Temple Digital Group has recently unveiled a cutting-edge private, institutional trading platform on the Canton Network. This platform enables continuous, 24/7 trading of digital assets through a central limit order book and a non-custodial market structure.

The platform facilitates trading in cryptocurrencies and stablecoins, catering specifically to institutions looking to transact with approved counterparties while upholding privacy and regulatory standards. Participants are able to maintain custody of their assets without relying on a central intermediary.

Powered by a price-time priority central limit order book with sub-second matching, the system also includes tools for execution monitoring and transaction cost analysis, tailored for institutional trading desks.

Currently live, the platform is actively onboarding institutional users such as asset managers, market makers, and financial institutions. It also has plans to introduce support for tokenized equities and commodities in 2026.

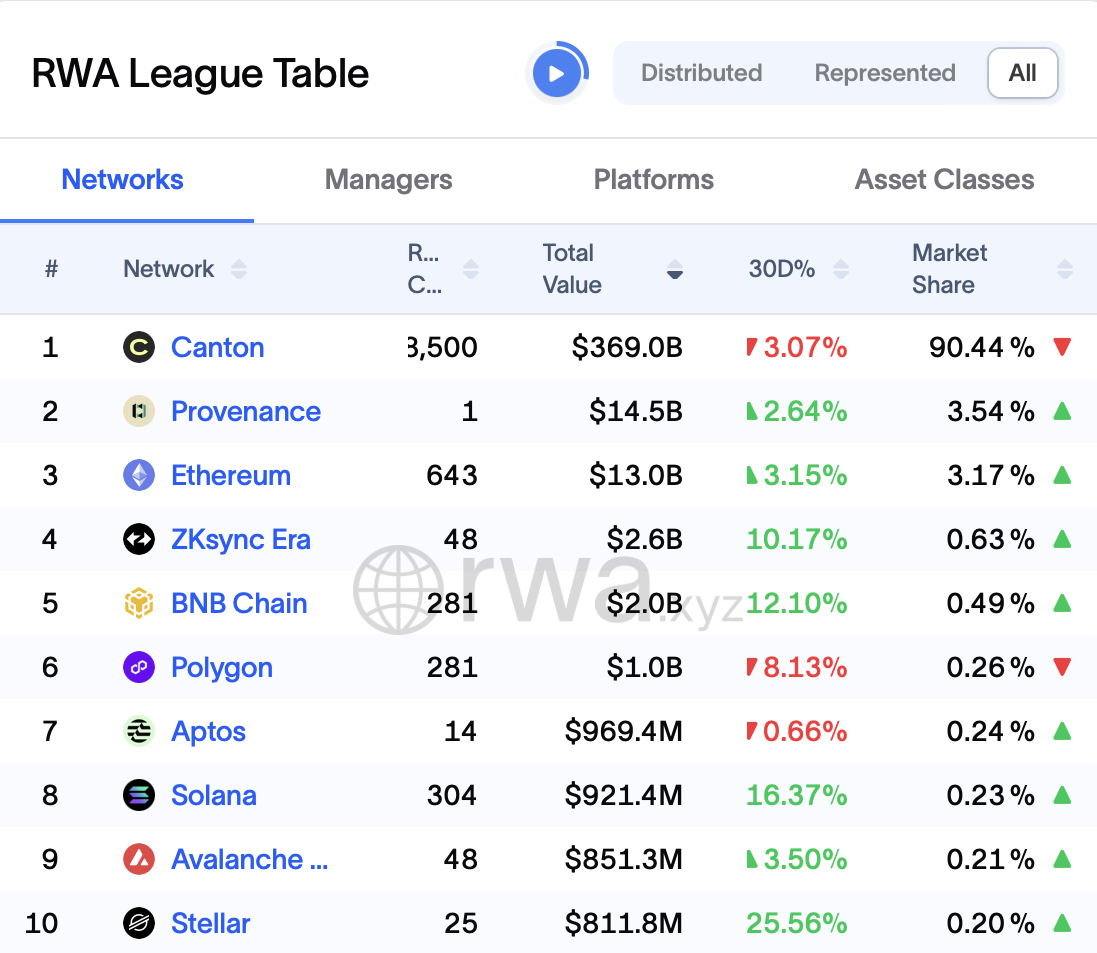

Top blockchains for tokenized real-world assets. Source: RWA.xyz

Temple Digital Group, based in New York, specializes in constructing non-custodial trading infrastructure for institutional digital asset markets.

The Canton Network, a permissioned blockchain developed by Digital Asset, enables regulated institutions to transact and settle tokenized assets onchain.

