Bitcoin and Cryptocurrency Liquidations Triggered by Rebound

Recent data indicates a surge in Bitcoin and other cryptocurrency prices, leading to a significant wave of short liquidations that have punished the bears in the market.

According to information from CoinGlass, there has been a substantial increase in liquidations on the cryptocurrency derivatives market. These liquidations occur when open contracts face forced closure due to losses exceeding a platform-defined threshold.

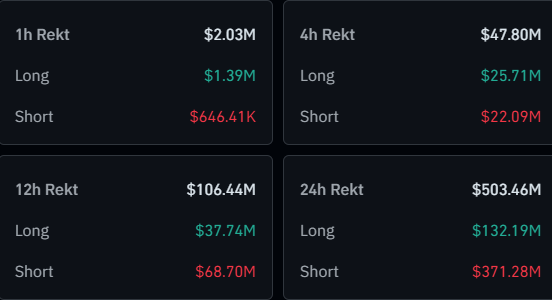

The table below illustrates the latest liquidation numbers in the market:

Recent data shows that the cryptocurrency sector has witnessed over half a billion dollars in derivatives liquidations within the past day. Of this amount, 73.7% of the liquidations, totaling $371 million, came from short investors alone.

This mass liquidation event has occurred as Bitcoin and other cryptocurrencies experienced a rebound following news of a ceasefire between Israel and Iran. Previously, US strikes on Iranian nuclear facilities had caused a market crash, resulting in a series of long liquidations. This time, however, it was the bears who faced the consequences.

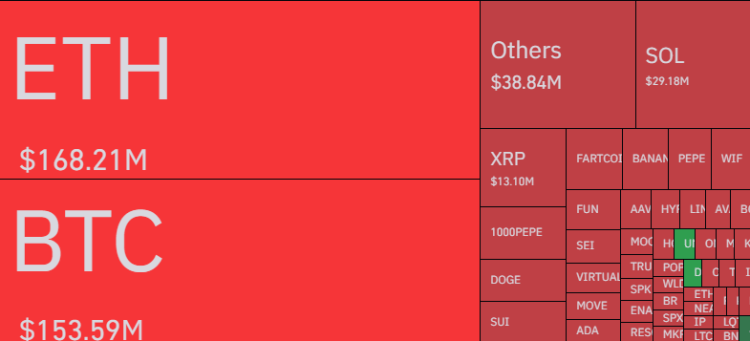

Bitcoin and Ethereum have traditionally been at the top of the list for liquidations, with Ethereum ($168 million) surpassing Bitcoin ($153 million) in the latest round. This unexpected shift could be attributed to Ethereum’s larger price increase compared to Bitcoin over the past day.

In addition, altcoins like Solana and XRP have also experienced liquidations, albeit on a smaller scale compared to Bitcoin and Ethereum, highlighting the differences in capital involved.

Meanwhile, Bitcoin taker buy volume has surged on the Bybit exchange, indicating a potential increase in long positions. This trend has historically preceded a rise in Bitcoin prices, as observed in the chart below:

Bitcoin Price Update

Following the recent recovery, Bitcoin has reached the $105,100 mark, signaling a positive trend in the cryptocurrency market.