- Cardano’s on-chain data indicated a buy signal.

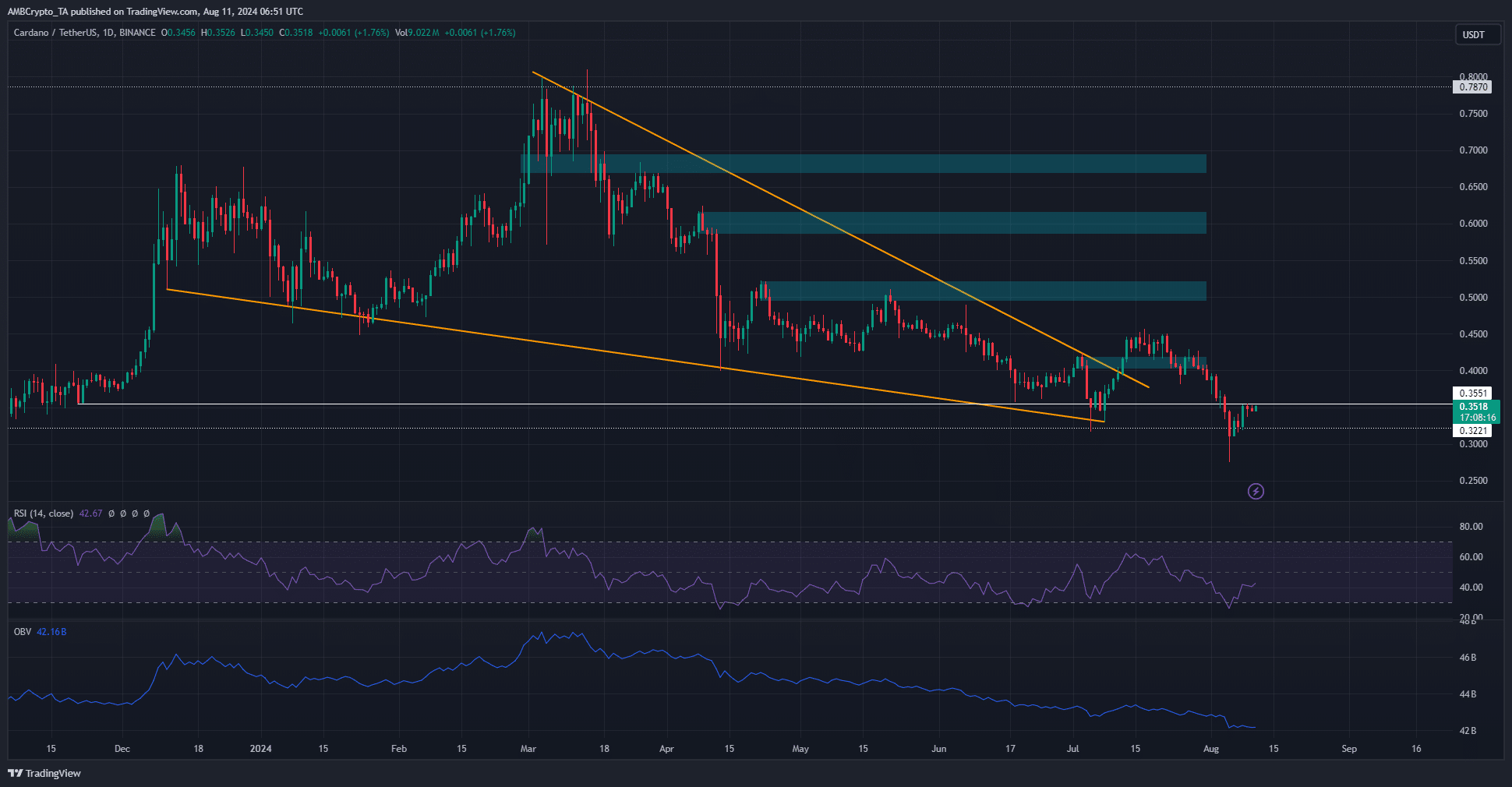

- A potential short-term uptrend could be forming, targeting the $0.43 resistance level as a take-profit area.

