- ADA has seen a remarkable 15% surge in the past week, with bullish reversal signals on technical charts.

- The increase in active addresses and rising Open Interest indicate a growing interest in ADA.

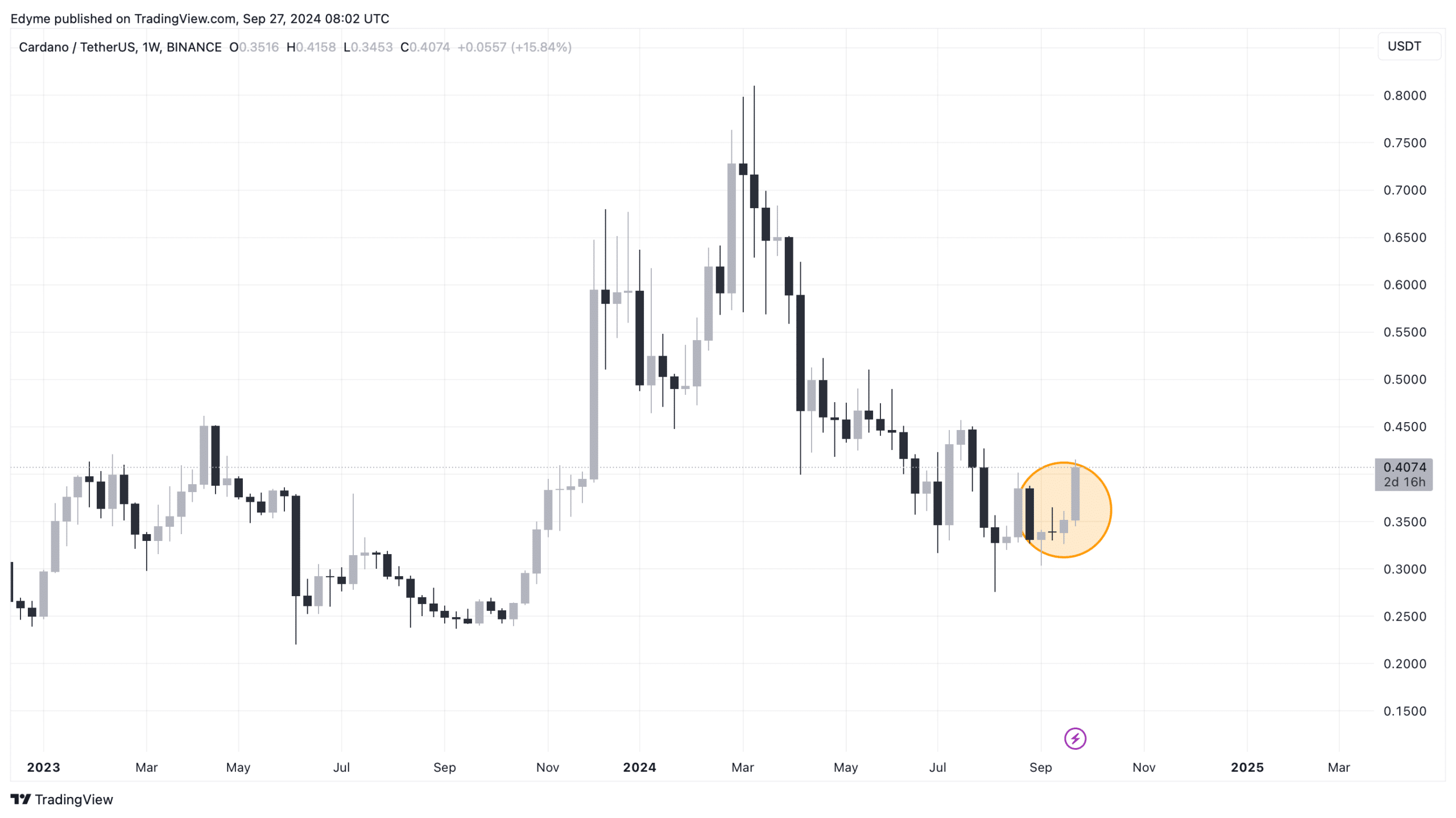

Cardano [ADA] has been on a notable price rebound after a prolonged period of correction earlier this year. Following its peak above $0.77 in January, ADA went through a significant downtrend.

However, in the past week, the asset has surged over 15%, extending this bullish trend in the last 24 hours and currently trading at $0.41, up by 2.6%.

ADA’s Potential Upside

This surge has grabbed the attention of the Cardano community, with analysts now evaluating whether this movement is sustainable or just a short-term bounce.

A closer look at ADA’s weekly price chart shows an important bullish signal. A bullish engulfing candlestick pattern, following an inverted dragonfly doji, has formed on the chart.

Source: ADA/USDT on TradingView

This pattern is typically seen as a significant reversal indicator, suggesting that a downward correction may be ending and a major upward price movement could be underway.

The presence of this pattern indicates the potential for sustained upward momentum for ADA, hinting at the possibility of a longer-term rally.

Backing it up with Fundamentals

While the technical outlook points to a continuation of ADA’s rally,

It is crucial to validate these signals with the underlying fundamentals to determine if this bullish momentum is supported by solid market factors.

