A subsidiary of a major Chinese commercial bank, China Merchants Bank (CMB), based in Hong Kong, has tokenized its $3.8 billion money market fund (MMF) on BNB Chain.

CMB International Asset Management (CMBI) has collaborated with BNB Chain to tokenize its CMB International USD Money Market Fund on the layer-1 (L1) blockchain, as announced by BNB Chain on Wednesday.

This partnership builds on CBMI’s real-world asset tokenization (RWA) cooperation with Singapore-based platform DigiFT, which tokenized the fund on the Solana blockchain in August.

The launch of CMBI’s fund on BNB Chain follows reports suggesting pressure from China’s securities regulator on local brokerages to halt their RWA projects in Hong Kong.

Overview of the Fund

The CMB International USD Money Market Fund, launched in early 2024, is a sub-fund of the CMB International Open-ended Fund Company, a public umbrella open-ended fund company in Hong Kong.

The fund primarily invests in US dollar-denominated deposits and state-backed money market instruments in various countries and regions.

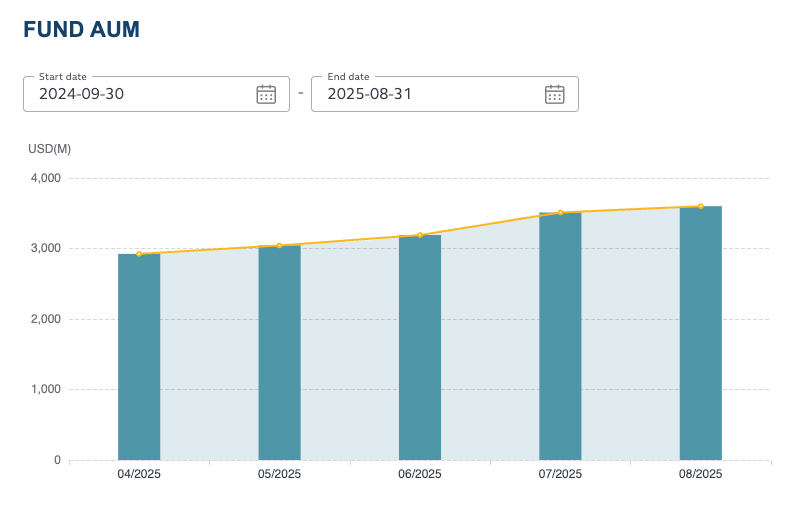

The AUM of the CMB International USD Money Market Fund from April 2025. Source: HKEX

According to data from the Hong Kong Stock Exchange (HKEX), the fund has shown steady growth, with AUM increasing from $2.9 billion in April to $3.6 billion by August.

CMBMINT and CMBIMINT Tokens on BNB Chain

The collaboration between CMBI Asset Management and BNB Chain is significant in bringing RWAs to the active blockchain ecosystem of BNB Chain.

By expanding onchain distribution, CMB International and BNB Chain offer Accredited Investors direct access to a top-performing fund with over $3.8 billion AUM.

Source: BNB Chain

The collaboration introduces two tokens, CMBMINT and CMBIMINT, on the BNB blockchain, allowing investors to invest in the fund using fiat currencies or stablecoins and redeem holdings via DigiFT.

The launch also involves RWA infrastructure provider OnChain, enabling investors to utilize the tokens in various decentralized finance (DeFi) applications.

Related: HashKey crypto exchange aims for Hong Kong listing this year: Bloomberg

Considering reports of mainland China regulators urging Hong Kong brokerages to pause RWA offerings, it remains unclear if the tokenized CMBI fund complies with local regulations.

The Hong Kong Monetary Authority declined to comment on the reported pressure from mainland China regulators when approached by Cointelegraph.

Cointelegraph reached out to BNB Chain for comment on the issue but did not receive a response at the time of publication.

Magazine: Hong Kong isn’t the loophole Chinese crypto firms believe it to be