Bitcoin is currently trading at a crucial level, holding steady above $118,000 but struggling to gather momentum for a breakout. Price action has been consolidating over the past few days, with analysts anticipating a significant move once key supply zones are absorbed or demand breaks below. The market is on edge, waiting for confirmation of the next trend.

Related Reading

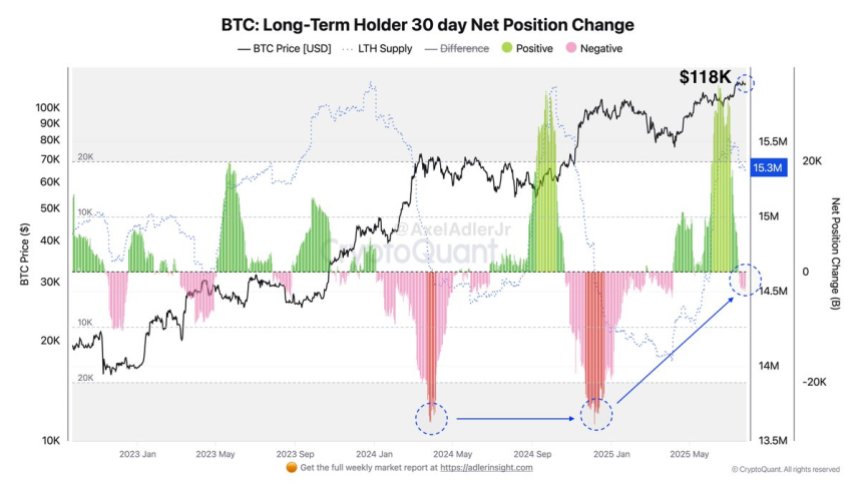

Fresh data from CryptoQuant reveals a notable shift in the behavior of long-term holders (LTH). At the $118K mark, LTH supply has started to decrease, indicating the beginning of a distribution phase. These holders, who are known for accumulating during downtrends and selling during uptrends, are gradually offloading their positions. This transition often signals the later stages of a bullish trend and reflects patterns from previous macro cycles.

As Bitcoin struggles to break above resistance and LTHs reduce their exposure, pressure continues to build. A clear breakout above the current range could spark renewed momentum and push BTC to new highs, while a break below support could trigger a sharper correction. The current standoff is expected to be resolved soon, with the upcoming days potentially bringing a definitive move that will set the tone for Bitcoin’s next major movement.

LTH Distribution Commences As Bitcoin Follows Fall 2024 Pattern

Renowned analyst Axel Adler has pointed out a significant development in Bitcoin’s current structure. According to Adler, LTH supply has dropped by 52,000 BTC so far, indicating a substantial shift in behavior. These holders, typically considered the most patient in the market, are now starting to reduce their exposure at a time when Bitcoin is consolidating tightly within a range.

This shift from accumulation to distribution closely resembles the behavior of LTHs during the fall of 2024, when Bitcoin surged from $65,000 to $100,000. During that period, long-term investors steadily sold their holdings as the market continued to climb, locking in profits as momentum picked up in the later stages. Adler suggests that if the current trend persists, the distribution phase will intensify with each upward price movement, similar to previous macro cycles.

The timing of this transition is crucial. Bitcoin is hovering just below its all-time highs, while altcoins are showing increased volatility. As Ethereum and other major assets become more active, capital rotation may accelerate, impacting Bitcoin either positively or negatively.

Related Reading

BTC Maintains Its Position Amid Ongoing Tight Range

Bitcoin continues to consolidate within a tight range of $115,724 to $122,077, with the current price hovering around $118,817 on the 4-hour chart. After bouncing off the lower boundary last week, BTC has managed to recover and is now trading above the 50 SMA ($118,175), 100 SMA ($118,228), and well above the 200 SMA ($113,777). These moving averages have flattened, indicating a balance between buyers and sellers.

Despite multiple tests of the $118K zone, BTC continues to hold key support levels, demonstrating resilience as selling pressure remains subdued. However, trading volume remains low, indicating that traders are adopting a wait-and-see approach, waiting for a decisive breakout before committing to larger positions.

Related Reading

The upper resistance at $122K has remained unbroken since mid-July, with each attempt being met with rejection. A decisive break above this level, accompanied by strong volume, would confirm a continuation of the broader uptrend and could lead to a push towards new all-time highs. On the downside, a breach below $115K would disrupt the current structure and likely result in increased market volatility.

Featured image from Dall-E, chart from TradingView