According to Coinbase Institutional, a challenging November has potentially set the stage for a strong finish to the year.

The firm indicates that open interest in Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) perpetual futures has decreased by 16% compared to the previous month.

Furthermore, US spot Bitcoin ETFs experienced outflows of $3.5 billion, while spot Ethereum ETFs saw redemptions of $1.4 billion, signaling a general risk reduction trend.

Additionally, Bitcoin perpetual funding rates dipped two standard deviations below their 90-day average before leveling off.

“A turbulent November may have paved the way for an unforgettable December…

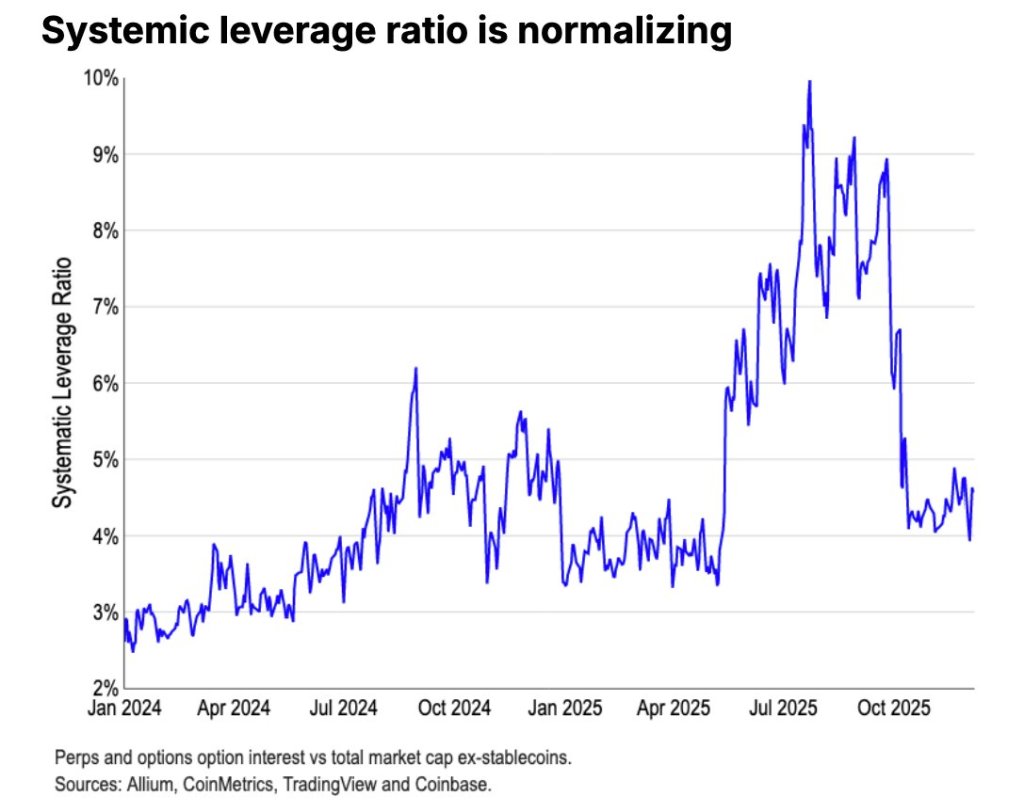

So, why the cautious optimism? Speculative excess seems to have been eliminated.

Our systemic leverage ratio, which measures purely speculative positions, has stabilized at around 4%–5% of the total market cap, down from approximately 10% earlier this summer.

Lower leverage equals a healthier market structure and reduced vulnerability to sudden downturns as we head towards the end of the year.”

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Featured Image: Shutterstock/robert_s