As the week draws to a close, all is quiet on the American front, despite reports from the Korea JoongAng Daily that a high-ranking Chinese trade official from the Ministry of Finance was seen at the U.S. Treasury Department headquarters in Washington, D.C. today. This meeting between Chinese and U.S. officials comes at a critical time, on the brink of a trade war shock that is now spreading across the Pacific, with the Port of Los Angeles expected to be the first casualty. High-frequency data indicates that the impact is likely to start next week and escalate in the following weeks.

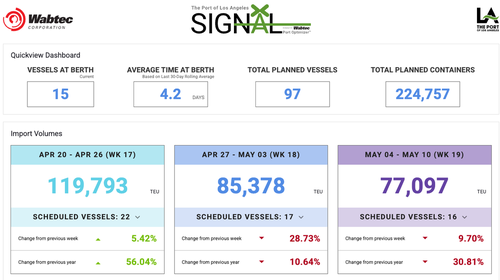

On the verge of a trade war shock, data from Port Optimizer—a tracking system used by vessel operators—indicates that scheduled import volumes into the Port of Los Angeles are set to decline starting next week and could plummet by mid-month.

Goldman analyst Jacob Malmstrom provides some charts to wrap up the week:

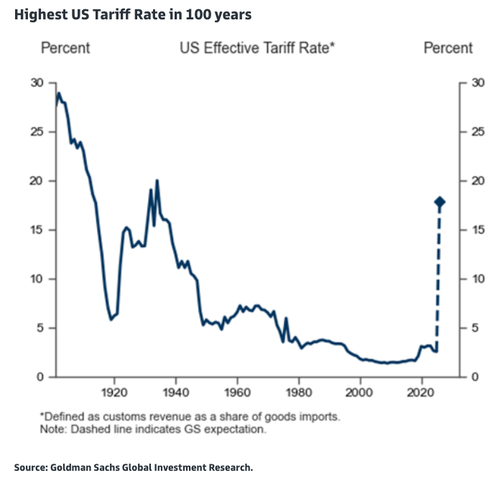

Geopolitical tensions have eased, lifting markets higher for the week, but the current effective tariff rate is at its highest level in a century.

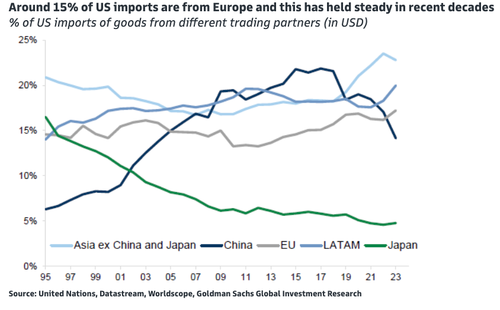

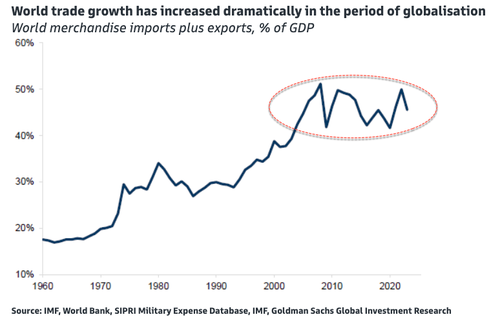

Trade growth has significantly increased during the era of globalization, but U.S. imports from Europe have remained around 15% in recent decades.

World trade growth has surged in the era of globalization

Malmstrom cautions in the markets:

It’s challenging to make a bullish case for the long term from this point onwards. We still need to see one of these four conditions met for a sustainable recovery: 1) Attractive valuations, 2) Reduction in extreme positioning, 3) Policy support, 4) Improvement in the growth momentum. Valuations in the U.S. seem reasonable when compared to ROE. Banks experienced a sell-off at the beginning of the year but have rebounded, while mega-cap tech stocks continue to decline. Earnings have been consistent with historical averages so far.

Our coverage delves into the events that have transpired this month, leading to the impending trade war shock—a situation that has already impacted China and is now on the verge of affecting the U.S. as well:

High-frequency data from the Port of Los Angeles suggests a significant impact on Chinese exports to the U.S. will commence next week, primarily due to the delay between factory closures or halted shipments in China—stemming from the 145% tariffs—and the time required for containerized cargo to traverse the Pacific Ocean on large vessels.

The list above outlines potential developments in the near future: downward pressure on the trucking industry in Southern California and the Empire Inland warehouse district. As highlighted by Goldman earlier, many companies’ inventories span 2–3 months but could deplete rapidly if panic buying ensues once consumers become aware of disruptions at the Port of Los Angeles. There may even be a temporary inflation surge this summer, although it is likely to be short-lived.

Loading…