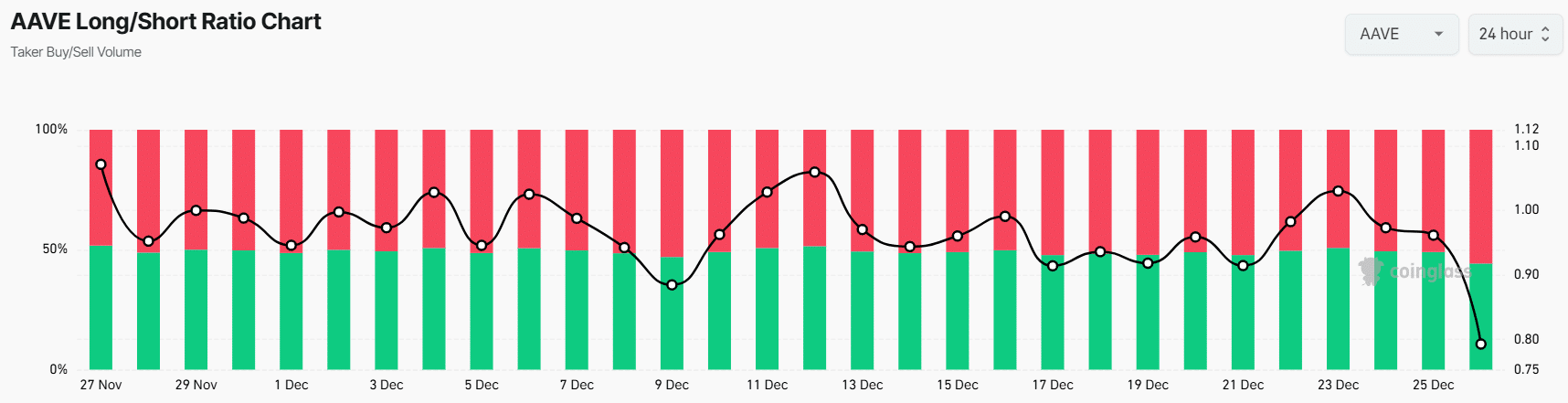

- 58.9% of top AAVE traders currently have short positions.

