- A large investor re-entered the market by purchasing $15 million worth of AAVE after selling 184.4 WBTC through Wintermute OTC.

- Data from exchanges indicated three consecutive days of negative Netflow, suggesting significant buying pressure across the board.

Following a surge to $270, Aave [AAVE] faced strong resistance and dropped to $239.

Despite the pullback, some investors saw an opportunity and returned to the market, including a whale who bought $15 million worth of AAVE after selling WBTC.

According to on-chain analyst Ember, the whale accumulated 57,715 AAVE tokens at an average price of $259.9.

The whale has been holding AAVE for two years and currently sits on a profit of $26.32 million.

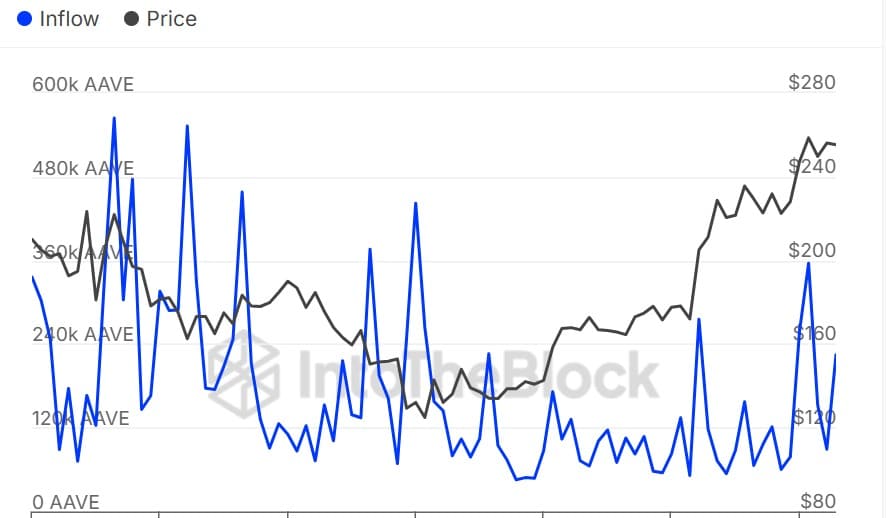

Source: IntoTheBlock

Aside from this whale activity, AAVE whales are actively accumulating the token with higher Large Holders Capital Inflows.

Whale capital inflow rose significantly in the past day, indicating increased accumulation.

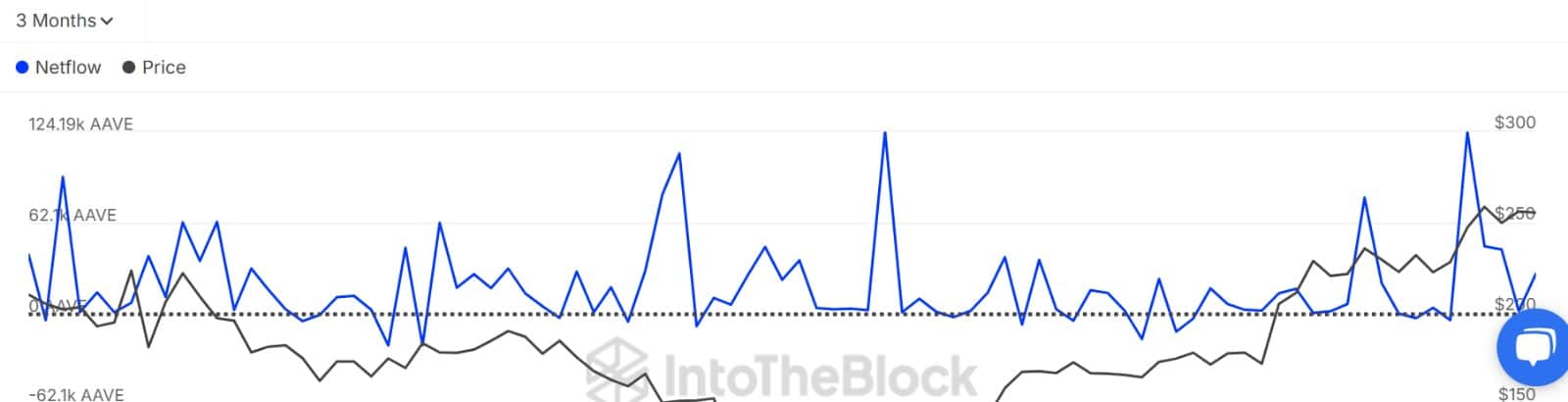

Source: IntoTheBlock

Furthermore, large holders’ Netflow remained positive, showing strong buying activity in the market.

Source: CryptoQuant

The positive sentiment among investors has pushed the price of AAVE higher, with a 24-hour gain of 1.73%.

If the current market sentiment continues, we could see AAVE reclaiming $270 and aiming for $284 resistance.

However, a drop to $231 support is possible if buyers lose control of the market.

Price reaction and outlook

The increased accumulation has positively impacted the price movement of AAVE, indicating a potential for further gains.

Overall, the market sentiment remains bullish, with strong buying pressure across all market participants.