- In the past week, LINK experienced a drop of over 6% in its price.

- Despite high buying pressure, indicators pointed towards a potential price decline.

Chainlink [LINK] started a bullish rally on July 7th, showing signs of recovery from previous losses. However, the uptrend was short-lived, and LINK lost its upward momentum.

Let’s delve deeper into the current situation and what can be anticipated for LINK in the upcoming days.

A bearish signal on LINK’s chart

According to CoinMarketCap’s data, LINK witnessed a decrease of more than 6% in its price over the last seven days. Although there was a slight improvement with the price reaching $13.2 in the last 24 hours, the trend was not sustained.

The price of Chainlink increased by only 2% in the past day and was trading at $12.81 at the time of writing, with a market capitalization exceeding $7.79 billion.

A popular crypto analyst, Ali, highlighted a possible reason for this decline in a tweet, mentioning a sell signal on the token’s 4-hour chart.

If this is accurate, we might see more red candlesticks on the token’s chart in the next few hours. Does this indicate a prolonged bearish trend? Let’s analyze the metrics to find out.

Strong buying pressure on LINK

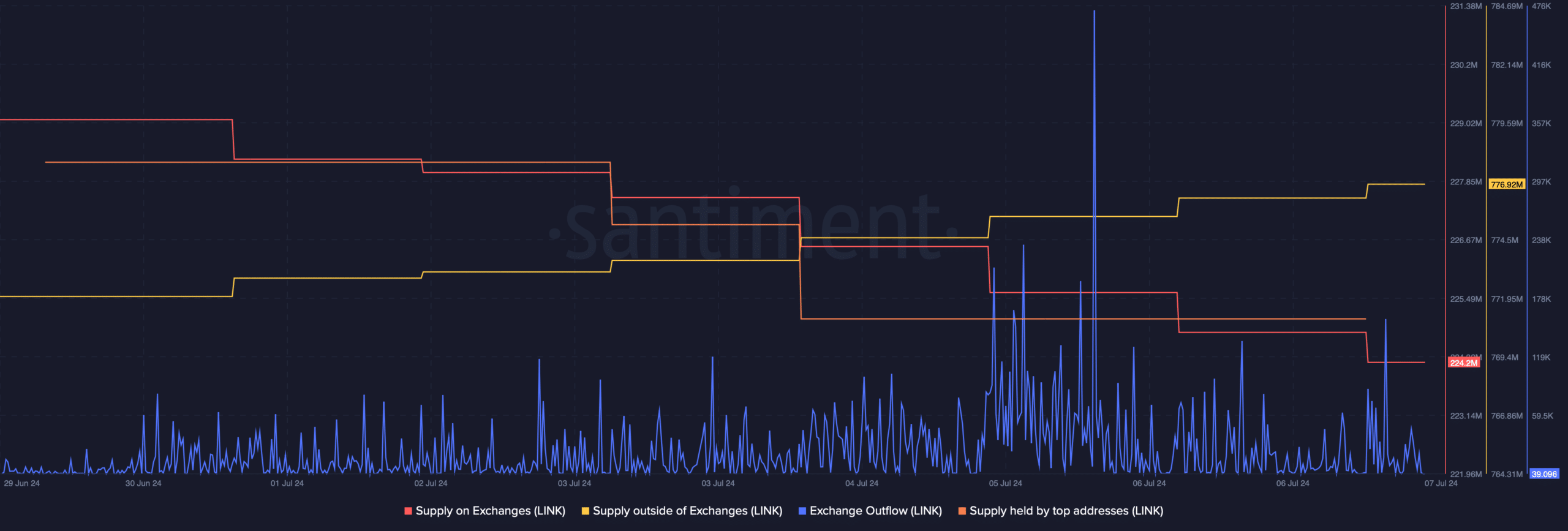

An analysis by AMBCrypto on Santiment’s data revealed that investors were actively buying LINK, which is typically a bullish sign. This was evident as LINK’s exchange outflow surged a few days ago.

Furthermore, the token’s supply on exchanges decreased while its supply off exchanges increased, indicating a high buying pressure.

However, large investors seemed less confident in LINK as the supply held by top addresses dropped last week.

Source: Santiment

Another positive metric was Chainlink’s fear and greed index, which stood at 23% at the time, indicating a “fear” phase in the market.

During such phases, the likelihood of a price increase is higher. We then proceeded to analyze the token’s daily chart.

