- The cryptocurrency market is experiencing a slight recovery following a surge in prices on Tuesday.

- Aave has stood out this week by trading against the general market downtrend.

On August 5th, the crypto assets suffered a sector-wide bloodbath, but Bitcoin’s price surged above $56K during Tuesday’s trading session.

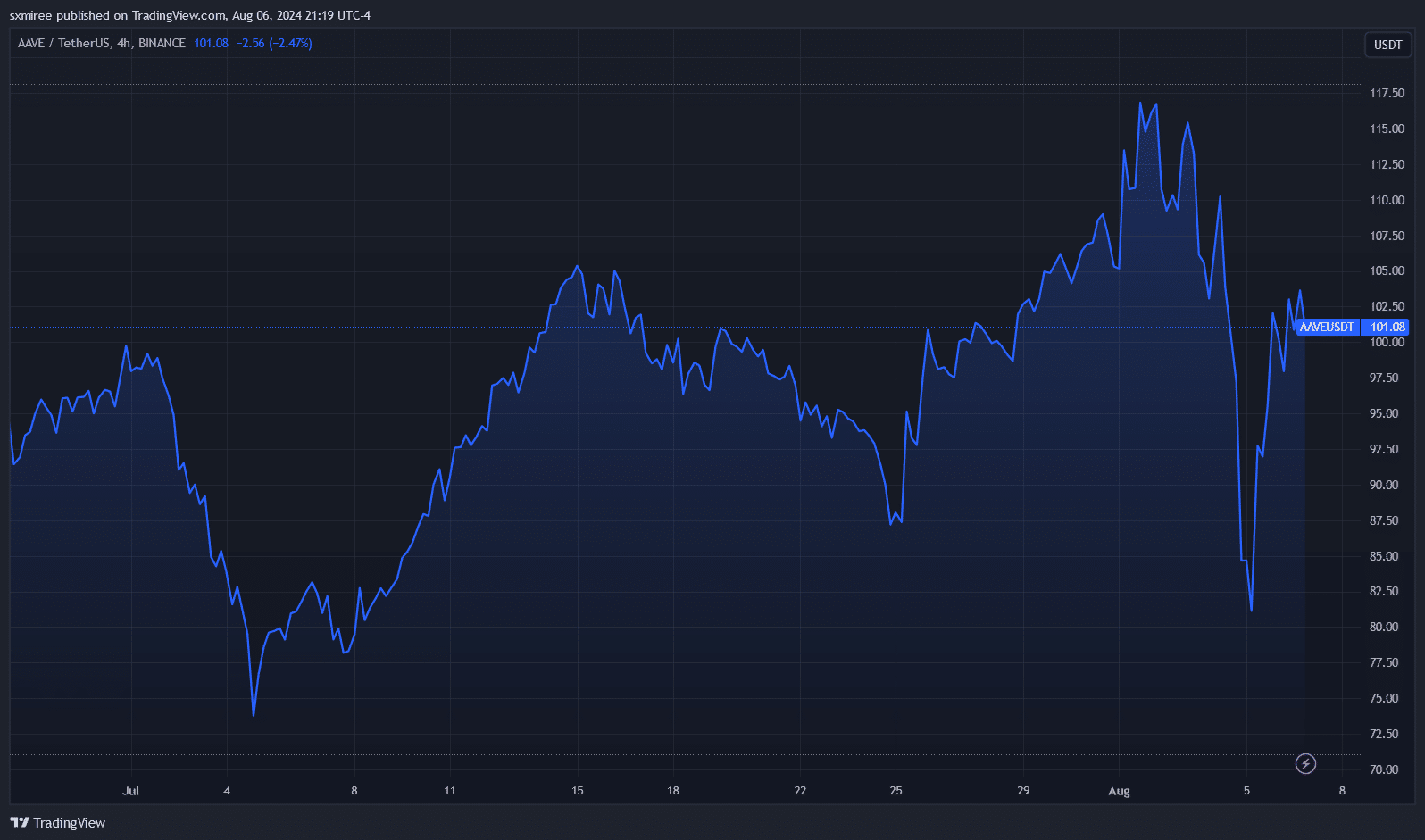

Meanwhile, Aave [AAVE] was trading at $101 at the time of writing, slightly below its intra-day high of $106.92 according to CoinMarketCap data.

