- Grayscale’s fee of 2.5% is significantly higher than its competitors, such as BlackRock, which charges only 0.25%.

- In response to Grayscale’s high fees, BlackRock has set its fees at 0.25%, anticipating a shift in market flows.

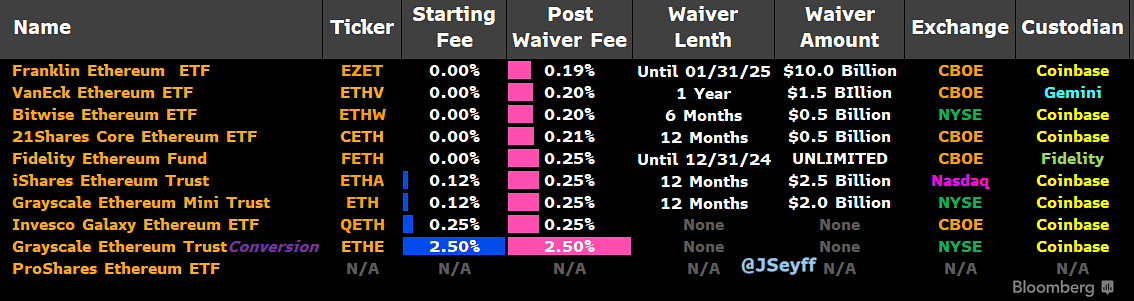

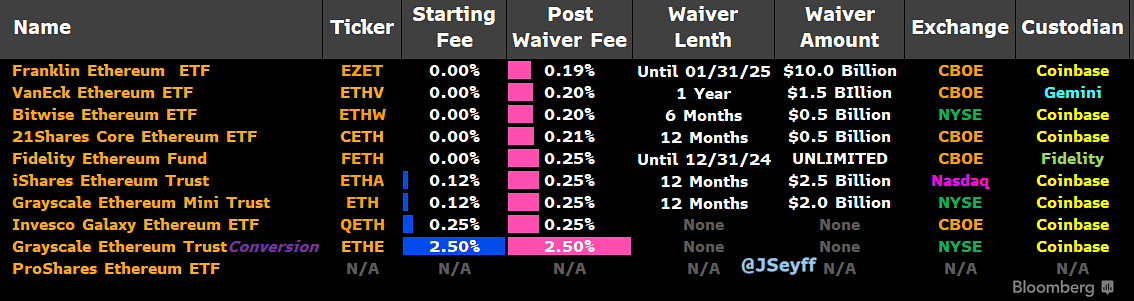

Potential Ethereum ETF issuers have updated their fee structures in preparation for S-1 approvals and product launches on July 23rd.

According to Bloomberg ETF analyst James Seyffart, seven issuers have waivers based on periods or assets held.

Grayscale’s ETHE has the highest fees at 2.5%, while BlackRock’s iShares Ethereum Trust has fees set at 0.25% post-waiver.

Source: X/James Seyffart

Grayscale’s ETHE will maintain a 2.5% fee even after converting to an ETF on July 23rd, unlike BlackRock’s decreasing fee structure for assets below $2.5 billion.

Ethereum ETF fee competition

Market commentators have expressed concerns about Grayscale’s high fees, with some predicting significant outflows from ETHE.

Bloomberg ETF analyst Eric Balchunas highlighted that Grayscale’s fees are 10 times higher than its competitors, potentially leading to significant outflows.

“Grayscale’s fees are significantly higher than the competition, which could result in substantial outflows. It will be interesting to see how this dynamic plays out.”

Despite BlackRock’s lower fees for its Mini Trust, market observers anticipate large outflows from ETHE following the fee announcement.

HODL15 Capital estimates that ETHE could experience outflows of 50%-60% due to the hefty fees.

“Will Grayscale repeat the fee mistake with ETHE? If so, expect significant outflows. The current AUM stands at over $10 billion.”

Source: HODL15Capital

SEC Commissioner Hester Peirce has suggested that ETH ETF staking could be reconsidered amid potential political changes in the U.S.

On the price front, Ethereum’s recent recovery faces resistance at $3.5K, with the digital asset trading at $3.4K and eyeing $4K upon clearing the $3.5K mark.