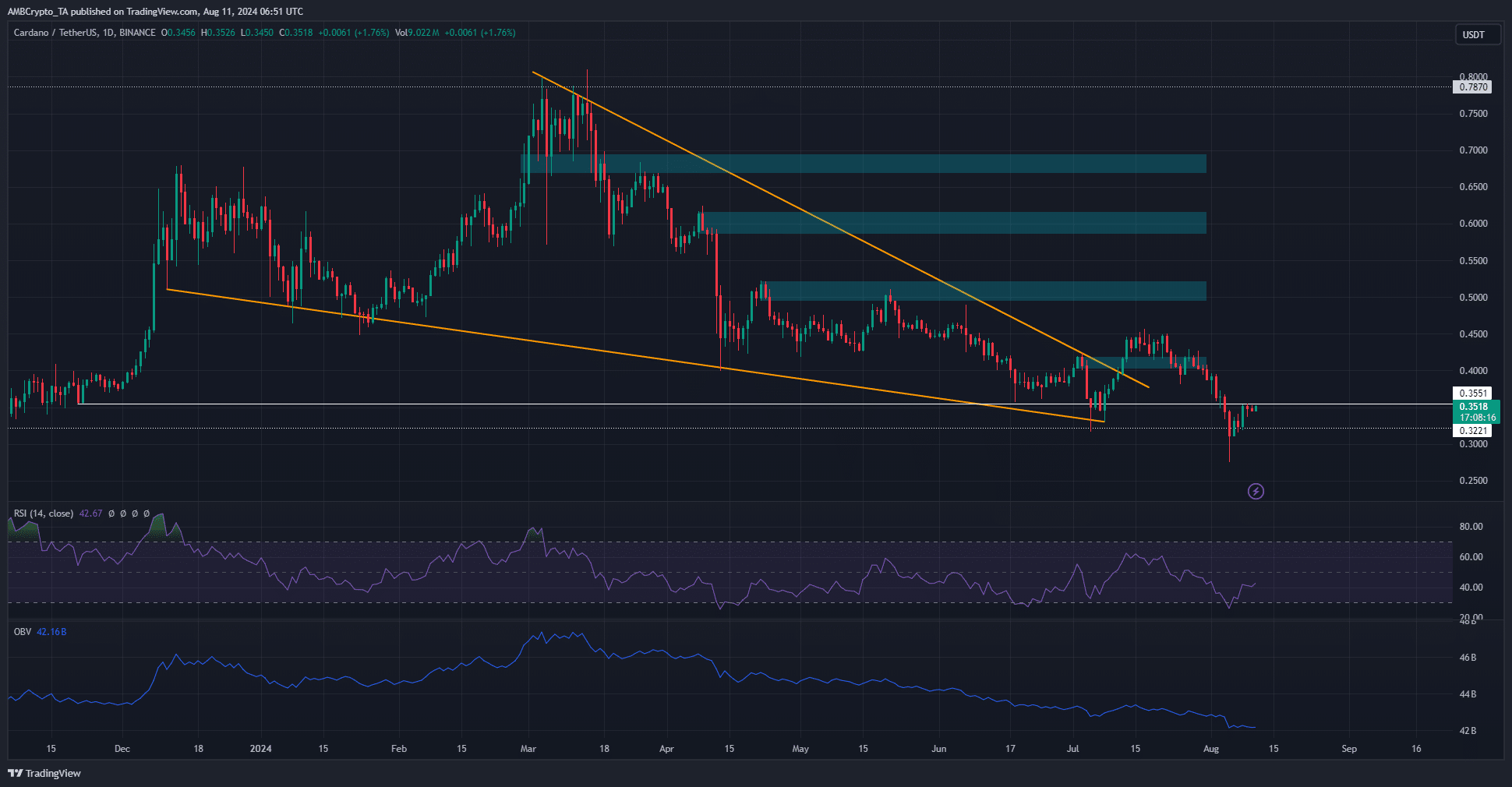

Cardano (ADA) was experiencing a downtrend on the daily chart and was hovering just below the $0.355 resistance level. The technical indicators also reflected a bearish trend.