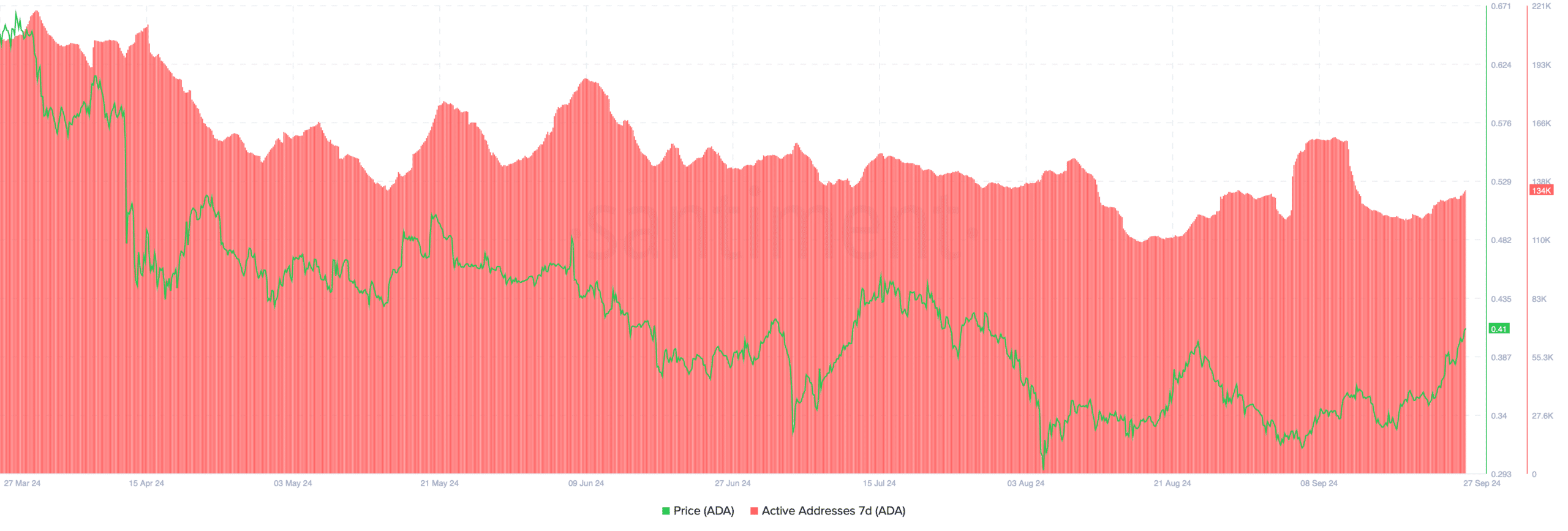

One key indicator to consider is ADA’s retail interest, measured by the number of active addresses.

According to data from Santiment, ADA’s active addresses have recently increased.

Source: Santiment

This rise in active addresses indicates renewed retail interest in ADA, suggesting a potential increase in trading activity and demand.

An uptick in active addresses often correlates with increased buying pressure and can lead to positive price action for the asset.

If this trend continues, it could strengthen ADA’s current upward momentum and support the possibility of a sustained rally.

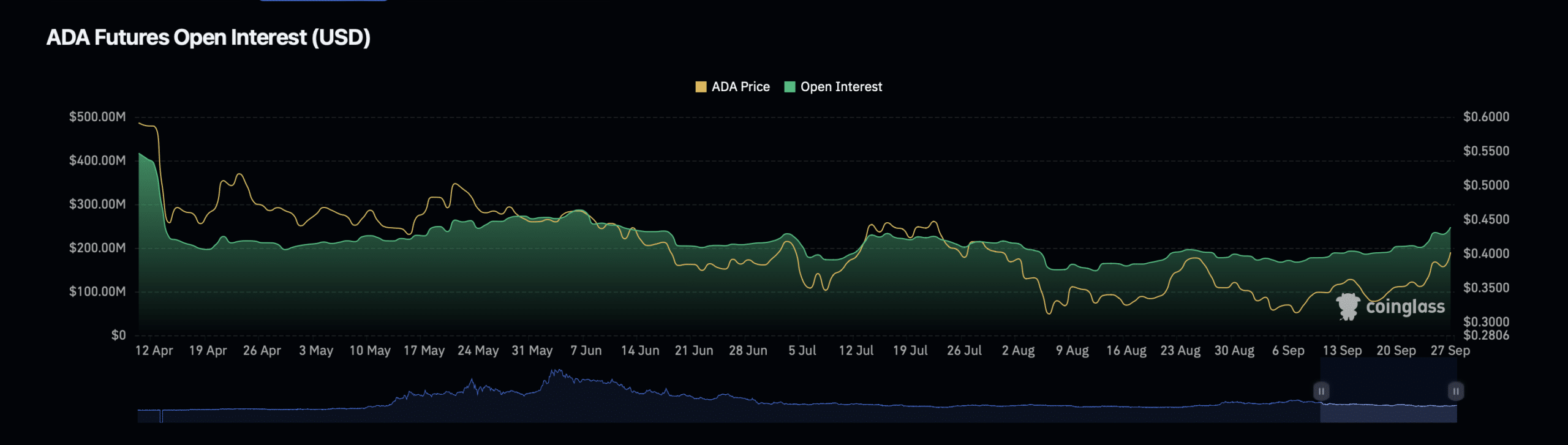

Another crucial metric contributing to ADA’s potential bullish trend is open interest, reflecting the total number of open contracts in the Futures market.

Data from Coinglass shows that ADA’s Open Interest has increased by 6.77%, reaching $255.04 million.

Source: Coinglass

Read Cardano’s [ADA] Price Prediction 2024–2025

An increase in Open Interest along with rising prices is generally viewed as a sign of confidence among traders, indicating new capital entering the market.

This scenario aligns with the potential for continued price growth, as more capital flowing into ADA futures contracts could amplify price movements and extend the current rally.

sentence: “The cat sat lazily in the sun.”

“The lazy cat lounged in the sunlight.”