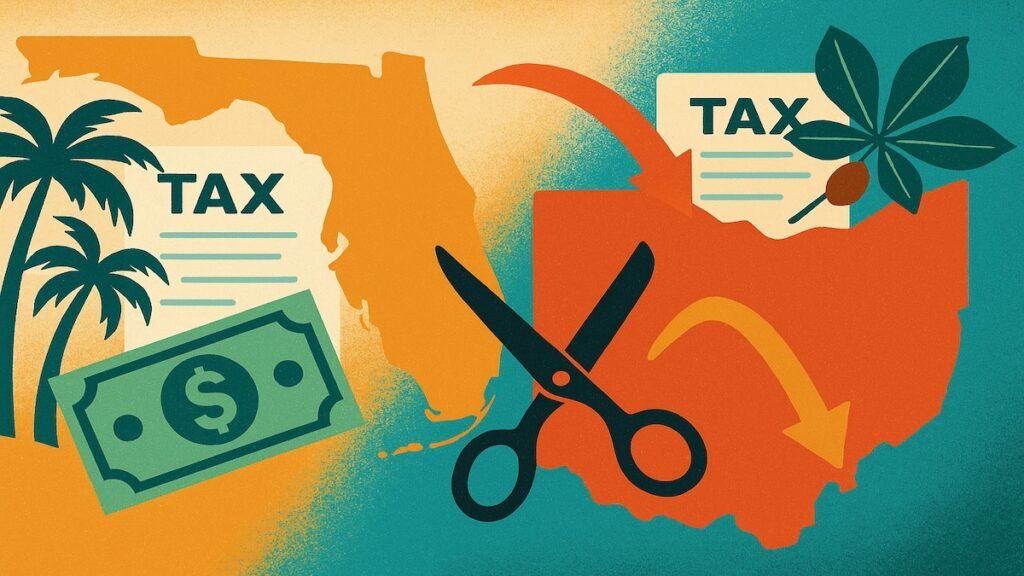

Florida House Republicans Advance Property Tax Cuts

Last week, House Republicans in Florida pushed forward a series of non-school property tax reductions in initial committees. These measures include proposals to completely eliminate such taxes or phase them out over a span of 10 years.

One of the bills being considered would eliminate non-school property taxes specifically for residents aged 65 and older.

Representative Juan Porras, a Miami Republican, emphasized that these measures are targeted to assist those in greatest need. He stated, “Our most vulnerable communities, those who have built the cities and counties, the areas that we all represent.”

Another key proposal aims to ensure law enforcement funding by mandating that police budgets remain intact.

If approved by the Legislature, these constitutional amendments will be presented to Florida voters in 2026, requiring a 60% majority for passage.

Democrats have expressed concerns about the potential negative impact on cities and counties heavily reliant on property taxes. The Florida Policy Institute estimates a significant funding gap of $43 billion under the House proposals.

House Democratic Leader Fentrice Driskell cautioned against removing tools from local governments, as this could lead to burdens being shifted in other ways, ultimately affecting those in need the most.

While the Florida Senate has not introduced companion bills, Governor Ron DeSantis has criticized the plan to place multiple tax amendments on the 2026 ballot, calling it a flawed approach.

Over the last three decades, Florida’s property tax burden has increasingly shifted towards residential property owners, with residential parcels now accounting for over 70% of property taxes statewide.

Five Property Tax Bills Head to Ohio Governor’s Desk

Ohio Governor Mike DeWine is currently reviewing five comprehensive property tax bills recently approved by the GOP-led Legislature. These bills follow a lengthy period of public feedback on the issue.

These proposals come after DeWine vetoed tax changes in the state budget, with lawmakers initially planning to override the vetoes but later backing down after one successful override involving substitute and emergency levies.

The proposed measures would allow county officials to reduce previously approved levies, limit tax bill growth to the inflation rate, expand opportunities for reductions, and alter the burden of proof in valuation disputes.

Republican Senator Sandra O’Brien emphasized that taxpayers are seeking property tax relief, and these bills aim to provide that relief.

O’Brien also warned about a separate ballot initiative that seeks to eliminate property taxes entirely, describing such a scenario as potentially detrimental to Ohio.

DeWine has stated that he will assess the bills based on recommendations from a property tax working group he established.

Over the past three decades, policy changes in Ohio have shifted a greater portion of the tax burden onto residential property owners, away from businesses, according to state data.