Related:Digital Asset secures fresh funding to ramp up Canton Network adoption

Institutional adoption gains momentum on the Canton Network

The Canton Network garnered increased institutional interest towards the end of 2025, with companies announcing new deployments involving tokenized funds, collateral, and financing infrastructure.

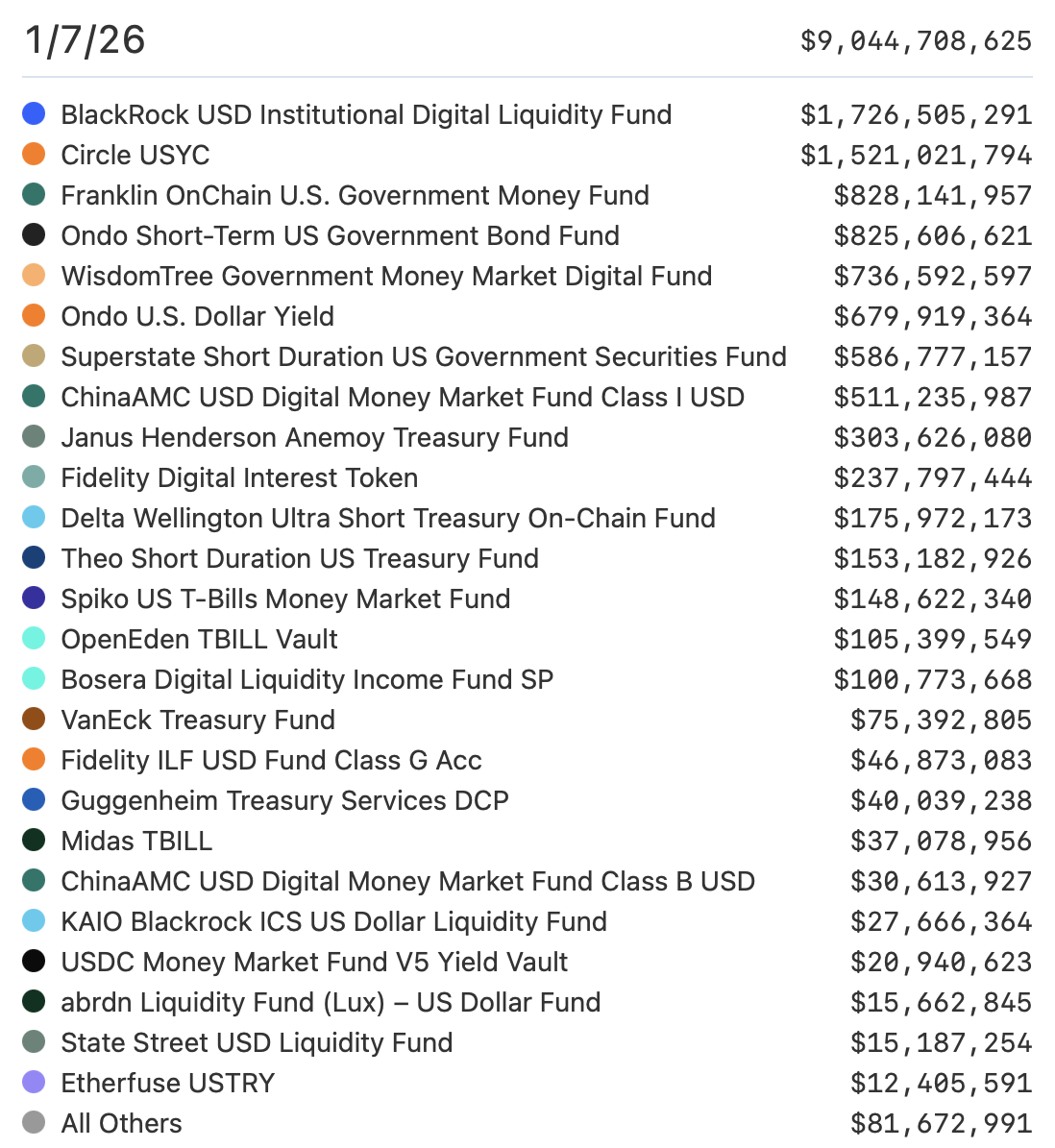

In December, Franklin Templeton expanded its Benji tokenization platform to Canton, allowing its tokenized US government money market fund to serve as collateral within Canton’s institutional ecosystem. The fund held $828 million in assets at the time of publication, according to industry data.

Tokenized US Treasury Funds. Source: RWA.xyz

On December 9, Digital Asset, the creator of the Canton Network, along with a group of major financial institutions, completed a second round of onchain US Treasury financing on Canton. This trial showcased the reusability of tokenized Treasurys as collateral in real time, demonstrating how blockchain-based infrastructure can streamline traditional collateral and financing markets.