Source: TradingView

Crypto-related stocks and global stock markets are also showing signs of stability after the recent plunge.

The improved sentiment is partially attributed to expectations of a Fed rate cut following Monday’s global market decline, which raised concerns about a potential US economic recession.

Success of Aave Protocol in DeFi Operations

In a post on the X platform on August 5th, Aave Labs co-founder Stani Kulechov highlighted the protocol’s resilience in active markets across various Layer 1 and Layer 2 blockchains.

The lending protocol managed decentralized liquidations effectively, generating $6 million in revenue for the Aave Treasury overnight.

Circle co-founder Jeremy Allaire echoed Stani’s sentiments in a repost,

“DeFi always on, never sleeps, open networks, open-source protocols, auditable in real time.”

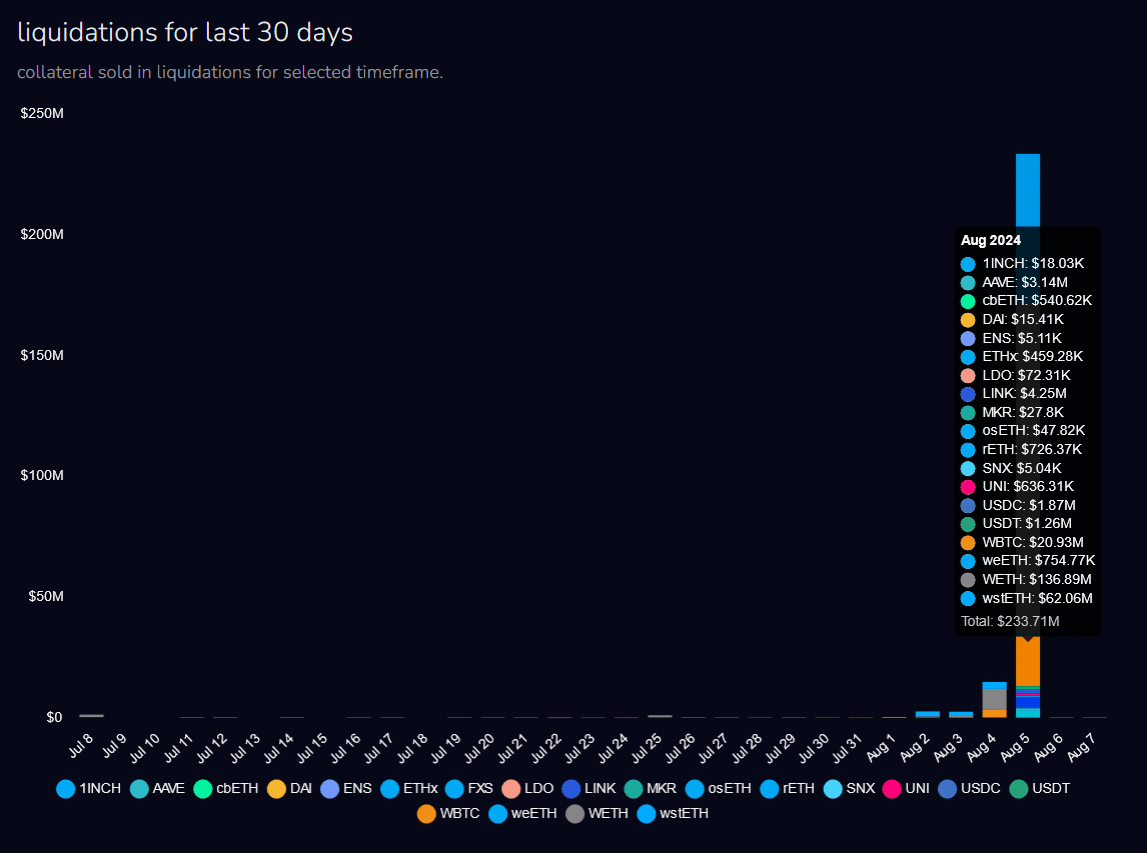

Between August 3rd and August 5th, $350 million worth of DeFi positions were liquidated, as reported by Parsec Finance.

