Authored by Mike Shedlock via MishTalk.com,

Currently, 2 million student loan borrowers are facing wage garnishment, with another 4 million projected to join them soon. The job market is becoming increasingly challenging for these individuals.

Student-Loan Borrowers Are at Risk of Docked Pay This Summer

The Wall Street Journal reports Nearly Two Million Student-Loan Borrowers Are at Risk of Docked Pay This Summer

Roughly six million federal student-loan borrowers are 90 days or more past due after a pandemic-era reprieve ended, according to TransUnion. The credit-reporting company estimates that about a third of them, or nearly two million borrowers, could move into default in July and start having their pay docked by the government. That’s up from the 1.2 million that TransUnion had estimated in early May.

An additional one million borrowers are on track to default by August, followed by another two million in September. Borrowers fall into default when they are 270 days past due.

Wage garnishment is also set to restart this summer. Until past due payments are paid in full or the default status is resolved, borrowers could see up to 15% of their wages automatically deducted from their paychecks.

Borrowers who have been newly reported as delinquent since then on their student loans have seen an average 60-point drop in their credit scores, according to TransUnion. Nine percent of borrowers who fell into delinquency were current on their payments by April, according to TransUnion.

The Education Department has been urging borrowers to resume payments and emphasizing the consequences. Roughly 43 million borrowers owe more than $1.6 trillion in student-loan debt.

More than nine million of them are expected to see their credit scores drop this year, according to data from the New York Fed released in March.

This situation is significant, affecting millions of zoomers and millennials who are already struggling financially. The looming wage garnishment of up to 15% adds to their challenges.

Additionally, recent college graduates are facing a tough job market.

Gen Z College Grads Hit the Job Market at the Worst Possible Time

Business Insider reports Gen Z College Grads Hit the Job Market at the Worst Possible Time

Recent college graduates are encountering difficulties in the job market due to economic uncertainty and AI disrupting entry-level positions. Many are frustrated by numerous rejections and lack of responses from potential employers, leading some to settle for any available work.

The unemployment rate for recent college graduates ages 22 to 27 has increased significantly compared to the overall workforce, especially in white-collar fields. The job market for young degree holders is currently one of the toughest in decades, with sectors like anthropology, physics, and computer engineering experiencing high unemployment rates.

The pool of available jobs has decreased, with job openings declining from 12 million to 7 million. The Big Stay phenomenon has seen current employees holding onto their positions, further limiting opportunities for new graduates.

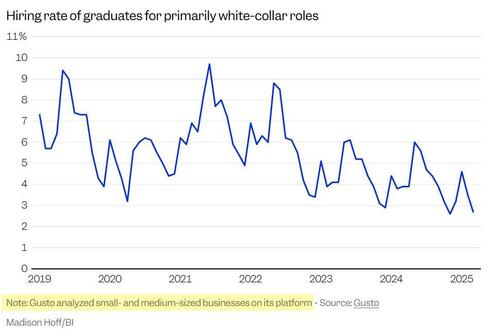

Small and midsize businesses aren’t hiring as many recent grads

Gusto reported a decline in primarily white-collar hires aged 20 to 24 at small and midsize employers. The share of 20-somethings working in roles that don’t require a college degree is increasing, signaling a shift towards skilled trades.

Fed Chair Jerome Powell’s assertion that the labor market is healthy is debatable in light of these challenges.

Loading…