Written by Charles Hugh Smith via OfTwoMinds blog,

History has shown that caution is warranted when “strong buys” are recommended at $45, only for the eventual bottom to be $4.

Following my recent article on The Rollercoaster Ride Ahead: 15 Years of Extreme Distortions Will Be Unwound, readers have been asking: What can I do in response? This is a valid question, as simply waiting for events to unfold and then scrambling for safety is a risky approach.

Let’s establish three key points: 1) this is not financial advice; everything presented here is based on historical observations or personal experiences following previous market bubbles; 2) there are no easy solutions—none, and 3) my last three books can be seen as a trilogy outlining macro and individual responses to the Great Unwinding. Links to free chapters will be provided at the end of this post. The aim is to offer a well-thought-out response based on historical lessons and system dynamics.

Do I have all the answers? No. Nobody does. Our best course of action is to formulate a coherent response grounded in historical insights and an understanding of what is fragile, risky, and unreliable versus what is more resilient and lower risk.

Given that no response is straightforward, we are dealing with varying degrees of complexity and what is feasible for each individual. We all have limitations in terms of experience, location, skills, capital, networks, and more. Therefore, there is no one-size-fits-all solution that will work for everyone. The essence of my book on Self-Reliance is that each of us must plan our own responses; we cannot simply adopt someone else’s plan.

There is a significant disparity between American aspirations and reality. According to a survey, the average American believes they need to earn over $180,000 to live comfortably. However, only 6% of US adults actually earn $186,000 or more, while the median family income falls between $51,500 and $86,000. In essence, everyone thinks they would be content if they belonged to the top 6%, while households earning $180,000 feel the need to earn $300,000 for comfort.

If you and your partner can collectively earn $300,000 or more annually, go for it. Yet, from a risk management perspective, it may be wise to anticipate a job loss at some point, so planning to live on $100,000 sooner rather than later makes sense.

Many readers have shared that they have already adopted a low-cost, resilient lifestyle, often by residing in a less expensive rural area with affordable housing, paying off debts, handling home and vehicle repairs themselves, growing some of their own food, and connecting with like-minded individuals in the community to collaborate with.

Living Well on Less Than $30,000 a Year–One American Family’s Story.

Embracing a low-cost lifestyle requires sacrifices, some of which may seem unattainable in the current environment: job opportunities and excitement are primarily found in cities and suburbs that are financially out of reach: Starter Homes Cost At Least $1 Million In 117 California Cities.

Learning how to repair, maintain, grow, cook, bake, and build also demands time, effort, and sacrifice. Transitioning from being a consumer to a producer is no simple task.

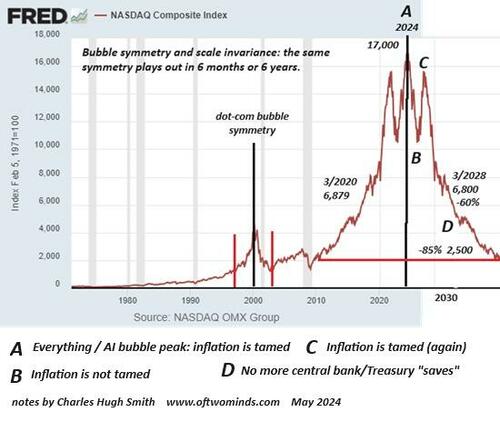

It has been a while since Americans faced a “real recession”: the last significant recession occurred in 1981-82, over 40 years ago. Subsequent recessions have been short-lived due to extensive bailouts and stimulus measures. However, the effectiveness of bailouts and stimulus has diminished, and relying on the same tactics as before may be wishful thinking. Times have changed, and as I have outlined, the situation could resemble more of 1973: a period of nine years marked by turmoil and persistent inflation.

The biblical concept of seven abundant years, seven lean years comes to mind. Humans tend to squander abundance in good times and hoard resources when faced with scarcity. Frugality is a practical approach: minimize waste, reduce needs, and focus on developing contingency plans.

Readers inquire: are there safe havens for my investments? Numerous claims have been made about safe havens, but my experience with past bubbles bursting over the past 50 years suggests that every asset suffers when massive credit-asset bubbles implode. “Good” assets are sold to cover margin calls as “bad” assets plummet, and debts must be serviced or paid off. This is the downside of a financial system heavily reliant on debt and leverage: asset values can collapse, while debts persist and can only be resolved through bankruptcy or insolvency.

Asset prices can plummet to levels deemed “impossible” during bubble peaks. This is the nature of bubbles: current valuations are perceived as rational, and history shows that they may continue to climb. For instance, stocks that dropped from $60 to $45 were touted as “strong buys” before eventually hitting $4. During the Great Depression, skyscrapers were sold for the value of their elevators.

Earning 4% on cash can be appealing when others who tried to “catch falling knives” have lost 40% of their capital. Patience often pays off as bubbles deflate, with volatile counter-rallies tempting speculators and those eager to “buy the dip.” Based on historical patterns, bubbles typically take several years to fully deflate as speculative fervor gradually diminishes.

The saying “cash is king” rings true in asset-bubble deflations, and for good reason. While cash may lose some purchasing power due to inflation, it generates income to offset inflation. In contrast, every other asset that surged during the bubble is vulnerable to selling pressure driven by debt repayment, deleveraging, and the urgency to exit positions to limit further losses.

The risks of patiently waiting for a bubble to deflate entirely are lower compared to the risks of trying to time market rotations ahead of automated trading algorithms and institutional investors who excel at triggering rapid counter-trends to lure in impulsive traders and speculators eager to exploit price dips.

It is worth noting that Wall Street typically does not advocate accumulating cash over a few years as this strategy generates no income for financial institutions, which thrive on high trading volumes driven by investors chasing the latest hot investment trends. While fortunes may be made, staying out of the speculative frenzy and waiting for the market bottom, when all hope seems lost, is not a popular recommendation within the financial industry.

Remember that the “market-determined fair value” of productive real-world assets is irrelevant. Whether my house is valued at $1,000 or $1 million, it still serves its purpose of providing shelter. Similarly, if a piece of land yields 1,000 pounds of food annually, its market value—whether $1,000 or $1 million—becomes inconsequential. Market fluctuations only matter in speculative or leverage-driven scenarios. If the focus is on utility value, market gyrations hold little significance.

The perceived value of anything is subjective. For instance, my wife recently purchased a nearly-new pair of $100 retail shoes for $2 at a thrift store. While someone may have valued the shoes at $100 initially, their worth has now depreciated to a few dollars.

Ultimately, health is the most valuable asset. Once health is compromised, even a fortune of $100 million cannot restore it.

During a bubble, everyone appears to be an expert, but only a few can endure the volatility over an extended period. While it may seem straightforward to navigate the highs and lows of market cycles, very few individuals can sustain success over five years of market turbulence.

History warns against blindly trusting “strong buys” at $45 when the eventual bottom could be $4. While this scenario may seem unlikely, similar sentiments were prevalent in 2000 and 2008, and they seem to be prevailing once again.

The true opportunities lie ahead, far beyond the current landscape. A simple strategy involves streamlining expenses, reducing debt, accumulating cash reserves, refining contingency plans, expanding practical skills for real-world applications, minimizing exposure to external disruptions, and resisting speculative temptations.

* * *

Loading…