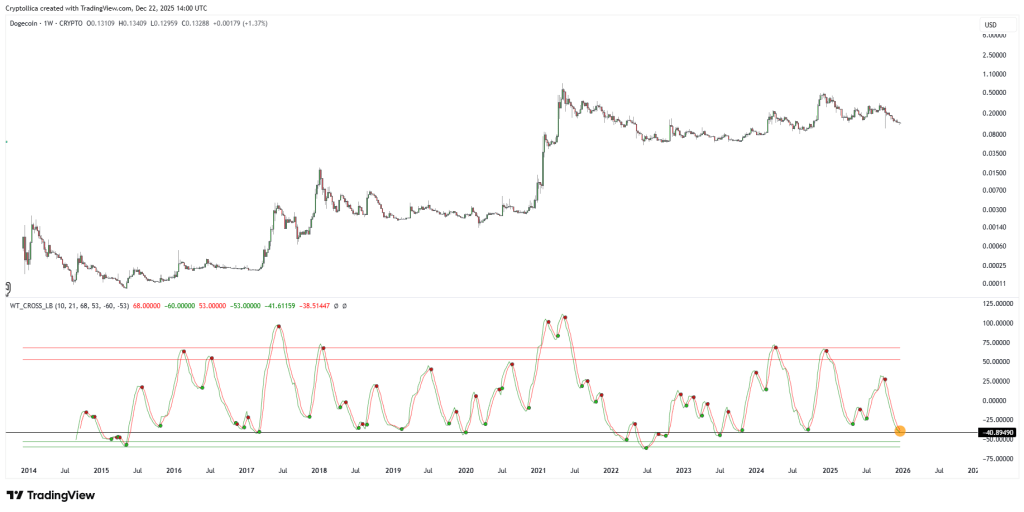

One crypto analyst known as Cryptollica, whose handle is @Cryptollica on X, is making a compelling argument about Dogecoin’s weekly chart. They believe that Dogecoin is currently in the process of forming a rounded base, reducing volatility, resetting momentum, and quietly setting the stage for what they describe as the “calm before the storm.”

In a recent analysis on TradingView titled “DOGE: The Cycle Repeats (1W Timeframe),” Cryptollica identifies the current structure as a “textbook fractal setup.” They point to four key “structural points (1, 2, 3, 4)” in Dogecoin’s history, with the market currently at “Point 4.” The main argument revolves around pattern recognition rather than a single indicator, with Cryptollica noting that the current structure is closely following the accumulation phases seen before previous bull runs.

Will Dogecoin Repeat History?

Cryptollica refers to Zones 1 and 2 as past “boredom phases,” periods of low volatility that hindsight reveals as accumulation phases. They describe Zone 2 as the starting point for the massive parabolic run in 2021. The current phase, labeled as Zone 4 by the analyst, is depicted as mirroring previous rounding bottom formations, suggesting a stabilizing price and a strong base similar to past explosive movements.

One of the key momentum indicators mentioned is the RSI, with Cryptollica emphasizing the significance of the red line (~32 level) as a historical support level. They point out that previous touches or near-hovers of this line have marked macro bottoms, and the current reset to this level indicates seller exhaustion and potential momentum reversal.

The analysis draws parallels to previous accumulation phases and asserts that DOGE is currently in an accumulation “buy zone,” with RSI near a historical floor and a base formation reminiscent of past cycle setups. However, another user, ZarinSyed, offers a cautionary note, highlighting that while the fractal analysis is intriguing, external factors such as macro conditions and liquidity flows can influence outcomes.

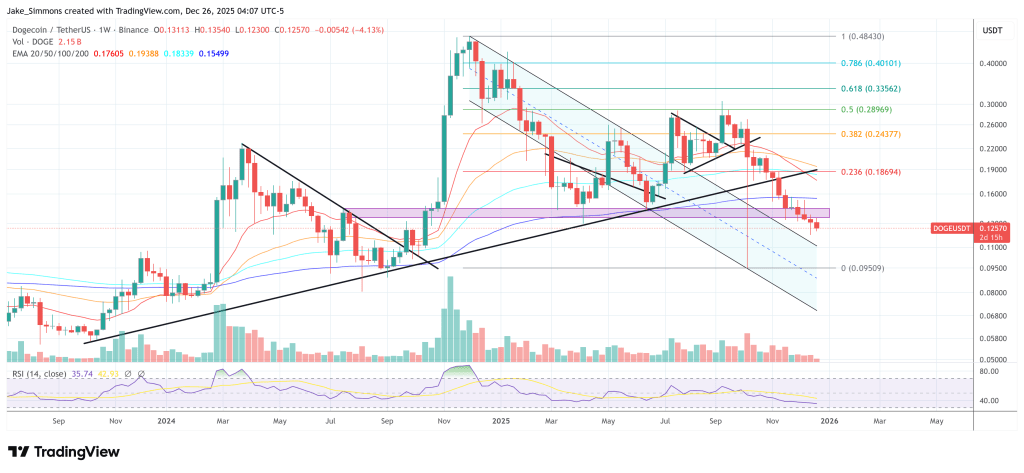

They suggest that confirmation of the bullish thesis would involve DOGE’s weekly close above the $0.15–$0.17 range, along with sustained momentum above the midline (50) on the RSI. They also point out the changing market dynamics with increased institutional involvement, which could impact the outcome of retail-driven fractals.

Ultimately, the analysis provides a roadmap for traders to monitor key levels and metrics, with an emphasis on confirmation through price action. It remains to be seen whether DOGE will follow the historical pattern outlined by Cryptollica or chart its own course in the evolving crypto landscape.

At the time of writing, DOGE was trading at $

Featured image created with DALL.E, chart from TradingView.com