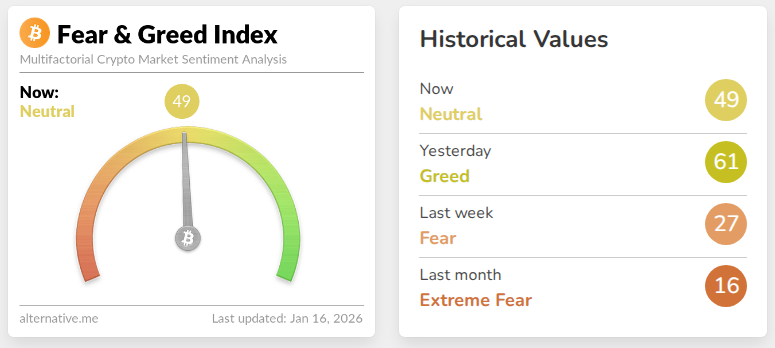

The sentiment in the cryptocurrency market took a sharp downturn after a brief surge in optimism. According to the Crypto Fear & Greed Index, the reading plummeted by 12 points on Friday, dropping from 61 to 49.

Related Reading

This swing shifted the gauge from “greed” to a “neutral” zone in just one session. Bitcoin had seen a 4.5% increase earlier in the week, reaching around $97,700, which contributed to the rise in sentiment. However, attention turned towards politics and legislative activities in Washington.

Regulatory Concerns Impact Market

Reports indicate that the primary trigger was the discussion surrounding a Senate version of a much-anticipated crypto market structure bill. This bill would outline how US regulators supervise digital assets and includes provisions to tighten regulations on stablecoin yields.

Several lobbyists and industry leaders expressed concerns about these provisions. Coinbase CEO Brian Armstrong withdrew his support, stating that the proposal would be detrimental and that a poorly written law could have negative consequences.

Following the backlash, the Senate Banking Committee postponed its planned markup, and the Senate Agriculture Committee rescheduled its session to late January to garner more support.

Social Media Reaction to Regulatory News

According to crypto analytics firm Santiment, there were contrasting trends in market activity: larger investors were accumulating positions while smaller retail traders were selling off.

Social media discussions reflected concerns following the regulatory developments, despite on-chain data showing accumulation by experienced wallets.

The index had reached its peak earlier in the week, marking the highest level since hitting 64 on October 10, the same day a market crash led to over $19 billion in liquidations, leaving a lasting impact on investors.

Smart Money vs. Retail Traders

Reports suggest that smart money accumulation can provide price support, but short-term sentiments are influenced by headlines. At the time of publication, Bitcoin was trading around $95,642, showing a slight decrease of about 0.02% over the past 24 hours, as per CoinGecko.

This minor movement illustrates market resilience, yet the decline in sentiment indicates the fragility of confidence when uncertainties arise in policies. Many traders closely monitor developments in Washington, sometimes more than technical charts.

Related Reading

Postponements Viewed as Opportunity by Some Industry Players

Some industry players viewed the delays as a positive step.

David Sacks, an advisor on crypto at the White House, mentioned that the pause could bridge the gap between stakeholders and refine the bill into something practical.

Ripple CEO Brad Garlinghouse continued engaging with lawmakers and saw the delay as a chance to enhance the legislation.

These contrasting perspectives, along with the alarmed voices, contribute to the mixed reaction in the market.

Featured image from The Drive, chart from TradingView