The housing markets in the Midwest are defying national trends by selling properties much faster than the average Days on Market (DOM) across the country. According to the most recent market data, properties in key Midwestern cities are selling up to 83% faster than the national average.

Regional performance surpasses national metrics

While the national median DOM for single-family homes is currently 63 days, Midwest markets are operating at a much quicker pace. Data from September 2025 shows that the average Midwest property sells in just 23.8 days – a significant 56.5-day advantage over the national figure.

Leading the pack is Grand Rapids, Mich., where homes sell in just 9.6 days on average, 83.3% faster than the national rate. Minneapolis, Minn. closely follows at 9.9 days (82.9% faster), and Milwaukee, Wis. properties typically sell within 14.6 days (74.7% faster than the national average).

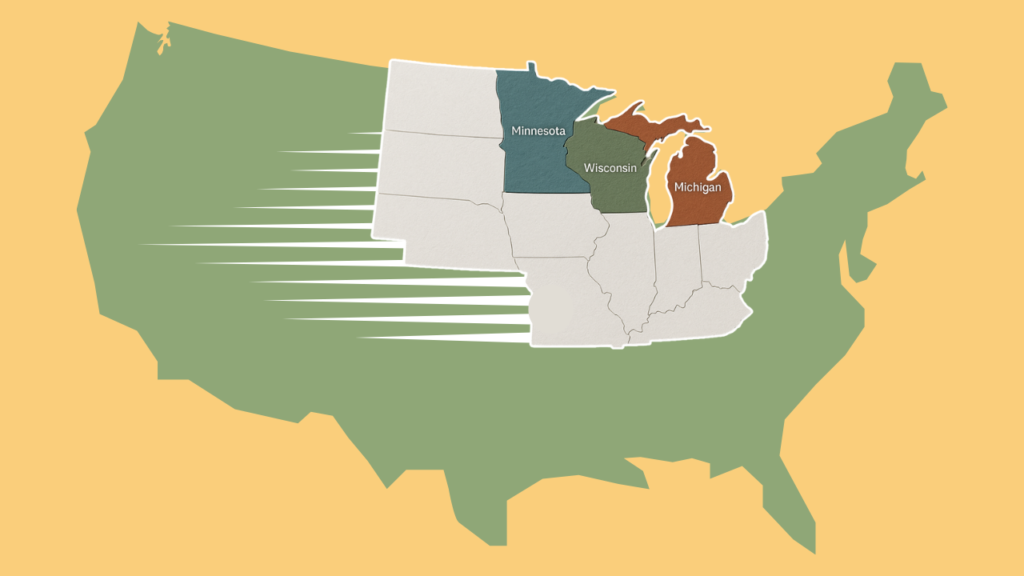

State-by-state analysis reveals a consistent trend

This trend extends beyond individual cities to entire states. Minnesota leads with properties selling 75.2% faster than the national average, followed by Wisconsin (72.2%), Michigan (63.6%), Kansas (50.4%), and Missouri (29.0%).

Even the slowest Midwest markets significantly outperform the national average. Saint Joseph, Mo., with the longest regional DOM at 43.3 days, still moves properties 31.3% faster than the national pace.

Market implications for housing professionals

For mortgage lenders, this data indicates a need for streamlined approval processes in Midwest markets. With homes selling in as little as seven days in some cities, traditional underwriting timelines may put buyers at a competitive disadvantage.

Real estate professionals should adapt their business strategies accordingly. The data suggests that properties in cities like Milwaukee and Grand Rapids require immediate marketing attention and showing availability due to the shorter window for buyer interest compared to national trends.

The data also highlights that Midwest markets maintain their accelerated pace despite price appreciation. Median home prices in Milwaukee at $525,000 and Minneapolis at $549,999 show that quick sales are not solely due to lower price points.

Looking ahead

A 90-day trend analysis reveals consistent performance across Midwest markets, indicating that this regional advantage is structural rather than cyclical. While national DOM figures have increased, sales in the Midwest have remained swift.

Industry analysts predict that this regional trend will continue through the end of the year, potentially widening as seasonal factors impact coastal markets more than Midwest regions.

HousingWire will continue to monitor these regional differences and provide ongoing coverage of the unique market dynamics shaping the Midwest housing landscape.

Related