Thor Hartvigsen, a crypto researcher, recently warned against the risky investment strategy of purchasing high-beta altcoins within the Ethereum ecosystem as a leveraged tactic, especially with the upcoming launch of spot Ethereum ETFs in the US.

In his analysis titled “ETH Beta – a Recipe for Disaster?” Hartvigsen delves into the viability of buying ETH-correlated altcoins, known as ‘ETH betas,’ as an investment strategy. These assets, such as OP, ARB, MANTA, MNT, METIS, GNO, CANTO, IMX, STRK, MKR, AAVE, SNX, FXS, LDO, PENDLE, ENS, LINK, PEPE, DOGE, SOL, AVAX, BNB, and TON, are considered to provide leveraged exposure to Ethereum’s price movements, with higher volatility compared to Ethereum itself.

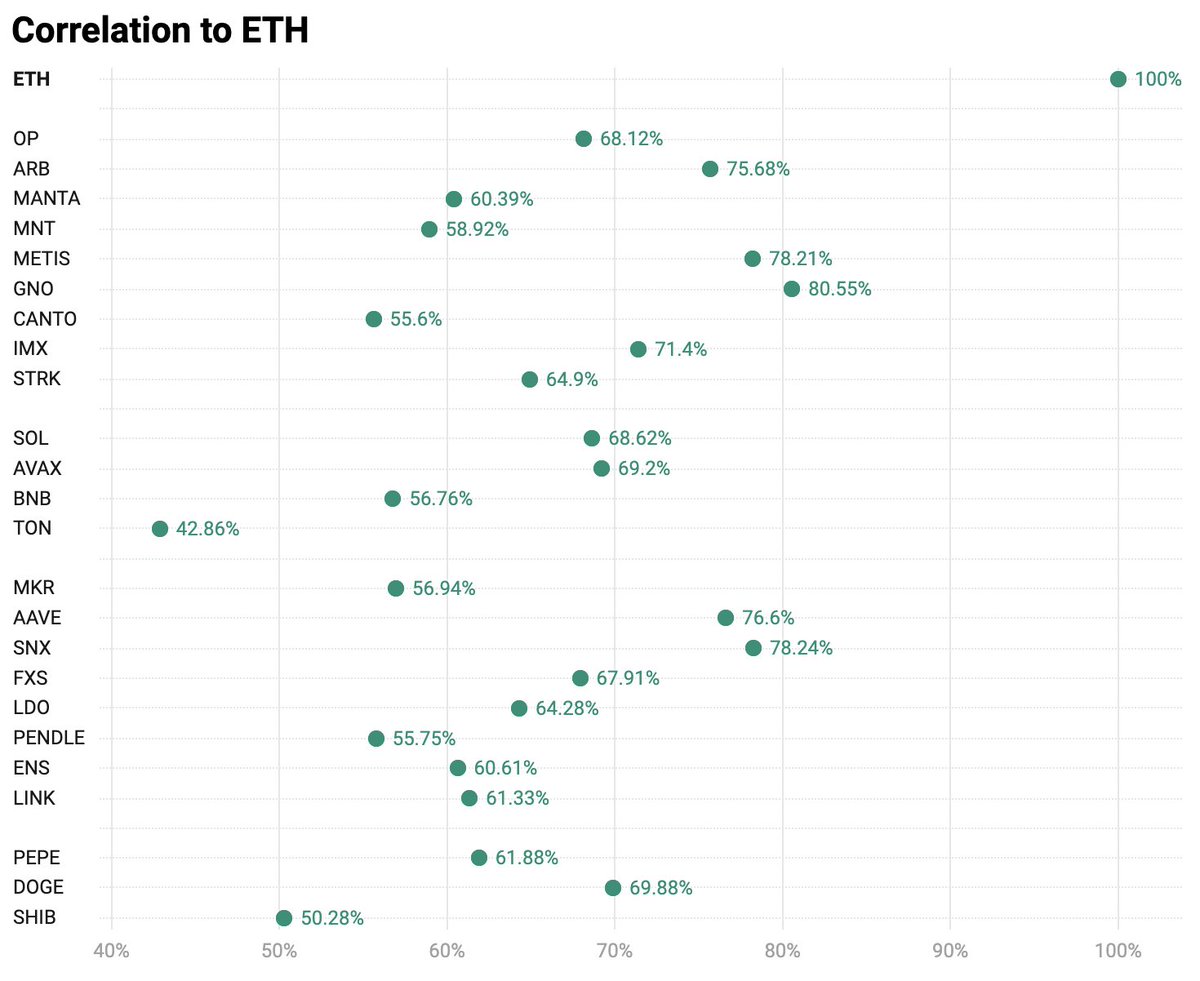

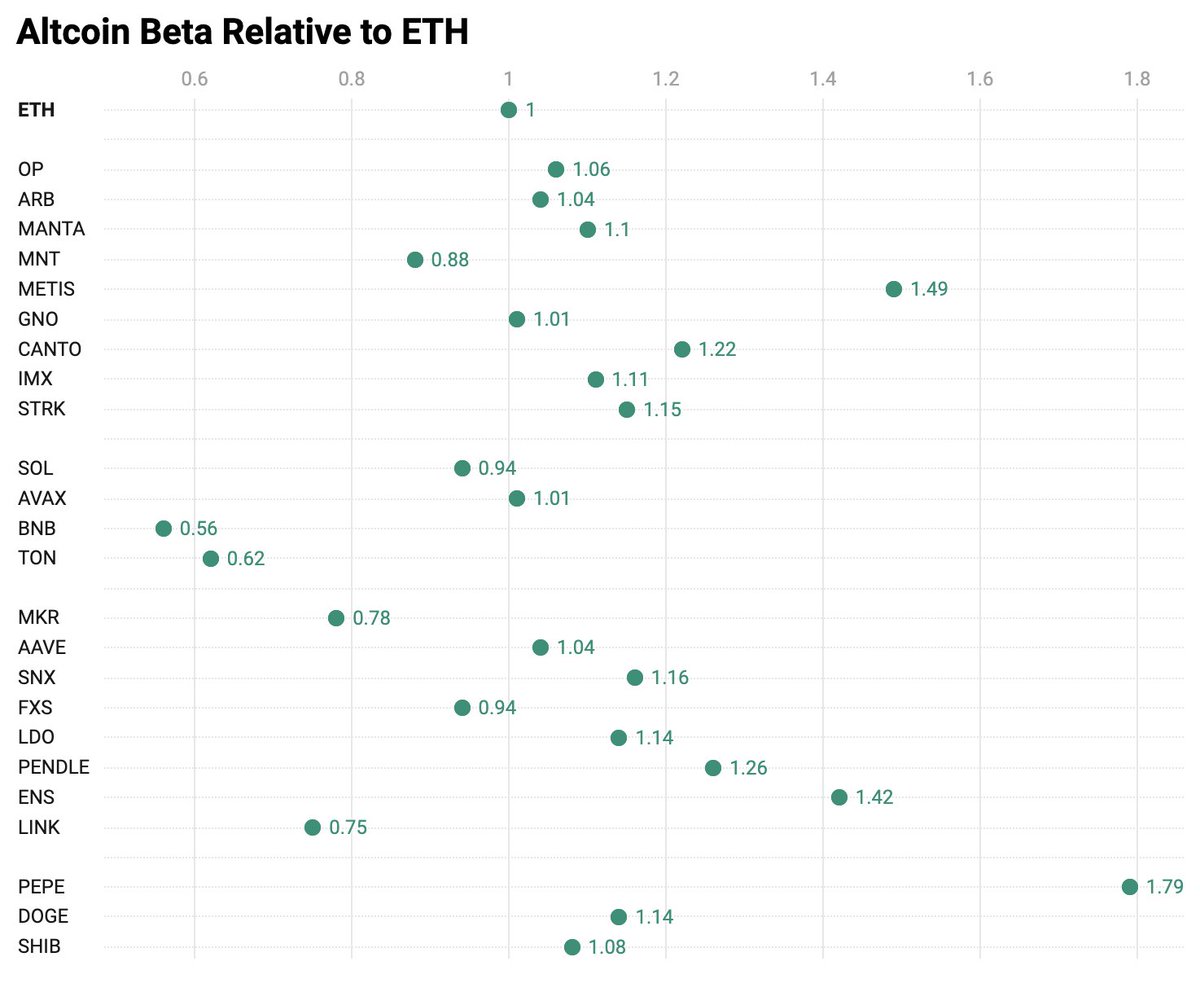

The report analyzes various aspects such as price performance, correlation, beta coefficients, and risk-adjusted returns of these altcoins in comparison to Ethereum. Hartvigsen emphasizes the risks and inefficiencies associated with relying on these altcoins for increased Ethereum exposure.

Why Investing in ‘Ethereum Beta’ Altcoins Might Not Be a Good Idea

Discussing price performance, Hartvigsen notes, “The TOTAL3 (altcoin market cap) against the ETH market cap is currently around 1.48, signaling the outperformance of ETH against most alts since 2020.” This trend suggests a challenging environment for altcoin investors expecting significant outperformance alongside Ethereum’s growth.