Despite the bearish signals, AMBCrypto’s analysis of on-chain metrics painted a more optimistic outlook for the bulls. The question remains – will the recovery happen in August, or will long-term holders need to exercise patience for several more weeks?

Cardano Striving for a Higher Low

Source: ADA/USDT on TradingView

The On-Balance Volume (OBV) remained stagnant in recent days following a significant decline in early August. This indicates that buying pressure has yet to dominate. The daily Relative Strength Index (RSI) stood at 40, signaling bearish momentum.

Despite the bearish indicators, there is a glimmer of hope for the bulls as ADA has been gradually climbing since dropping below $0.3. If it can surpass the $0.355 resistance level, it may establish a bullish structure with higher lows and higher highs in the coming weeks. However, the recent lower high at $0.429 on the daily chart remains a critical level.

Encouraging Network Activity

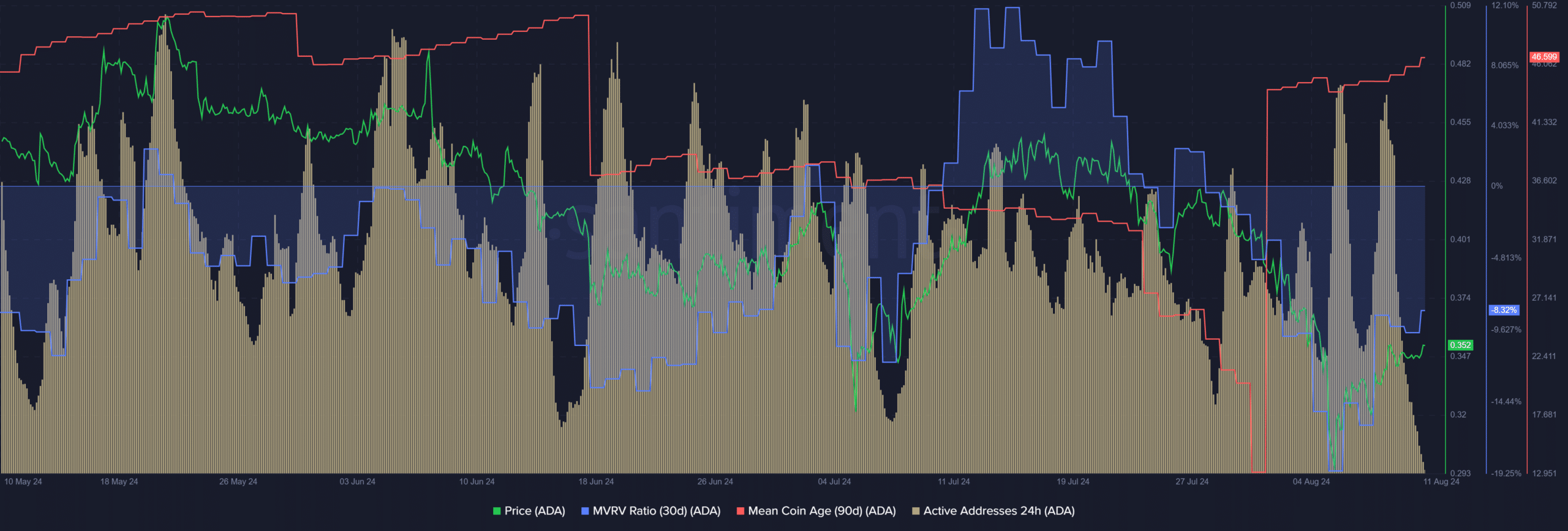

The 30-day Market Value to Realized Value (MVRV) ratio was negative, but the average coin age was on the rise, signaling that ADA was undervalued and being accumulated.

Read Cardano’s (ADA) Price Prediction for 2024-25

The number of daily active addresses surged compared to mid-July. Peaks in activity on August 5th and 8th coincided with price movements, hinting at increased speculation and demand for the token.

If this trend persists, it could indicate a growing interest in ADA.

Disclaimer: The information provided is the author’s personal opinion and does not constitute financial advice.