Block Analitica, a DeFi risk intelligence platform, indicates that liquidations on Aave peaked at $234 million on August 5th.

The Aave protocol is currently operational on a dozen chains, including Ethereum mainnet, Optimism, Arbitrum, Polygon, Base, Gnosis Chain, and BNB Chain.

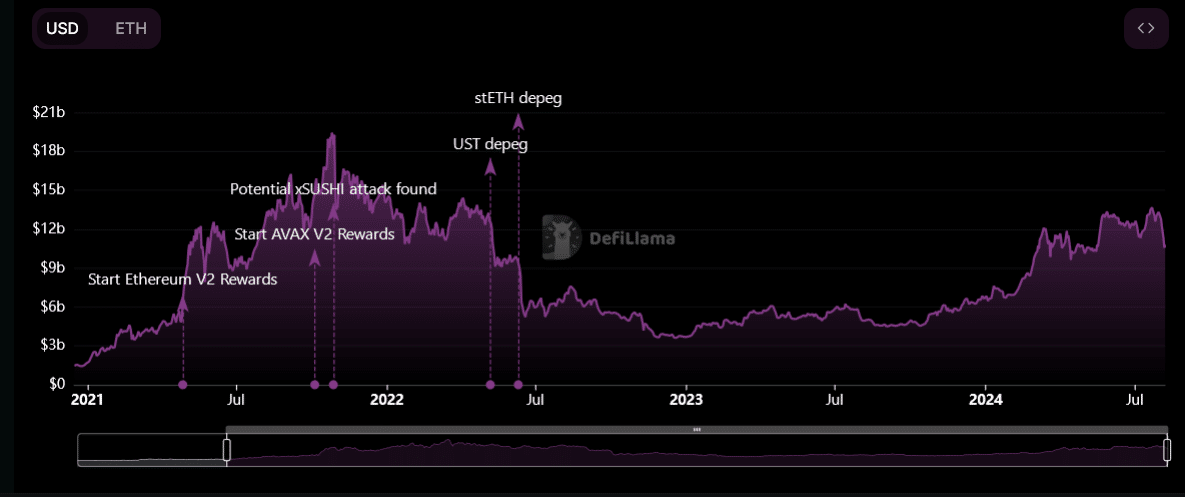

According to DeFiLlama data, Aave had a total value locked (TVL) of $10.8 billion at the time of writing.

Source: DeFiLlama

These strong fundamentals have enabled the AAVE governance token to bounce back quickly and outperform many other tokens on Tuesday.

Key Events in July

On July 25th, Aave-chan Initiative founder Marc Zeller proposed the introduction of a ‘fee switch’ within the protocol to distribute fees to AAVE holders by repurchasing tokens from the secondary market.

The new Lido V3 market, which was the first custom deployment on Aave V3, had a market size of $250 million at the time of publication.

In a separate development, Aave Labs announced the release of Aave V3.1, which went live on July 31st.

The Aave v3.1 upgrade, proposed by BGD Labs in April, was activated following a community forum proposal.