A week later, the Depository Trust and Clearing Corporation (DTCC) announced its intention to mint a subset of US Treasury securities on the Canton Network, expanding blockchain-based settlement into the market infrastructure that processed $3.7 quadrillion in transactions in 2024.

Recently, Digital Asset and Kinexys by JPMorgan revealed plans to integrate JPMorgan’s US dollar deposit token, JPM Coin, directly onto the network.

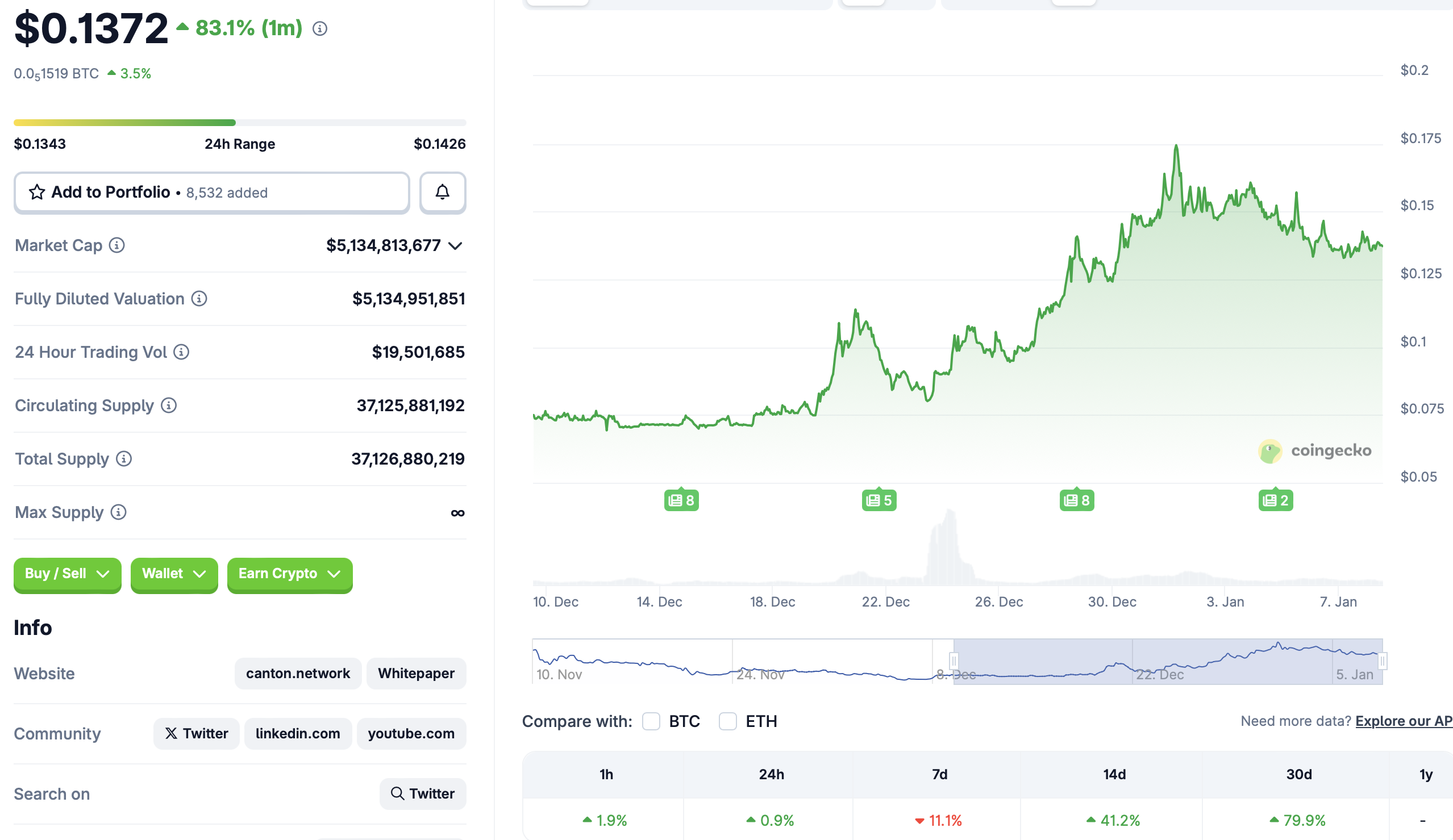

The Canton Coin (CC) has experienced significant growth, surging over 40% in the past two weeks and more than 80% in the last month, according to CoinGecko data at the time of writing.

Source: CoinGecko

Magazine:DaVinci Jeremie bought Bitcoin at $1… but $100K BTC doesn’t excite him