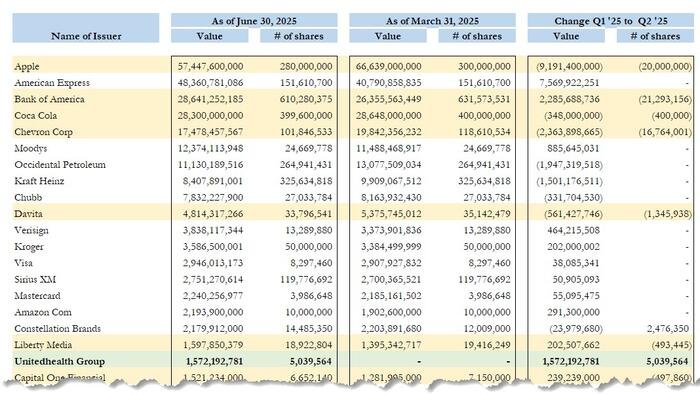

Warren Buffett’s Berkshire Hathaway quietly acquired a stake in distressed health insurer UnitedHealth during the second quarter, as confirmed in its latest 13F filing. The conglomerate purchased over 5 million shares of UnitedHealth, valued at $1.6 billion as of June 30. This investment comes after a series of crises for UnitedHealth, including the shocking assassination of UnitedHealthcare CEO Brian Thompson and unexpected increases in medical costs.

The news of Buffett’s stake in UnitedHealth sent the insurer’s shares up more than 10% in after-hours trading. In addition to this investment, Berkshire made several other notable changes to its portfolio, which totaled $258 billion as of June 30. Buffett resumed selling his Apple stake, offloading 20 million shares, while also trimming holdings in Bank of America.

Despite reducing holdings in some top positions, Buffett added to investments in Constellation Brands, Domino’s, and Pool Corp. One problematic investment for Berkshire has been its stake in Kraft Heinz, which resulted in a $3.8 billion impairment charge earlier this year.

In addition to liquidating its stake in T-Mobile, Berkshire added new positions in Nucor, DR Hodton, Lamar Advertising, and Allegion. The company also increased its investment in US homebuilders, betting on lower interest rates in the future. These changes were omitted in a previous filing as Berkshire requested confidentiality. The full breakdown of Berkshire’s portfolio changes can be seen in the provided image.

Overall, Berkshire’s investment strategy under Buffett’s leadership continues to evolve, with a focus on adapting to changing market conditions and seeking opportunities for growth.