- During the last 30 days, Ethereum whales have acquired more than 1.49 million ETH.

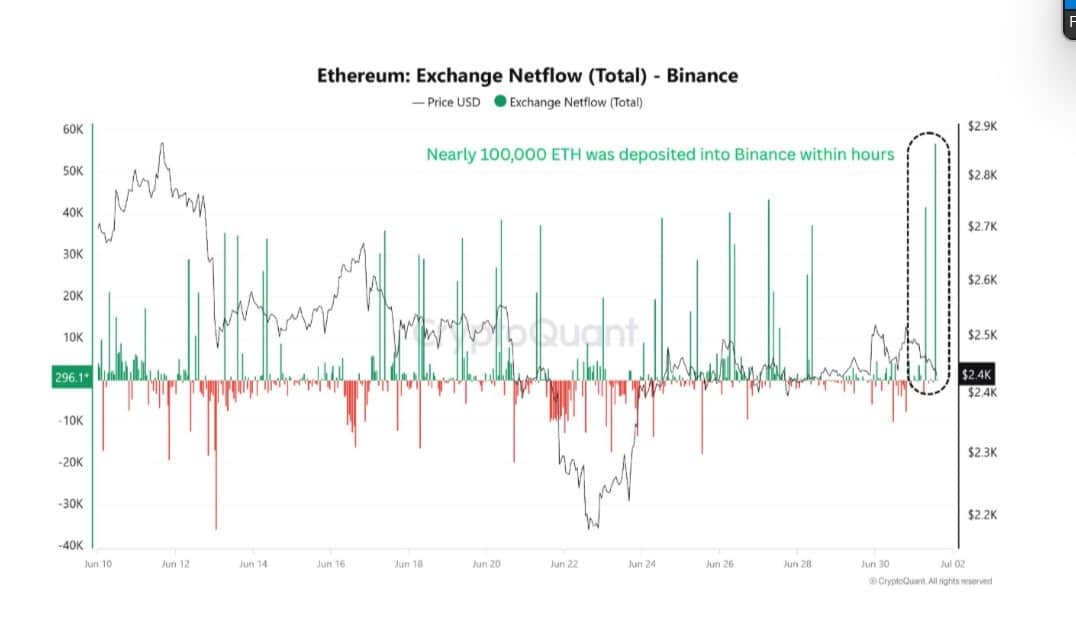

- Binance has seen an inflow of 100k ETH valued at $250 million, indicating aggressive selling activity.

The price of Ethereum [ETH] has been fluctuating between $2.4K and $2.5K in recent weeks, struggling to recover from last month’s drop from $2.8K to $2.1K.

This lack of significant price movement has led to varying reactions, with whales accumulating while other investors are aggressively closing their positions.

Whales Quietly Accumulating ETH

Despite Ethereum’s stagnant price, whales have been seizing the opportunity to accumulate more tokens.

Source: CryptoQuant

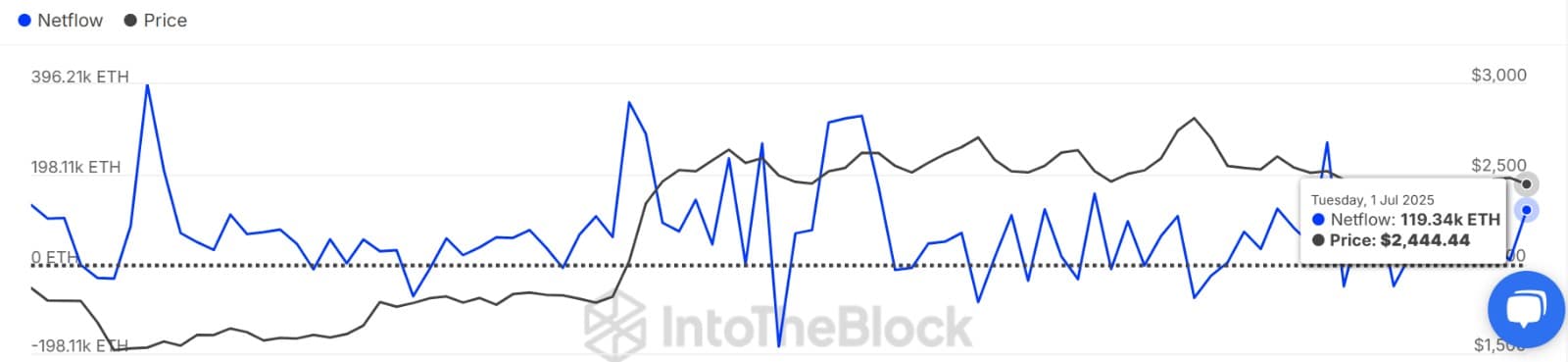

Over the past month, large holders have accumulated 1.49 million ETH, increasing their total balance by 3.72%. This trend has been consistent, with significant purchases of 704K ETH on July 1st.

Source: IntoTheBlock

The net inflow of ETH by whales signals accumulation, indicating a strategic positioning for potential market movements.

Selling Pressure from Other Players

While whales are accumulating, institutions and small-scale investors are engaging in selling activities. The Ethereum Foundation, for instance, has been transferring a significant amount of ETH to Multisig, totaling 13k ETH worth $32 million.

This divergence in behavior raises the question of whether it signifies profit-taking or a more cautious approach.

Retail Investors Sending ETH to Exchanges

Source: CryptoQuant

Recent data from CryptoQuant shows a surge in Ethereum’s Exchange Inflows, with Binance receiving 100K ETH valued at $250 million in a single day.

Conflicting Paths for Ethereum

The current scenario reflects a tug-of-war, with whales accumulating while other market players sell off their holdings. This dichotomy has created a strong support level for Ethereum, contrasting with profit-taking activities by small-scale investors.

Source: TradingView

The RSI Divergence Indicator for Ethereum is currently around 48.62, suggesting a period of market consolidation as participants await the next catalyst.

The outcome of this battle between accumulating addresses and profit-takers will determine Ethereum’s next move. If buying pressure prevails, the altcoin could target $2548 and potentially break out to $2.7k. Conversely, if selling pressure dominates, Ethereum may drop to $2,372, breaching the lower boundary of its consolidation range.

following sentence in a different way:

Original sentence: The cat jumped onto the table and knocked over the vase.

Rewritten sentence: The vase was knocked over when the cat jumped onto the table.