2025 saw the crypto market experience its most significant liquidation event, resulting in the largest single-day losses for ETH, SOL, and BTC since 2023 and June, respectively. This led to a sharp downturn in sentiment across major cryptocurrencies and large-cap altcoins. In a recent video analysis, CryptoInsightUK advised caution, suggesting that the recent market movement was more of a leverage flush rather than a structural shift. He pointed to various indicators such as liquidity maps, momentum gauges, and market-cap composites that still indicate a positive outlook once the dust settles.

He emphasized the importance of not panicking and rushing to make decisions based on the current market conditions. Instead, he suggested taking a step back and evaluating the overall market structure. He highlighted the recent highs in market-cap aggregates and encouraged investors to look for familiar bottoming patterns that often follow intense liquidation events.

Related Reading

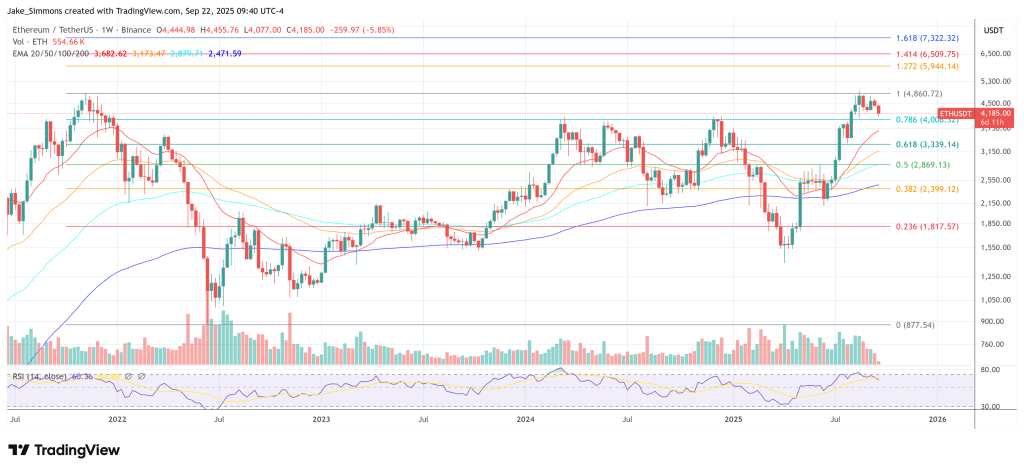

The analyst outlined a short-term roadmap that includes a liquidity sweep and momentum divergence. He explained that after a sharp drop in price, he expects the market to stabilize and potentially form a reversal pattern with a higher low on the RSI. This setup, he believes, is a reliable indicator of a trend reversal.

Crypto Watch: ETH, XRP, DOGE, ADA

He provided insights into specific cryptocurrencies like ETH, XRP, DOGE, and ADA, highlighting key price levels and liquidity zones to watch out for. He mentioned that despite the recent downturn, the overall market sentiment remains positive, especially for long-term investors.

He stressed that the recent market volatility was driven by leverage rather than fundamental factors. He noted that a reset in leverage could be a positive development for the market in the long run. He advised traders to focus on predefined support levels and maintain a clear-headed approach to decision-making.

What To Watch Now

Looking ahead, he highlighted the importance of monitoring post-flush market movements to determine the next phase of the market cycle. He encouraged investors to remain calm and focus on identifying potential buying opportunities during oversold conditions.

At the time of writing, ETH was trading at $4,185.

Featured image created with DALL.E, chart from TradingView.com

The sentence was not provided. Please provide the sentence that needs to be rewritten.