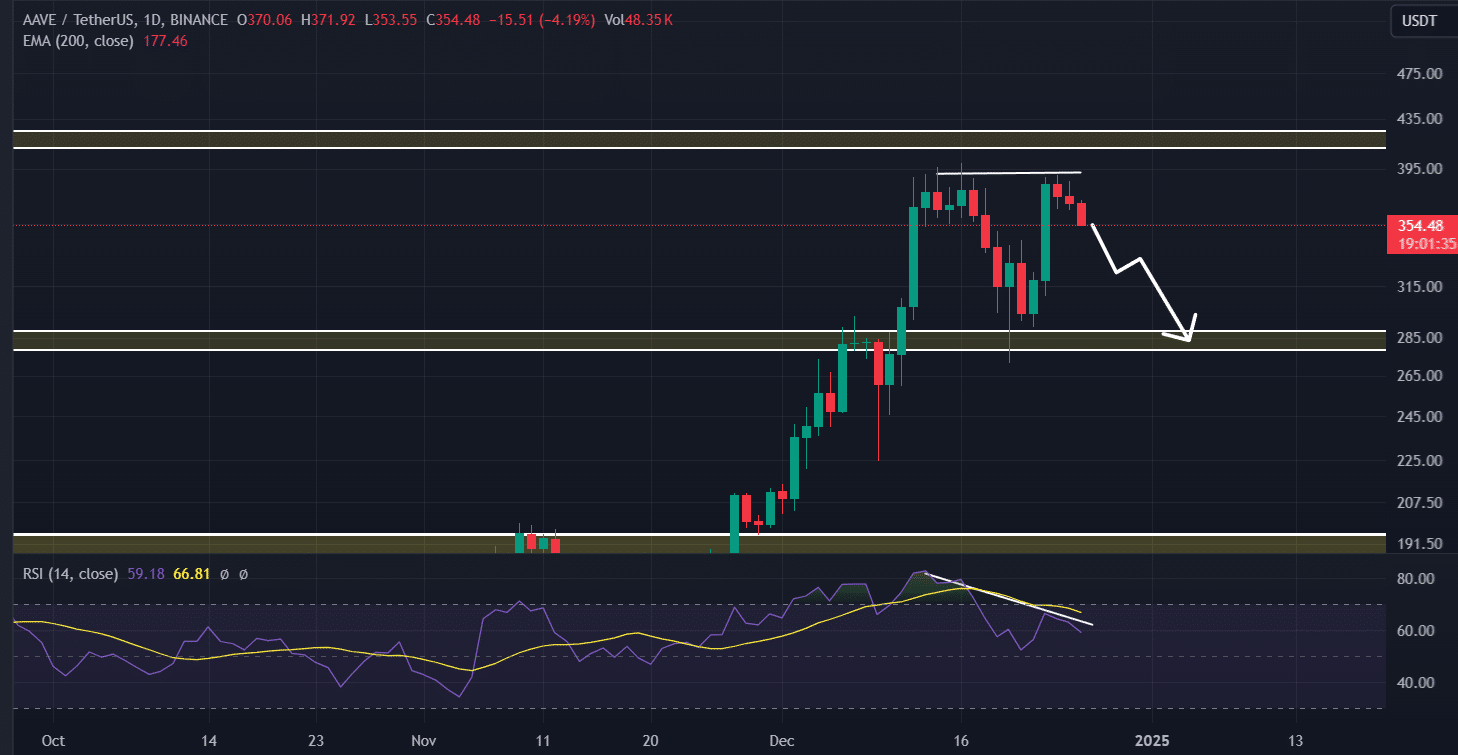

- AAVE’s daily chart has formed a bearish divergence and a double-top price action pattern.

In the midst of market volatility, Aave [AAVE] seems primed for a price drop in the coming days, with a bearish price action pattern evident on the daily timeframe.

Apart from the bearish price action, market sentiment and the potential for profit-taking in the altcoin are also factors contributing to AAVE’s negative outlook.

In addition to AAVE, other major cryptocurrencies like Bitcoin [BTC], Ethereum [ETH], and XRP are also following similar trends.

AAVE Shows Bearish Signals

Reviewing data from on-chain analytics firm Coinglass, it is observed that AAVE’s Spot Inflow/Outflow indicates a notable inflow of over $5.2 million worth of AAVE into exchanges.

In cryptocurrency terms, inflow signifies the movement of assets from wallets to exchanges, often pointing towards potential selling pressure that could lead to a price decline.

Besides recent activity among long-term holders, traders are showing a preference for short positions, anticipating a potential price decrease, as per Coinglass reports.

Currently, AAVE’s Long/Short Ratio stands at 0.79, the lowest since late November 2024, indicating strong bearish sentiment among traders.

Source: Coinglass

At present, 58.9% of top AAVE traders hold short positions, while 41.10% are in long positions.

Hence, it seems that traders and long-term holders are favoring short positions, contributing to a bearish outlook for the asset. This aligns with the recent formation of bearish price action.

AAVE Technical Analysis and Future Levels

According to technical analysis by AMBCrypto, AAVE has formed a bearish double-top price action pattern. The chart indicates a bearish divergence on the daily timeframe, suggesting a potential price drop in the coming days.

Source: TradingView

Based on recent price movements and historical momentum, the asset is anticipated to decline by 18% and reach the $290 level soon.

Read Aave’s [AAVE] Price Prediction 2025–2026

Current Price Trend

At the moment, AAVE is trading around $350 after a drop of over 9% in the past 24 hours.

During the same period, its trading volume has decreased by 28%, indicating reduced activity from traders and investors amidst the bearish market conditions.