AAVE Price Analysis

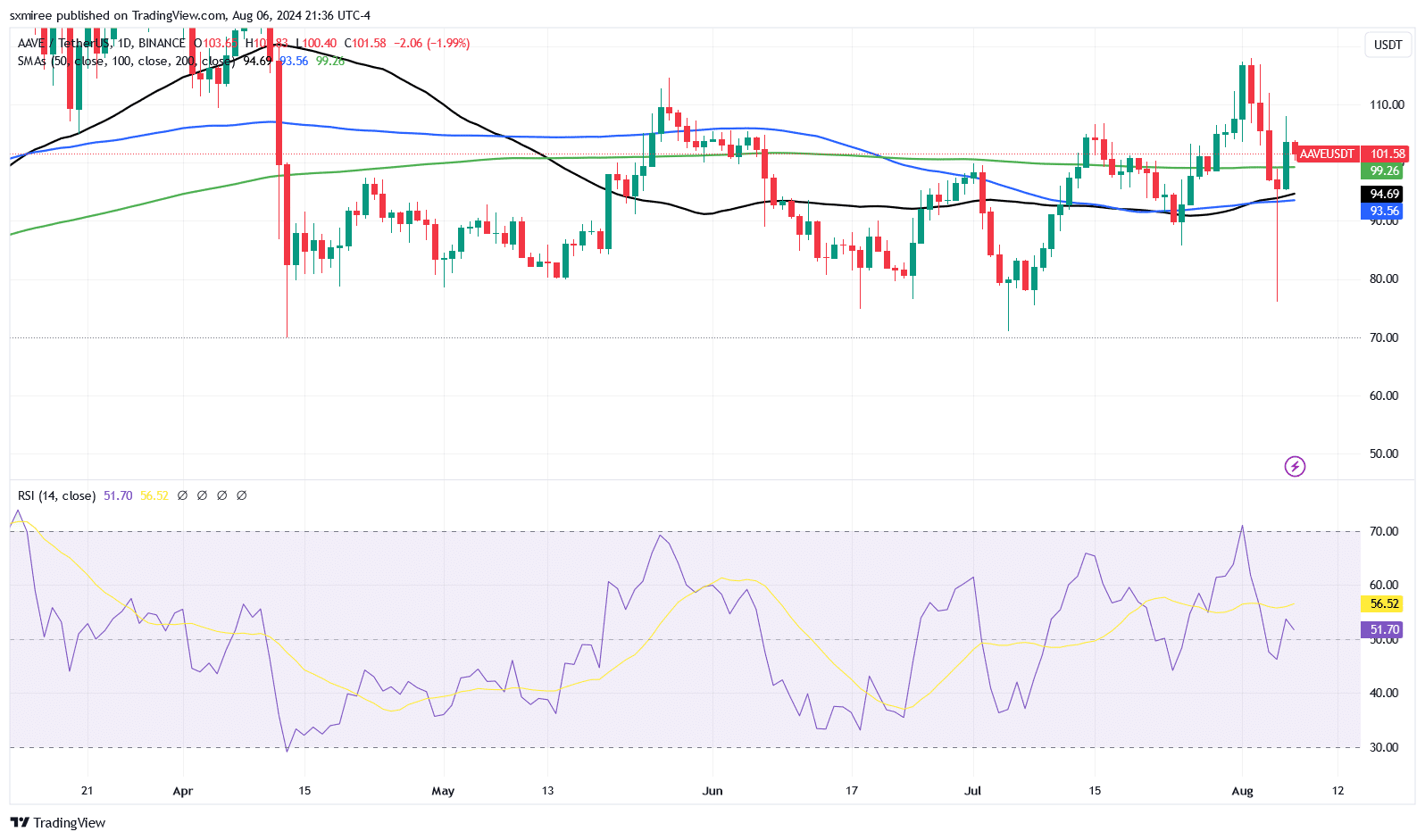

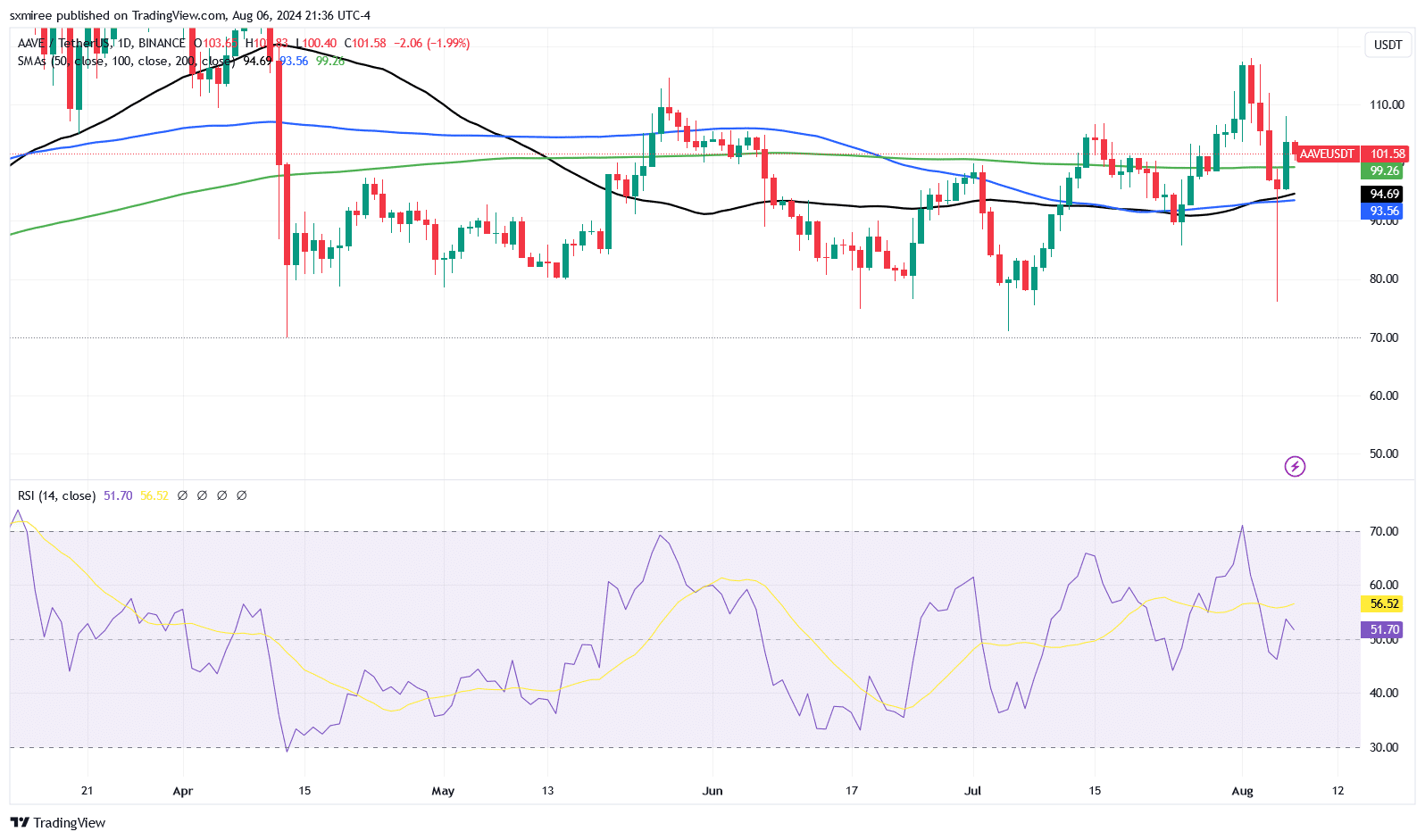

AAVE dipped below $80 on August 3rd but managed to reclaim $100 on Monday, a level it has mostly maintained since then. Although Tuesday’s rebound pushed the price above the 50-, 100-, and 200- simple moving averages on the 4-hour chart, it failed to sustain those levels.

However, on the daily chart, AAVE/USDT is trading below all three averages.