He highlights that none of the Layer 2 tokens have outperformed ETH year-to-date, with tokens like GNO, MANTA, STRK, and CANTO experiencing significant declines. Among alternative Layer 1 tokens, only AVAX has shown a negative performance compared to ETH. In the DeFi sector, tokens like PENDLE, ENS, and MKR have outperformed ETH, while others like FXS have seen substantial losses. Memecoins like PEPE, SHIB, and DOGE have shown impressive gains this year.

The correlation analysis reveals that certain altcoins like GNO, SNX, METIS, AAVE, and ARB are highly correlated with Ethereum. However, Hartvigsen cautions that correlation does not guarantee similar performance outcomes, especially in the volatile crypto market.

When it comes to beta coefficients, only a few altcoins like PEPE, METIS, ENS, and PENDLE exhibit high volatility relative to ETH. This implies potential for higher returns but also higher risk compared to Ethereum.

The Sharpe ratio calculations highlight the volatility-adjusted returns of these altcoins, underscoring the significant variations in returns. Hartvigsen suggests that investors often underestimate the additional risk associated with these ‘ETH beta’ assets.

In conclusion, Hartvigsen advises against buying these altcoins for leveraged exposure to Ethereum, citing it as a risky move. Instead, he recommends a 2x ETH long on platforms like Aave for a more straightforward and less risky approach to gaining leveraged ETH exposure.

At the time of writing, ETH was trading at $3,439.

Featured image created with DALL·E, chart from TradingView.com