However, the market indicators appeared bearish, with the MACD showing a bearish crossover, the Chaikin Money Flow moving downwards, and the Relative Strength Index following a similar trend, all suggesting a potential price decline.

Source: TradingView

Realistic or not, here’s LINK’s market cap in BTC’s terms

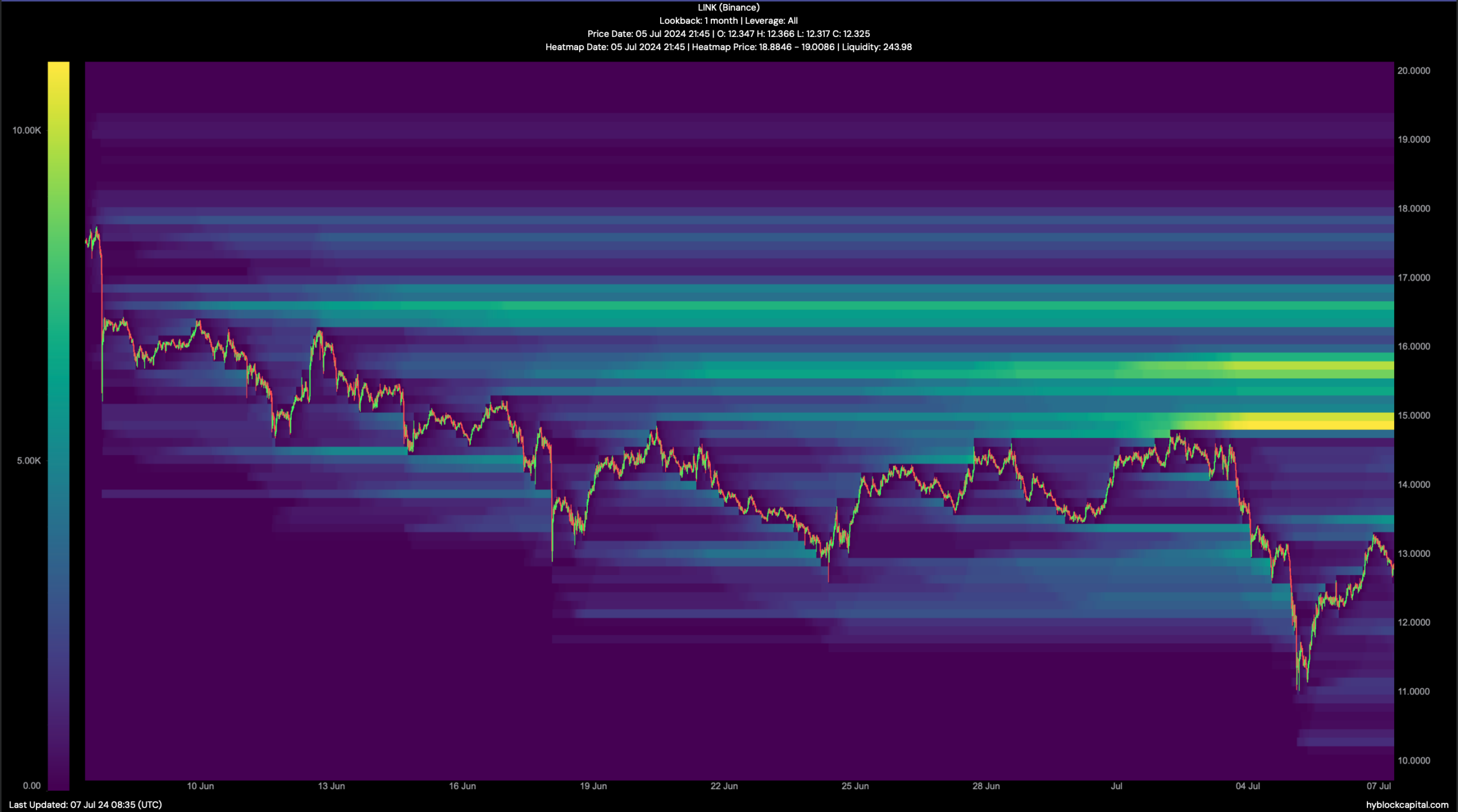

Based on our analysis of Hyblock Capital’s data, if bears dominate and drive LINK’s chart downwards, a drop to $11 would not be surprising.

Conversely, if bulls take control, investors could witness LINK reaching $15 soon.

Source: Hyblock Capital

following sentence:

“The cat ran across the street and climbed up a tree.”

The cat sprinted across the road and scaled a tree.