower prices, with buying sentiment dominating both spot and derivative markets, supporting the accumulation narrative.

Traders identify accumulation opportunities

In the spot market, significant buying activity has been observed, with $9.83 million worth of BNB accumulated in the last 24 hours, totaling $21.04 million over three days.

This accumulation trend signifies traders’ interest in buying BNB at discounted prices in the spot market.

Similarly, the derivatives market shows positive Open Interest (OI)-Weighted Funding Rate, indicating bullish sentiment among traders.

Source: Coinglass

The OI-Weighted Funding Rate currently indicates a bullish sentiment in BNB’s futures market, with a reading of 0.0020% at the moment. This metric is used to gauge market sentiment, showing bullish behavior above 0% and bearish behavior below 0%.

With ongoing bullish sentiment in both spot and derivative markets, BNB is poised to achieve the projected price surge to its December peak.

text using different words:

The text needs to be rewritten in order to avoid plagiarism.