Authored by Mike Shedlock via MishTalk.com,

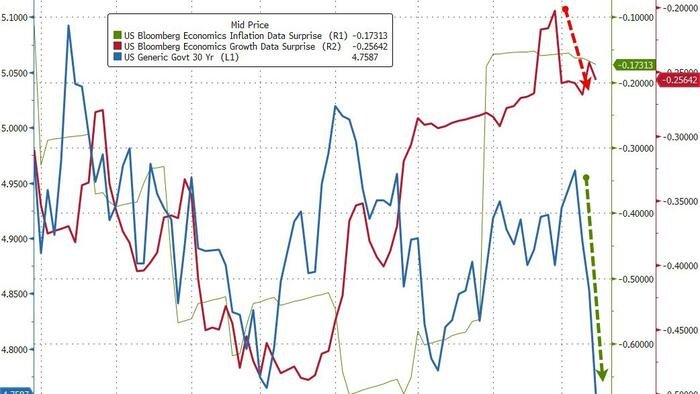

The recent shift in the bond market sentiment reveals a growing concern over jobs and economic growth rather than inflation.

US Treasury Yield Notes

-

From August 5 to August 21, bond yields for US treasuries with a duration of 2 years or longer experienced an increase.

-

The period between August 21 and September 2 was particularly challenging for 30-year long bond holders but beneficial for others.

-

Following September 2, there was a significant rally in the bond market across the board.

Treasury Yield Changes Since September 2

What Led to This Shift?

-

The ISM report on September 2 indicated weak hiring trends.

-

The BLS JOLTS report on September 3 highlighted a situation where unemployment exceeded job openings for the first time since the pandemic.

-

The ADP report on September 4 showed weakness, particularly among small businesses.

-

The nonfarm payroll report on September 5 was deemed disastrous.

The trajectory of the 10-year treasury note and the 30-year long bond has aligned once again, both heading downwards.

Ultimately, the focus has shifted from inflation concerns to job market weakness, although Powell remains cautious unless drastic circumstances arise.

Loading recommendations…