Authored by Antonio Graceffo via The Epoch Times,

Beijing’s defenses against the Belt and Road “debt trap” argument dismantled after 12 years.

Last month marked the 12th anniversary of the Belt and Road Initiative (also known as One Belt, One Road). Despite ongoing claims of being a debt trap, the Lowy Institute think tank revealed that 75 developing nations are now grappling with severe debt crises due to hefty repayments to China. Developing countries are set to pay China a record $35 billion this year, with $22 billion coming from the poorest nations in the world, leading to significant cuts in healthcare, education, and essential services.

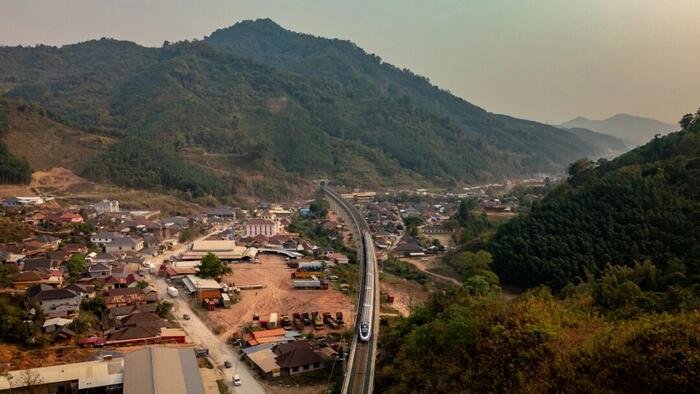

The BRI, launched in 2013, funded massive infrastructure projects in Asia, Africa, and Latin America through state-backed loans, establishing China as the largest bilateral creditor globally. Over the program’s first decade, approximately 80 percent of Chinese lending went to countries already in or near default. As these debts come due, the strain on public finances intensifies, reinforcing the argument that China intentionally created a global debt trap.

In response, the Chinese Communist Party (CCP) presents four flawed arguments to refute the notion of the BRI as a debt trap: first, many developing countries owe more to Western lenders; second, U.S. interest rate hikes triggered their debt issues; third, currency devaluation and a sluggish global economy are responsible; and fourth, China rarely seizes assets from delinquent countries. However, each of these claims crumbles under scrutiny.

The CCP’s initial defense—that some Belt and Road countries owe more to Western or international lenders than to China—is technically correct in certain instances but highly deceptive. While Chinese loans may constitute less than half of a country’s total debt, these nations had extremely low credit ratings and were deemed too risky for conventional lenders. Western institutions ceased lending to prevent default. China, on the other hand, stepped in and provided the very loans that pushed them over the edge. In numerous cases, Beijing became the lender of last resort because responsible lenders had withdrawn.

The second argument—that escalating U.S. interest rates caused the debt crisis—is equally flawed. Fluctuating rates are a known risk factored into every sovereign credit evaluation. Countries that continue borrowing heavily despite poor ratings do so with the understanding that refinancing will become costlier as global rates rise. Responsible lenders consider this risk and retract support when borrowers reach unsustainable debt levels. China disregards these warnings, persisting in lending and ensuring that default becomes inevitable.

The third claim—that the crisis is due to currency devaluation and a sluggish global economy—also falters under scrutiny. Economic downturns and currency fluctuations are foreseeable risks that must be evaluated prior to taking on debt. Many Belt and Road countries have weak, partially convertible currencies but must repay their loans in U.S. dollars. As the dollar strengthens, debt servicing expenses escalate, depleting national reserves and worsening economic turmoil. This is not the fault of the West or a consequence of U.S. monetary policies aimed at harming others. The CCP’s rationale is flawed, particularly since most Belt and Road loans are denominated in dollars.

The fourth argument put forth by the CCP against the “debt trap” allegation is that it seldom seizes assets from countries unable to repay; instead, it claims to offer “debt relief” through refinancing or extending loans. However, this approach only deepens reliance. Beijing typically provides short-term restructuring, such as extending maturities or grace periods, to low-income nations without reducing principal or easing interest rates.

It also relies on “rescue lending” mechanisms, including bridge loans from state banks, currency swap drawdowns via the People’s Bank of China, and commodity prepayment arrangements. These actions do not address underlying solvency issues but merely postpone default, sustaining borrowers long enough to safeguard China’s financial system.

A comprehensive study by AidData, the World Bank, Harvard Kennedy School, and the Kiel Institute indicated that by the end of 2021, China had executed 128 bailout operations totaling $240 billion across 22 countries, signaling a clear shift from infrastructure financing to emergency rescue loans. In 2010, less than 5 percent of China’s overseas lending was directed to distressed borrowers; by 2022, that figure had surged to 60 percent.

These bailouts also lay bare Beijing’s double standards: while accusing the West of predatory interest rates, the average Chinese rescue loan carries an interest rate of around 5 percent, more than double the IMF’s standard 2 percent. As of October 1, 2025, despite higher U.S. interest rates, the IMF’s Special Drawing Rights lending rate remains at just 3.41 percent, significantly lower than what China charges struggling nations for purported relief.

The actual extent of Belt and Road debt may be far greater than official figures indicate. To shield its banking system, the Chinese regime increasingly leverages the People’s Bank of China’s global swap-line network, which has supplied over $170 billion in short-term liquidity to foreign central banks. These loans, often labeled as “temporary,” are routinely rolled over for years, enabling governments to mask their true debt exposure since international reporting standards exclude short-term liabilities.

This practice has led to substantial “hidden debts,” estimated at approximately $385 billion by AidData in 2021, with the figure likely higher today as more loans mature and few have been repaid in the intervening period.

The CCP’s opaque bailout strategy, geared toward safeguarding its lenders rather than aiding struggling nations, ensures that the full weight of Belt and Road debt remains obscured from public scrutiny.

Opinions expressed in this article are those of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

Loading recommendations…