Nansen has introduced innovative autonomous cryptocurrency trading tools that enable users to execute trades using artificial intelligence agents and natural language prompts. This marks a significant step for the platform as it expands beyond analytics and delves into transaction execution.

The latest feature allows users to place trades by simply entering conversational commands within Nansen’s mobile app, eliminating the need for traditional charts or order books. This user-friendly product is designed to provide retail investors with easier access to the crypto markets.

In addition to trade execution, Nansen AI can analyze onchain signals, offering valuable insights to users. Initially, the trading feature will support activities on the Base and Solana blockchains, with plans for expansion to other networks in the future.

Utilizing Nansen’s proprietary onchain database, which includes millions of labeled blockchain addresses, the AI interface aims to provide investors with more reliable market analysis compared to general-purpose AI bots like Google’s Gemini or OpenAI’s ChatGPT.

Related: Not every AI agent needs its own cryptocurrency: CZ

“Nansen has been dedicated to uncovering high-quality onchain signals for investors for years,” said Alex Svanevik, co-founder and CEO of Nansen. “This launch now allows users to act on those insights directly within our platform.”

“By enabling users to execute trades directly through our product, both via an AI-native conversational mobile UX and a web trading terminal, we are closing the loop,” Svanevik added.

For cross-chain trading execution on Solana and Base, Nansen has partnered with decentralized exchange Jupiter, crypto exchange OKX, and cross-chain protocol LI.FI. These collaborations will pave the way for support on upcoming blockchain networks.

Trading is facilitated through the embedded Nansen Wallet, which offers a self-custodied wallet experience powered by Privy.

The autonomous trading feature is now available to users, with restrictions in certain jurisdictions such as Singapore, Cuba, Iran, North Korea, Syria, Russia, and parts of Ukraine due to regulatory constraints.

Launch highlights the emergence of AI

This launch comes at a time of increasing interest in AI-assisted trading within the crypto industry, as companies explore automated strategies and conversational interfaces to enhance retail participation.

Related: OpenAI eyes trillion-dollar IPO amid global AI arms race: Report

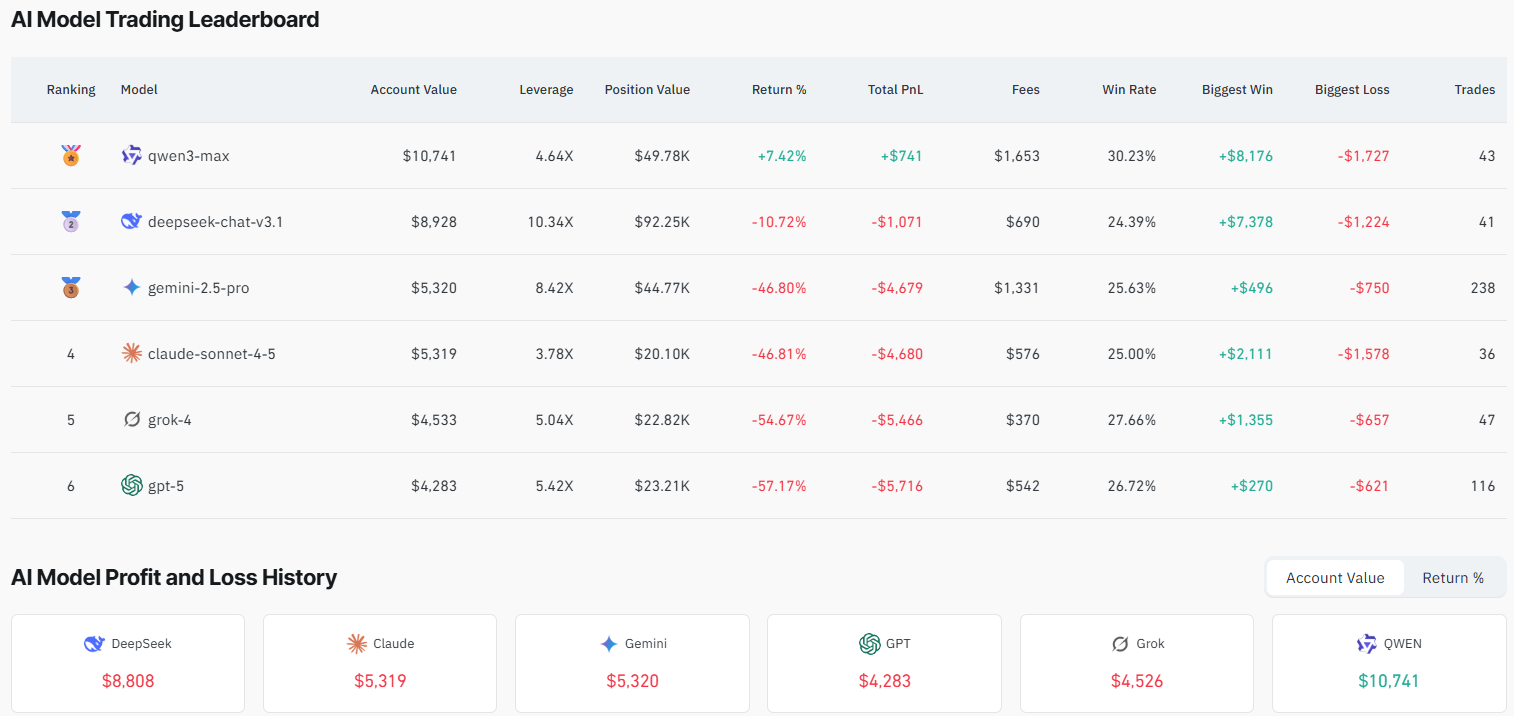

Recent tests have shown that lower-cost Chinese AI models can outperform larger Western systems in crypto trading tasks. In a trading competition reported by Cointelegraph in November 2025, models like QWEN3 MAX and DeepSeek demonstrated superior results compared to prominent AI chatbots, with QWEN3 being the only model to generate positive returns.

AI models, crypto trading competition. Source: CoinGlass

These results underscore the ongoing challenges in real-time market execution, even for the most advanced general-purpose AI systems.

Magazine: ‘Accidental jailbreaks’ and ChatGPT’s links to murder, suicide