Source: TradingView

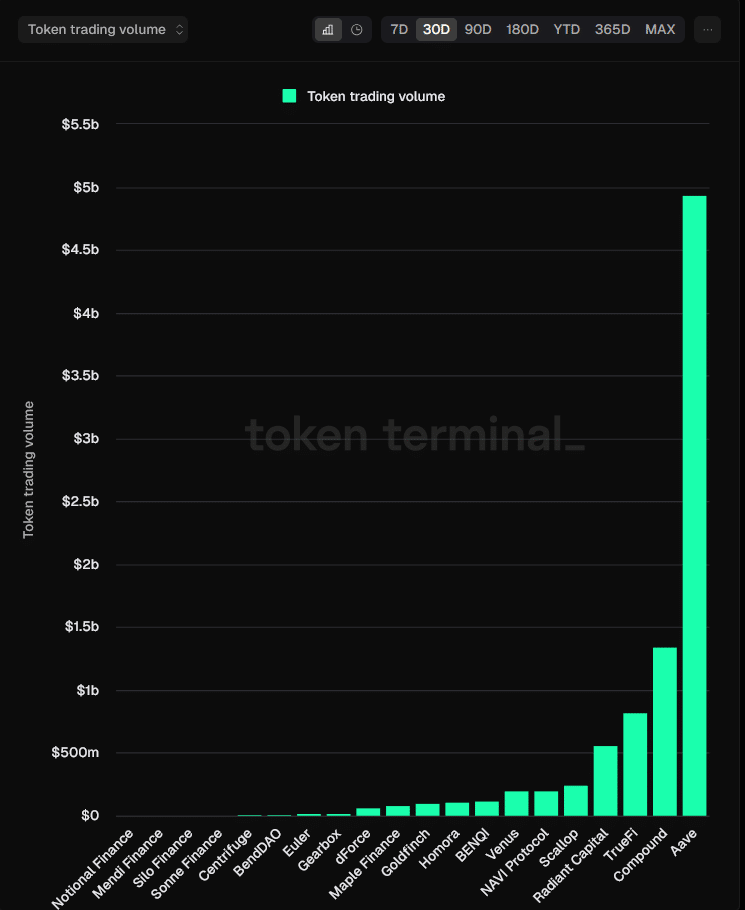

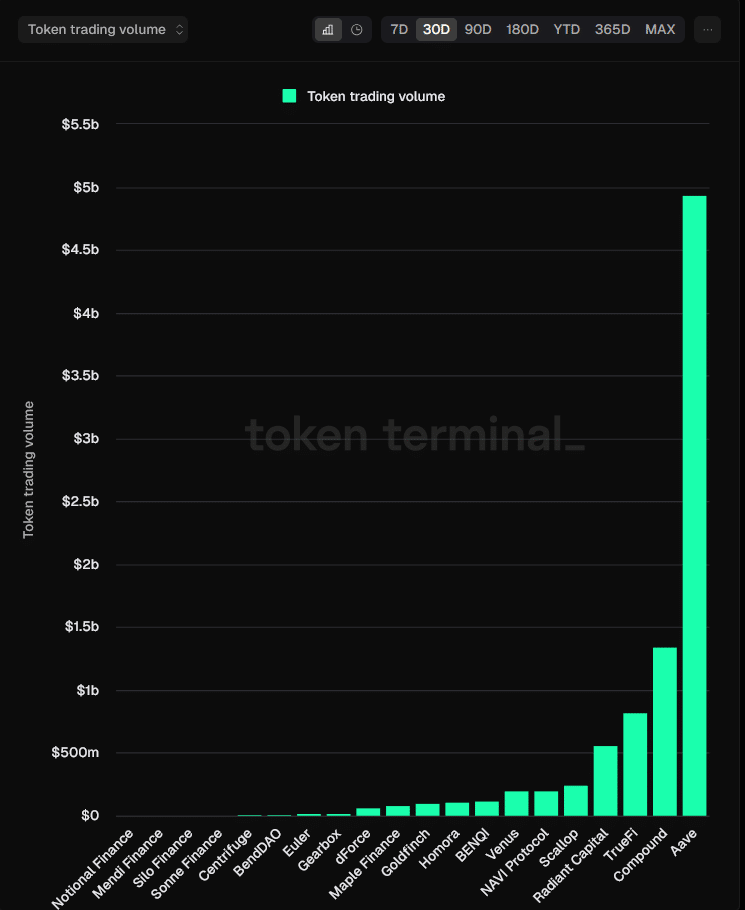

According to Token Terminal data, AAVE has been the most traded asset in the last 30 days, with a monthly trading volume exceeding $4.9 billion.

Source: Token Terminal

Additionally, the Relative Strength Index (RSI) indicator is hovering around the neutral level of 50, indicating a balance between buying and selling pressures.

However, it’s crucial to note that the crypto market remains volatile, with speculators exercising caution. As a result, any recovery is likely to be limited by the prevailing market pessimism.

text in a clearer way:

Rewrite the text in a more concise manner:

Please revise the text for clarity.